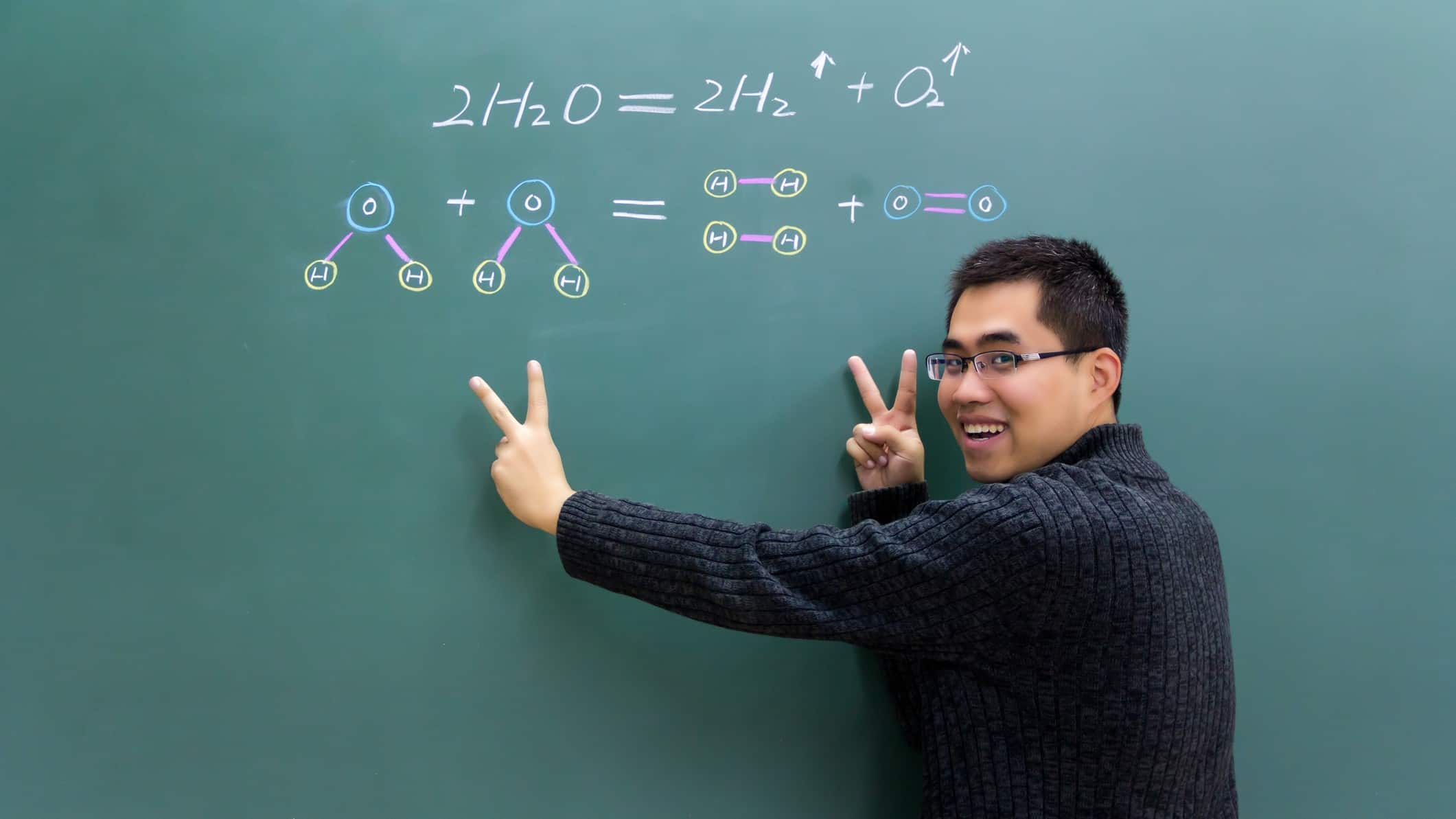

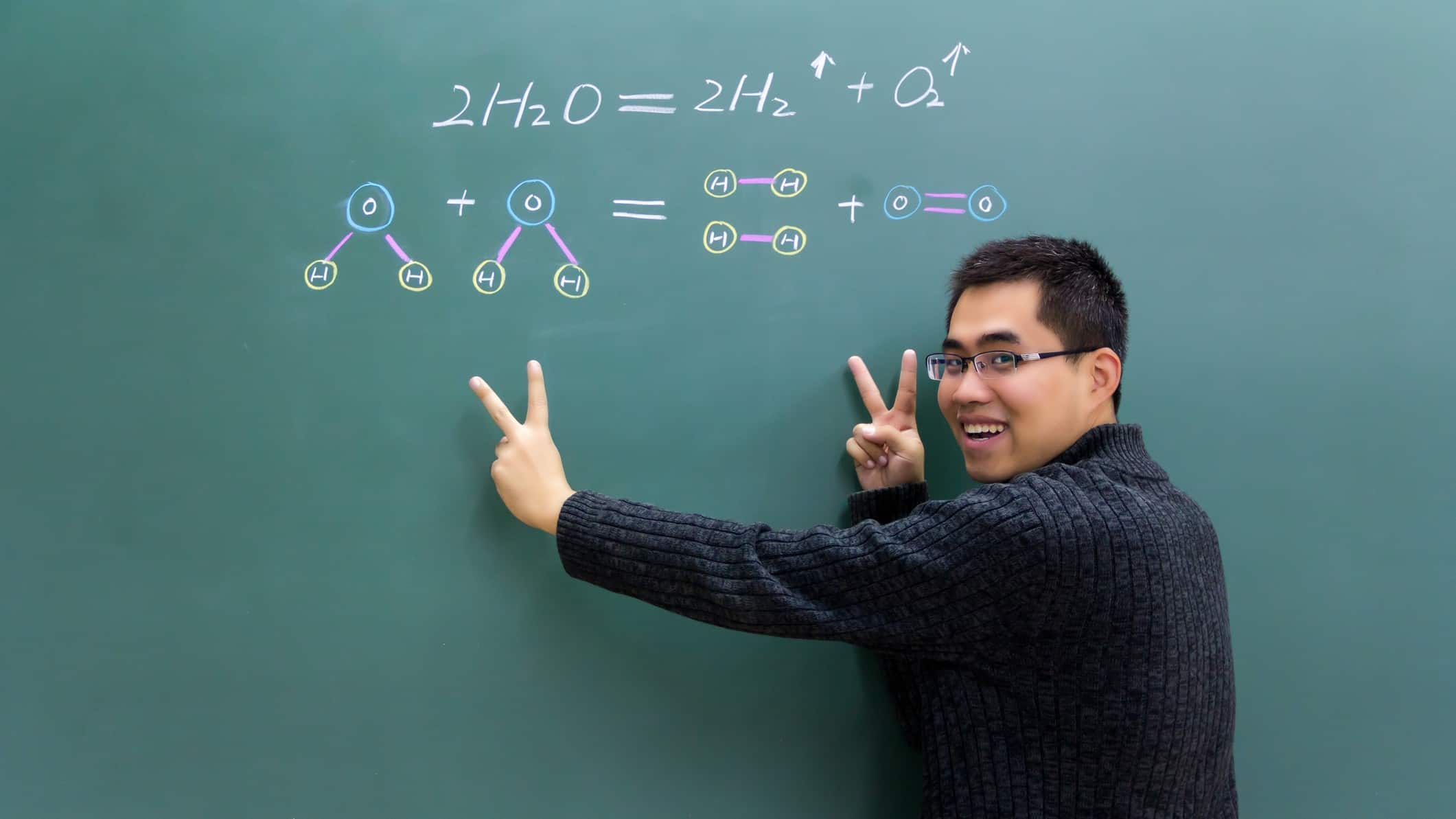

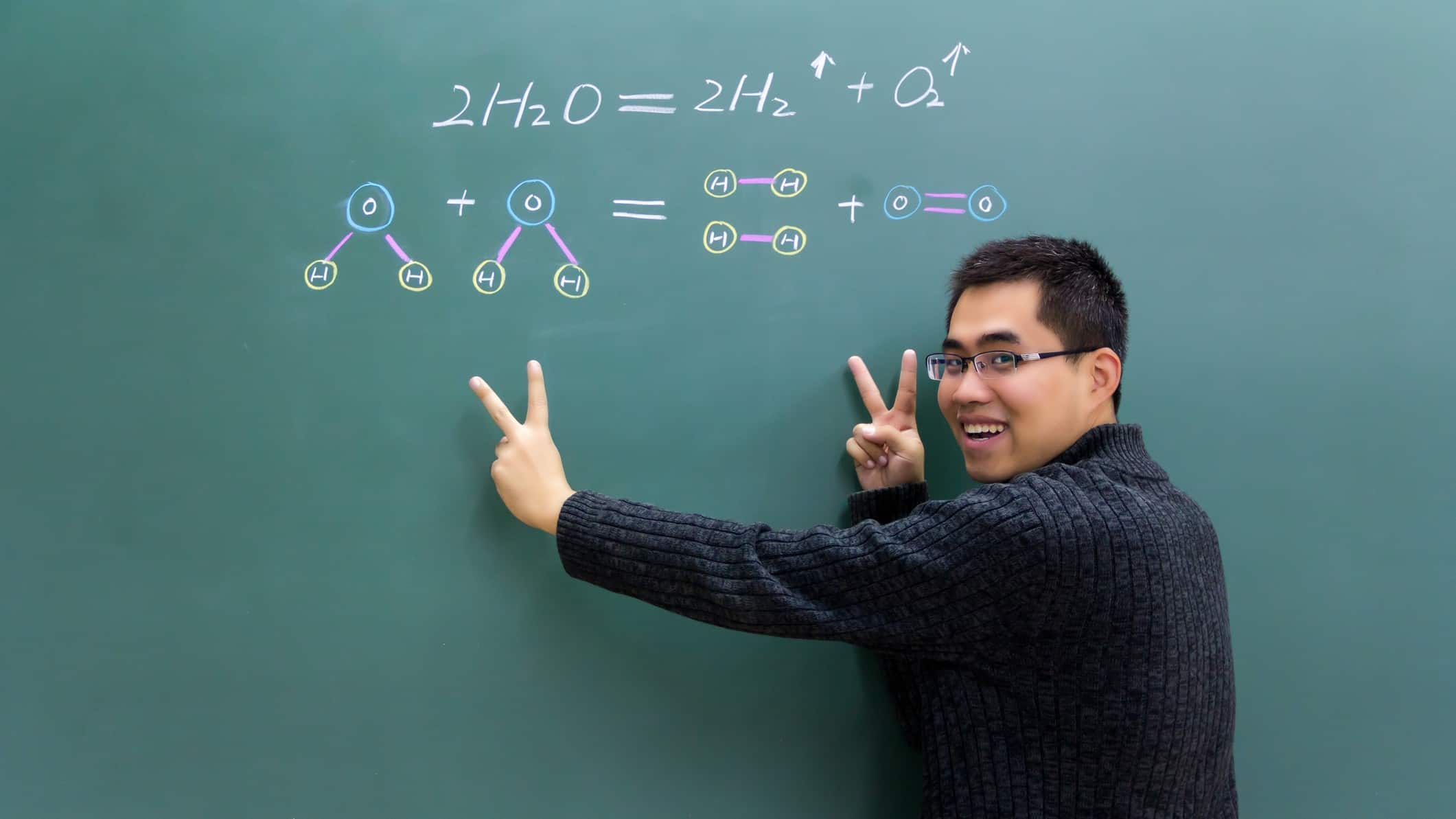

Origin Energy Ltd (ASX: ORG) is edging higher on news the company is planning a new hydrogen hub in the Hunter Valley region of New South Wales.

The Origin share price is $5.725 at the time of writing, a 0.26% gain. For perspective, the S&P/ASX 200 Index (ASX: XJO) is 0.53% in the green today.

Let’s take a look at what the energy giant announced.

What did Origin announce?

Origin will partner with Orica Ltd (ASX: ORI) in a new hydrogen hub. The hub would deliver green hydrogen from water and renewable electricity using a grid connected to a 55-megawatt electrolyser.

Origin said the hub would produce a “safe, reliable and commercial scale” green hydrogen supply chain in Newcastle.

The hydrogen could provide fuel for trucks and buses in the Hunter, Central Coast, and Sydney, according to the company.

Origin stated the plan supports the NSW government’s goal for 10,000 fuel cell electric vehicles by the end of the decade.

Recently, Origin revealed it would be exiting coal-fired power generation early. Origin plans to retire the Eraring power station in NSW by August 2025.

