The Commonwealth Bank of Australia (ASX: CBA) share price was an early star of this August ASX earnings season. It’s not quite as fresh now, but when CBA reported its FY21 earnings on 11 August, complete with a dividend hike and a $6 billion share buyback program, it caused quite the stir.

Not only did CBA shares rocket to a new all-time high of $109.03 a share shortly afterwards, it also prompted a rally in the entire ASX banking sector, and by extension, the S&P/ASX 200 Index (ASX: XJO) itself.

But now these earnings are in the rear-view mirror, and the CBA share price has cooled somewhat (it’s going for a flat $100 at the time of writing, up 0.06% for the day), it might be a good idea to gauge this bank’s performance over August so far. So let’s get into it.

How has the CBA share price perform over August so far?

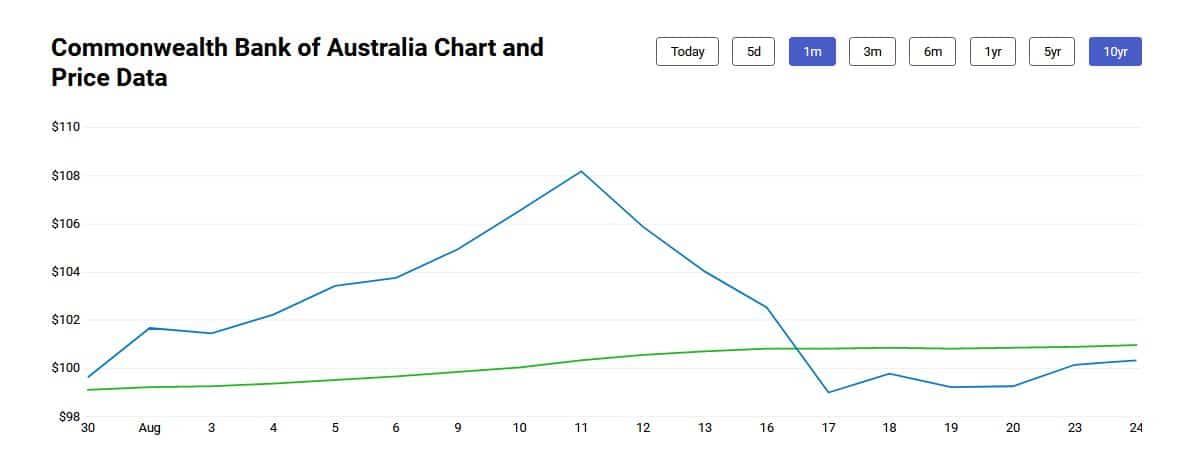

Here’s a look at how the CBA share price has performed since the start of the month of August:

As you can see, it’s been a pretty wild rise for CBA over August so far. The company started the month at just under the $100 a share mark at $99.65. But that proved short lived. CBA spent the next week or two building up to its earnings, rising by almost 7% by the day before its earnings were released.

On the big day, CBA shares responded with unbridled enthusiasm. Soon after market open on 11 August, CBA was at its current new all-time high of $109.03.

But, as you can see above, that turned out to be the peak of CBA’s goodwill. Ever since its reporting date, the CBA share price has been edging lower. On today’s prices, the bank is now a hefty 8.3% down from that high watermark.

So a long story short, CBA’s August share price performance so far revolves around the earnings report the bank delivered on 11 August.

At the current share price of $100, CBA is now up 19.65% year to date in 2021 so far, and up 45.3% over the past 12 months. It’s also up 36.8% over the past 5 years.

This share price gives Commonwealth Bank a market capitalisation of $177.7 billion, a price-to-earnings (P/E) ratio of 21.3 and a dividend yield of 2.49%.

The post Here’s what has been moving the CBA (ASX:CBA) share price in August 2021 appeared first on The Motley Fool Australia.

Should you invest $1,000 in CBA right now?

Before you consider CBA, you’ll want to hear this.

Motley Fool Investing expert Scott Phillips just revealed what he believes are the 5 best stocks for investors to buy right now… and CBA wasn’t one of them.

The online investing service he’s run for nearly a decade, Motley Fool Share Advisor, has provided thousands of paying members with stock picks that have doubled, tripled or even more.* And right now, Scott thinks there are 5 stocks that are better buys.

*Returns as of August 16th 2021

More reading

- Here’s what has been moving the ANZ (ASX:ANZ) share price in August 2021

- What’s moving the ASX 200 Index (ASX:XJO) on Monday?

- CBA (ASX:CBA) share price gaining as bank rolls out vax centres

- ASX 200 Weekly Wrap: Miners drag ASX back to earth

- Down 8%: Is the CBA (ASX:CBA) share price a buy?

Motley Fool contributor Sebastian Bowen has no position in any of the stocks mentioned. The Motley Fool Australia’s parent company Motley Fool Holdings Inc. has no position in any of the stocks mentioned. The Motley Fool Australia has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy. This article contains general investment advice only (under AFSL 400691). Authorised by Bruce Jackson.

from The Motley Fool Australia https://ift.tt/3zdBPnc

Leave a Reply