Determining the best shares to buy now is clearly very subjective. Every investor will have their own views on which companies provide the most attractive investment opportunities.

However, some of the most appealing stocks are likely to have a mix of solid fundamentals, sound strategies and track records that suggest they can perform well in a variety of operating conditions.

Buying such companies at fair prices could prove to be a profitable move. They may be more likely to outperform the stock market and deliver high capital returns.

The best shares to buy now may have solid track records

A solid track record of performance in a range of economic situations may differentiate the best shares to buy now from their peers. The economic outlook is currently very uncertain. Political risks are elevated, while the challenges faced in 2020 regarding coronavirus look set to continue at least in the early part of next year.

Therefore, companies that have been able to deliver impressive sales and profit growth in a variety of operating environments could be relatively attractive. They may be able to outperform their peers in the short run, which could equate to lower levels of risk. Meanwhile, they could be in a stronger position to capitalise on a likely economic recovery in the coming years that produces a higher valuation.

A sound growth strategy

The best shares to buy now may also have sound strategies that can lead to growing profitability in the coming years. The past 12 months have included major change across many industries. This could mean that companies with static business models that fail to innovate quickly become outdated.

By contrast, companies that are able to respond quickly to changing consumer tastes may be the major winners in the likely stock market recovery.

Clearly, it is difficult to assess whether a specific strategy will be successful or not. However, by analysing a company’s recent investor updates compared to those of its peers, it is possible to identify the most flexible and adaptable businesses within a specific sector. They may be able to adjust their operations to accommodate a rapidly-changing economic outlook over the long run.

Financial strength ahead of an uncertain 2021

As mentioned, the best shares to buy now are likely to have solid financial positions. While this is always the case, a solid balance sheet may be worth more than usual in the eyes of investors at the present time. Companies with low debt and strong cash flow may offer less risk during what could prove to be an uncertain period for the economy.

They may also be able to invest to a greater extent in new products and services. Over time, this could produce higher profit growth and a rising share price.

Where to invest $1,000 right now

When investing expert Scott Phillips has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for more than eight years has provided thousands of paying members with stock picks that have doubled, tripled or even more.*

Scott just revealed what he believes are the five best ASX stocks for investors to buy right now. These stocks are trading at dirt-cheap prices and Scott thinks they are great buys right now.

*Returns as of June 30th

More reading

- 3 ASX shares to buy for 2021 and beyond

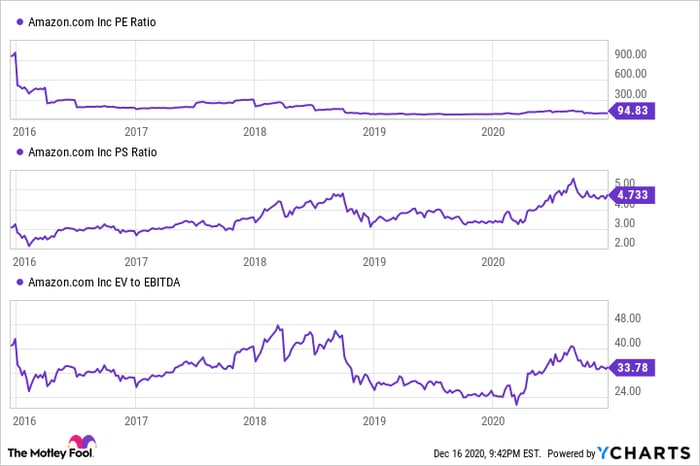

- Why Amazon’s stock is so expensive

- 2 great ASX growth shares that are rapidly expanding

- 2 ASX dividend shares to buy for 2021

- 2 rapidly growing ASX tech shares to buy

Motley Fool contributor Peter Stephens has no position in any of the stocks mentioned. The Motley Fool Australia has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy. This article contains general investment advice only (under AFSL 400691). Authorised by Bruce Jackson.

The post Looking for the best shares to buy now? I’d take these 3 simple steps today appeared first on The Motley Fool Australia.

from The Motley Fool Australia https://ift.tt/34I7IqI