On February 18, the Origin share price fell 8% amid the company completing the sale of a 10% interest in Australia Pacific LNG.

Management comment

Commenting on the news, Origin CEO Frank Calabria said:

By collaborating with Orica and other partners, we have an invaluable opportunity to further explore how green hydrogen could help to power a cleaner future for manufacturing, transport and industrial customers in Australia.

Both Origin and Orica are well established in the Hunter region and bring considerable expertise in different aspects of the hydrogen value chain, which will help contribute to the continued development of this emerging industry.

Origin share price snapshot

The Origin share price has surged 6% in the past month.

In the last year, it has gained around 27% and is up more than 9% year to date.

In contrast, the S&P/ASX 200 Index (ASX: XJO) has climbed around 5% over the past 12 months.

Origin has a market capitalisation of about $10 billion.

The post Origin (ASX:ORG) share price lifts amid green hydrogen news appeared first on The Motley Fool Australia.

Should you invest $1,000 in Origin Energy right now?

Before you consider Origin Energy, you’ll want to hear this.

Motley Fool Investing expert Scott Phillips just revealed what he believes are the 5 best stocks for investors to buy right now… and Origin Energy wasn’t one of them.

The online investing service he’s run for over a decade, Motley Fool Share Advisor, has provided thousands of paying members with stock picks that have doubled, tripled or even more.* And right now, Scott thinks there are 5 stocks that are better buys.

*Returns as of January 13th 2022

More reading

- Origin (ASX:ORG) share price slides 7% but UBS is still bullish. Here’s why

- Australia’s largest coal power plant set for early D-day. What it means for Origin (ASX: ORG) shares

- Origin (ASX:ORG) share price slides 5% following another half of losses

- Power surge! These 2 ASX 200 utilities shares are storming higher today

- Origin (ASX:ORG) share price gains despite $200 million financial hit

The Motley Fool Australia’s parent company Motley Fool Holdings Inc. has no position in any of the stocks mentioned. The Motley Fool Australia has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy. This article contains general investment advice only (under AFSL 400691). Authorised by Bruce Jackson.

from The Motley Fool Australia https://ift.tt/y9aRgMA

Leave a Reply