This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

What happened

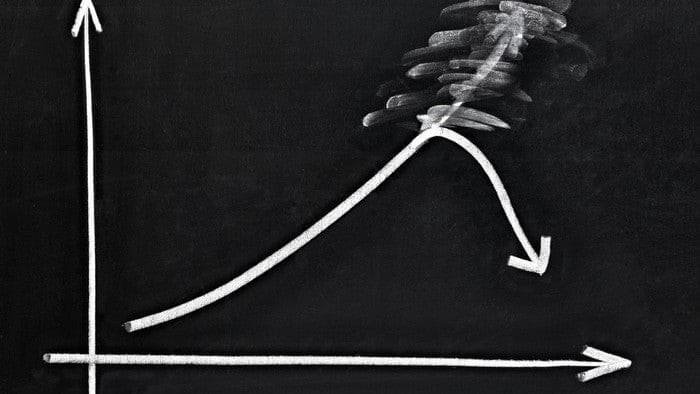

Easy come, easy go. After two straight days of mind-boggling gains, shares of tiny, relatively unknown — at least up until this week — Australian electrical equipment stock Tritium DCFC Limited (NASDAQ: DCFC) are succumbing to gravity this morning.

By market close, the maker of charging stations for electric vehicles saw its stock slide 15.1%.

So what

Let’s recap, shall we? On Tuesday, Tritium stock soared on an announcement that it is building a new factory in Tennessee. One day later, Tritium stock was off to the races once again, this time because President Biden stood on a stage and praised the company (and its new Tennessee factory) by name.

To an extent, this was a logical reaction: After all, President Biden’s trillion-dollar infrastructure bill, which passed late last year, contains some $7.5 billion worth of federal funding to support companies working to create a network of 500,000 electric vehicle charging stations in the U.S. And Tritium will almost certainly share in this loot, now that the president has put his imprimatur of approval upon it.

Now what

It’s logical, therefore, to assume that Tritium is now in line to receive millions (or even tens of millions) of federal revenue dollars on its top line. For a company that did barely $56 million in sales over the last 12 months, this is a big deal.

That being said, Tritium has not yet shown itself capable of turning any level of revenue into real profit on the bottom line. Subsidies from the government will certainly help with that — in fact, I’d go so far as to say it’s now more likely than not that Tritium will turn profitable over the next several years. But will it be profitable enough to justify the $2.1 billion market capitalization that the company has amassed over the past couple of days?

That remains to be seen — and until it is seen, investors are right to be cautious.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

The post Why Tritium shares dropped 15% today appeared first on The Motley Fool Australia.

Wondering where you should invest $1,000 right now?

When investing expert Scott Phillips has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for over ten years has provided thousands of paying members with stock picks that have doubled, tripled or even more.*

Scott just revealed what he believes could be the five best ASX stocks for investors to buy right now. These stocks are trading at near dirt-cheap prices and Scott thinks they could be great buys right now.

*Returns as of January 12th 2022

More reading

- Zap! Tritium (NASDAQ:DCFC) share price rockets another 65%. What’s next?

- Tritium (NASDAQ:DCFC) share price rockets 39% on what Biden describes as ‘great news for the planet’

- Why did the Tritium (NASDAQ:DCFC) share price just leap 7%?

- Here’s how Tritium (NASDAQ:DCFC) has been performing since listing in the US

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

from The Motley Fool Australia https://ift.tt/WZRx90a

Leave a Reply