Oil remains buoyant this week with Brent crude now back above US$100 per barrel. At the time of writing, it is fetching US$108/Bbl.

In the meantime, natural gas markets continue raging to yearly highs with the natural gas price nudging US$7.05/MMBtu on Thursday.

Woodside Petroleum Ltd (ASX: WPL) shares are also lifting in afternoon trade to $32.36. This follows an announcement by Woodside today that it plans to list on the New York Stock Exchange (NYSE).

US listing plans give Woodside share price a bump

Woodside shares are currently up 0.97% at the time of writing.

The company proposes the listing to occur after the merger with BHP Group Ltd (ASX: BHP), which is set for June.

Woodside said it hopes to list in June after the merger with BHP is finalised. Last week, the pair took another step on the ladder in gaining third-party approval from an independent auditor.

“The listing on the NYSE is expected to become effective on completion of the Merger, targeted for

1 June 2022,” Woodside said. “Each Woodside ADS represents one ordinary share of Woodside.”

The company stated further:

The Registration Statement relating to these securities has been filed with the SEC but has not yet become effective. These securities may not be sold nor may offers to buy be accepted prior to the time the Registration Statement becomes effective.

The effect on ASX investors is there will be more liquidity, which has implications for trading activity.

Investors seeking more information on Woodside’s ADS listing can read the F-4 and F-6 forms here.

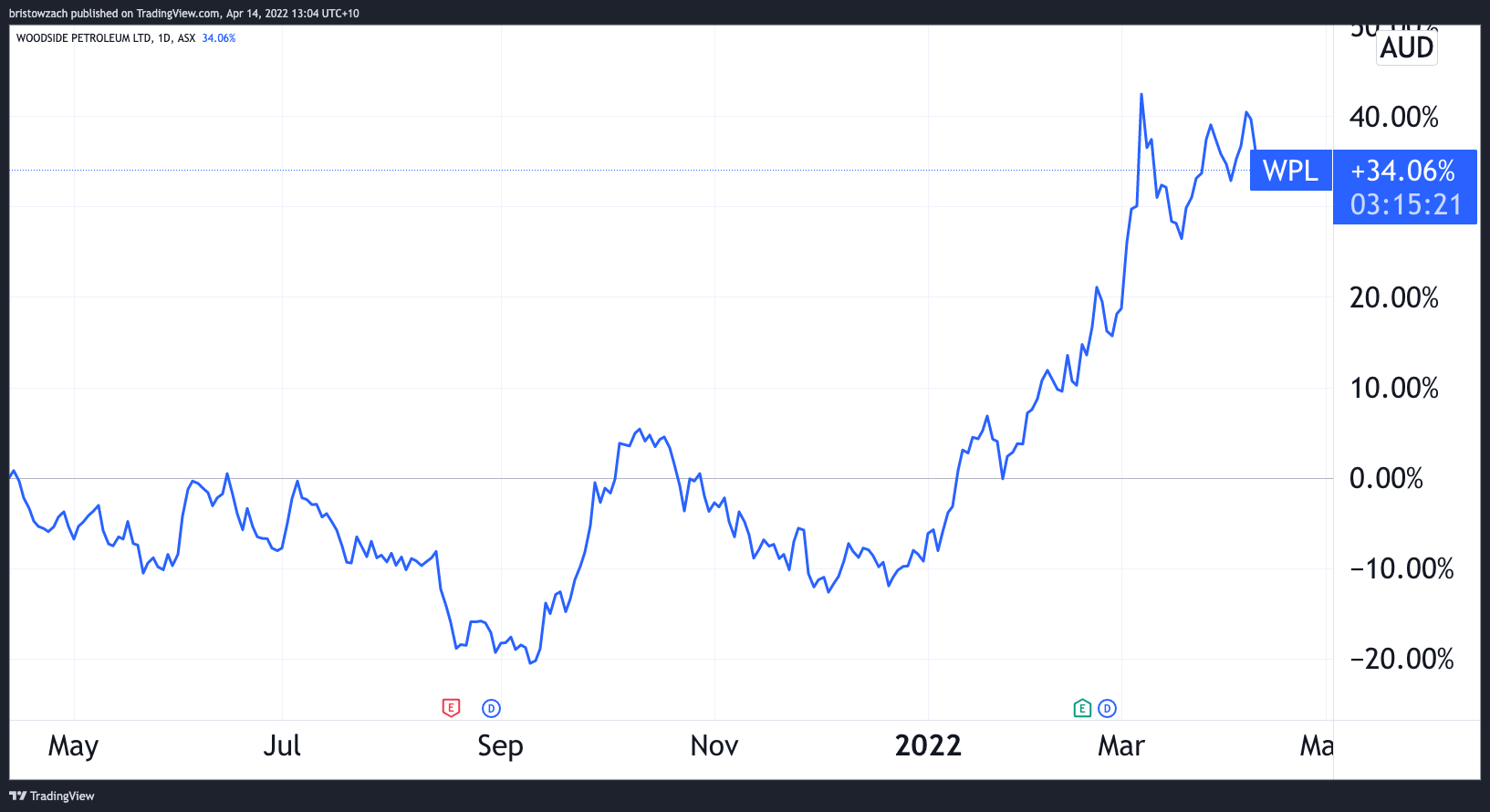

Woodside share price snapshot

Woodside shares have climbed 47% this year to date and are up by 34% over the past 12 months.

The post Woodside share price lifts amid US listing plans appeared first on The Motley Fool Australia.

Should you invest $1,000 in Woodside Petroleum right now?

Before you consider Woodside Petroleum, you’ll want to hear this.

Motley Fool Investing expert Scott Phillips just revealed what he believes are the 5 best stocks for investors to buy right now… and Woodside Petroleum wasn’t one of them.

The online investing service he’s run for over a decade, Motley Fool Share Advisor, has provided thousands of paying members with stock picks that have doubled, tripled or even more.* And right now, Scott thinks there are 5 stocks that are better buys.

*Returns as of January 13th 2022

More reading

- 5 things to watch on the ASX 200 on Thursday

- Could these ASX shares be the new FAANG stocks on the block?

- Why did the Woodside share price just get hit with a 5% downgrade?

- What’s with the Woodside share price on Monday?

- 5 things to watch on the ASX 200 on Monday

Motley Fool contributor Zach Bristow has no position in any of the stocks mentioned. The Motley Fool Australia’s parent company Motley Fool Holdings Inc. has no position in any of the stocks mentioned. The Motley Fool Australia has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy. This article contains general investment advice only (under AFSL 400691). Authorised by Bruce Jackson.

from The Motley Fool Australia https://ift.tt/k4O5gfs

Leave a Reply