This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

Video-streaming veteran Netflix (NASDAQ: NFLX) is trading near all-time highs right now, currently fetching $440 per share. Jefferies analyst Alex Giaimo sees more gains ahead. Giaimo opened coverage of Netflix on Thursday with a buy rating and a price target of $520 per share.

The investment thesis

The analyst cited three main reasons to own Netflix shares today:

- This company’s addressable market is “vastly underappreciated.”

- Improving profit margins will lead to sustainable free cash flows over time.

- Netflix has proven its “ability to create value” in a rapidly changing market.

Giaimo expects year-over-year subscriber growth to remain in double-digit percentages until 2023 alongside a relatively stable penetration of the domestic market. His model assumes Netflix will widen its international household penetration from 18% to 28%, addressing a global market of roughly 850 million broadband households. Meeting the analyst firm’s targets would give Netflix approximately 285 million subscribers in 2023, up from 183 million paid memberships today.

The financial background

Netflix has been consuming a lot of cash in recent years due to the high up-front costs of producing a lot of original content. Management has said that 2019 should be the peak of Netflix’s cash burn, topping out at $3.1 billion. Since content production efforts have ground to a halt under COVID-19 lockdown policies, Netflix expects to consume roughly $1 billion of free cash in 2020, followed by larger content production expenses in 2021.

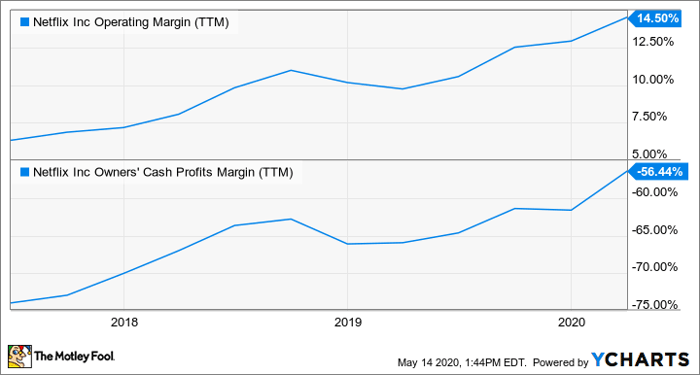

The key to unlocking positive cash flows is indeed found in wider profit margins. Here’s how Netflix’s operating margins and cash profit margins have developed over the last three years:

NFLX Operating Margin (TTM) data by YCharts

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

NEW! 5 Cheap Stocks With Massive Upside Potential

Our experts at The Motley Fool have just released a FREE report detailing 5 shares you can buy now to take advantage of the much cheaper share prices on offer.

One is a diversified conglomerate trading 40% off it’s all time high, all while offering a fully franked dividend yield of over 3%…

Another is a former stock market darling that is one of Australia’s most popular and iconic businesses. Trading at a significant discount to its 52-week high, not only does this stock offer massive upside potential, but it also trades on an attractive fully franked dividend yield of almost 4%.

Plus, this free report highlights 3 more cheap bets that could position you to profit in 2020 and beyond.

Simply click here to scoop up your FREE copy and discover the names of all 5 cheap shares.

But you will have to hurry because the cheap share prices on offer today might not last for long.

Returns as of 7/4/2020

More reading

Anders Bylund owns shares of Netflix. The Motley Fool owns shares of and recommends Netflix. The Motley Fool has a disclosure policy. The Motley Fool Australia’s parent company Motley Fool Holdings Inc. owns shares of and recommends Netflix. The Motley Fool Australia has recommended Netflix. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy. This article contains general investment advice only (under AFSL 400691). Authorised by Scott Phillips.

The post Will Netflix Be a $520 Stock? appeared first on Motley Fool Australia.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

from Motley Fool Australia https://ift.tt/2WW563T

Leave a Reply