The Charter Hall Group (ASX: CHC) share price is soaring today, up 6.09% to $18.30 per share.

This comes after the ASX 200 real estate share released its results for the financial year ending 30 June (FY21).

Charter Hall share price lifts on increased FUM

The company’s earnings highlights include:

- Operating earnings of $284.3 million

- Operating earnings per security (OEPS) post-tax of 61.0 cents per share (cps)

- Statutory profit of $476.8 million, after tax attributable to shareholders

- 5% return on contributed equity

- Declared full year dividend of 37.9 cps

What happened during the reporting period for Charter Hall?

In FY21, Charter Hall’s Property Investment portfolio increased by 18.8% to reach $2.4 billion. The portfolio generated a 15.0% total property investment return.

The portfolio remains well-diversified, with no single asset making up more than 5% of the total. Occupancy was 97.4% with a weighted average lease expiry (WALE) of 9.1 years, up from 8.7 years in FY20.

The company reported $1.1 billion of development completions during the financial year, with a re-stocked development pipeline growing to $8.8 billion.

Charter Hall’s share price could also be getting a lift after reporting its managed funds increased by 29% over the 12 months, to $52.3 billion. The company credits most of that to $5.9 billion of net acquisitions and positive revaluations of $4.1 billion.

On the funding side, the group has $6.7 billion of available investment capacity and more than $500 million on its balance sheet.

What did management say?

Commenting on the results, Charter Hall CEO David Harrison said:

[W]e have generated record fund inflows, gross transactions and FUM growth of $11.7 billion in FY21, whilst generating sector-leading returns for our investor customers and shareholders… Our success as a business is built upon partnering with our tenant and investor customers to drive mutually beneficial outcomes with a razor-sharp focus on being customer centric.

This partnership approach generated $5.3 billion of gross equity inflows, with all equity sources recording strong inflows. FUM grew 29% as our strategy of securing long-leases with best-in-class tenants continued to drive returns for investors. We transacted on a record $10.1 billion of assets, successfully deploying our investment strategies both on and off-market…

Sale and leaseback transactions represented over 40% of our transaction activity as we continue to partner with tenants and investors to unlock investment opportunities. Our develop-to-core strategy also saw us deliver over $1 billion in development completions.

What’s next for Charter Hall?

Looking ahead, the company offered earnings guidance (provided there are no significant unfavourable changes to current market conditions) indicating a 6% increase in dividend distribution for FY22.

Harrison commented:

As we begin FY22, we are well positioned with $6.7 billion of investment capacity to deploy into our $8.8 billion development pipeline, which will be further advanced with continuing equity inflows.

The Charter Hall share price is up 49% over the past 12 months.

The post Charter Hall (ASX:CHC) share price surges 6% on $477 million FY21 profit appeared first on The Motley Fool Australia.

Should you invest $1,000 in Charter Hall right now?

Before you consider Charter Hall, you’ll want to hear this.

Motley Fool Investing expert Scott Phillips just revealed what he believes are the 5 best stocks for investors to buy right now… and Charter Hall wasn’t one of them.

The online investing service he’s run for nearly a decade, Motley Fool Share Advisor, has provided thousands of paying members with stock picks that have doubled, tripled or even more.* And right now, Scott thinks there are 5 stocks that are better buys.

*Returns as of August 16th 2021

More reading

- Leading brokers name 3 ASX shares to buy today

- How do BHP (ASX:BHP) earnings compare to Woodside Petroleum’s?

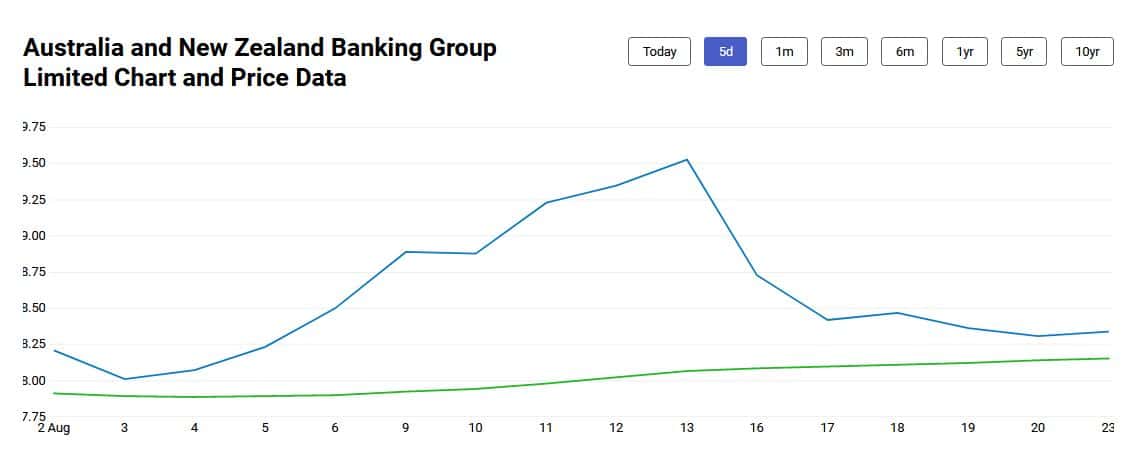

- Here’s what has been moving the ANZ (ASX:ANZ) share price in August 2021

- NIB (ASX:NHF) dividend up 70%, shares sink regardless

- 2 ASX COVID-19 shares reporting big growth

The Motley Fool Australia’s parent company Motley Fool Holdings Inc. has no position in any of the stocks mentioned. The Motley Fool Australia has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy. This article contains general investment advice only (under AFSL 400691). Authorised by Bruce Jackson.

from The Motley Fool Australia https://ift.tt/3j6VWh5