This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

What happened

Shares of renewable-energy company Tesla (NASDAQ: TSLA) surged to all-time highs on Tuesday, and the reason isn’t obvious. CEO Elon Musk sent out an email to talk about “breaking even,” reminding Wall Street this stock may be mere weeks away from inclusion in the S&P 500.

As of 2:00 p.m. EDT, Tesla stock was up 6.5%. But earlier in the session, it was up a little higher and briefly achieved a market capitalization of $200 billion for the first time.

So what

Once a quarter, a committee adjusts the S&P 500. New companies are often added while others are removed. To be considered, companies must meet various eligibility requirements. Tesla already meets some requirements, like being based in the U.S. and having a price per share over $1. But it’s lacked profitability.

Four consecutive quarters of profitability are needed to be considered by the committee. Tesla has reported three consecutive quarters. Considering it’s already a large-cap stock headed into mega-cap territory, a fourth consecutive quarter of profits would make it a shoo-in for inclusion into the S&P 500.

According to CNBC, a leaked email from Musk encouraged employees to “go all out” because “[b]reaking even is looking super tight.” Without more context, it’s hard to know what this means. But it appears Musk needs more productivity from his workers down the stretch of the quarter to be profitable. And Musk is likely aware of what’s at stake if the company swings to the green.

As a reminder, Tesla’s fiscal quarter ends today, providing a small window of opportunity.

Now what

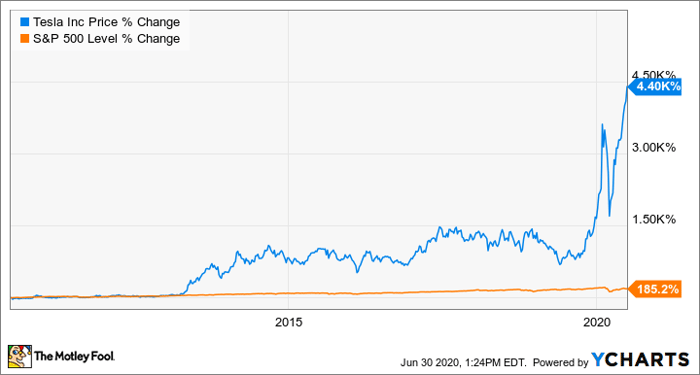

So why would investors be excited about Tesla getting included in the S&P 500? Tesla is a polarizing stock, with passionate investors on both sides. At times, this makes Tesla stock volatile. Consider that it’s up over 150% in 2020, but it also fell more than 60% from February to March. That’s a wild ride.

Once in the S&P 500, that volatility could mitigate. Tesla stock will be purchased for index funds, and as long as it’s in the club, those shares won’t be sold. It could create a floor for Tesla stock. However, while it’s an interesting development for Tesla shareholders, it doesn’t make the stock a buy in isolation. Investing in stocks for the long haul requires a good assessment of the underlying business as well.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

We hear it over and over from investors, “I wish I had bought Altium or Afterpay when they were first recommended by The Motley Fool. I’d be sitting on a gold mine!” And it’s true.

And while Altium and Afterpay have had a good run, we think these 5 other stocks are screaming buys. And you can buy them now for less than $5 a share!

*Extreme Opportunities returns as of June 5th 2020

More reading

- These 2 ASX shares are perfect for a beginner investor

- Millennials be warned! Signs of dangerous ASX share trading grow

Jon Quast has no position in any of the stocks mentioned. The Motley Fool Australia’s parent company Motley Fool Holdings Inc. owns shares of and recommends Tesla. The Motley Fool Australia has no position in any of the stocks mentioned. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy. This article contains general investment advice only (under AFSL 400691). Authorised by Scott Phillips.

The post Here’s why Tesla stock surged to all-time highs on Tuesday appeared first on Motley Fool Australia.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

from Motley Fool Australia https://ift.tt/3eJ76nI

Leave a Reply