The Altamin Ltd (ASX: AZI) share price has soared higher in trade on Wednesday following the company’s response to a takeover offer from VBS Exchange Pty Ltd.

At the time of writing, the Altamin share price had surged to 10.5 cents apiece, a 45.83% gain on the day so far.

Yesterday, the market was informed by Thomson Geer Lawyers that it was acting on behalf of VBS in its attempted buyout of Altamin.

The bidder’s statement disclosed the details of VBS’ “off-market takeover bid to acquire all the fully paid ordinary shares which it does not already own in Alamin”.

Meanwhile, the S&P/ASX 200 Materials Index (ASX: XMJ) is 0.68% lower today, dragging the S&P/ASX 200 Index (ASX: XJO) 0.07 into the red at the time of writing.

Altamin recommends shareholders take no action

Following the announcement yesterday, Altiamin has pushed back and recommended its shareholders take no action.

The company said:

Altamin notes the announcement by VBS Exchange that it intends to acquire all of the fully paid ordinary shares in Altamin that it do[es] not already own or control via an off-market takeover for 9.5 cents per share, implying an offer value of approximately $37.2 million.

The VBS Takeover Offer is expected to open in mid-May and will remain open for at least a month, and there is therefore no urgency to take action at this time.

If you sell your Shares on-market you will not receive any increase in the VBS Takeover Offer price, and you will pay brokerage.

At the time of the release, VBS said it controlled a 19.73% stake in Altamin, making it the company’s largest shareholder.

However, VBS didn’t appear to have much of a shot in its attempted raid on the company, given the acquisition wasn’t solicited by Altamin.

According to the Altamin statement:

As the VBS Takeover Offer was not solicited by the Company, it will need to be considered in detail by the Board of Altamin and its advisors before a formal recommendation is made to Altamin shareholders.

Shareholders should wait until they receive and consider the Target’s Statement before deciding whether to accept or reject the VBS Takeover Offer.

In the meantime, VBS says it has appointed Canaccord Genuity in Australia to continue purchasing Altamin shares “on-market at the price offered under its bid until the end of the offer period”.

The Altamin share price is around 4% in the red over the last year of trade, however, has shot 47% higher in 2022.

The post Altamin share price explodes 46% on takeover approach appeared first on The Motley Fool Australia.

Should you invest $1,000 in Altiman right now?

Before you consider Altiman, you’ll want to hear this.

Motley Fool Investing expert Scott Phillips just revealed what he believes are the 5 best stocks for investors to buy right now… and Altiman wasn’t one of them.

The online investing service he’s run for over a decade, Motley Fool Share Advisor, has provided thousands of paying members with stock picks that have doubled, tripled or even more.* And right now, Scott thinks there are 5 stocks that are better buys.

*Returns as of January 13th 2022

More reading

- Top broker tips 17% upside for Qantas shares following Airbus order

- What would happen if Appen shares were removed from the ASX 200?

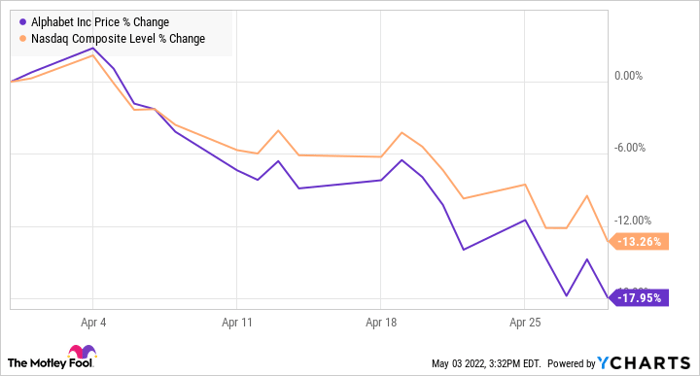

- Why Alphabet stock fell 18% in April

- ASX 200 midday update: ANZ higher on results, Flight Centre and JB Hi-Fi sink following updates

- What’s the outlook for the CBA share price in May?

Motley Fool contributor Zach Bristow has no position in any of the stocks mentioned. The Motley Fool Australia’s parent company Motley Fool Holdings Inc. has no position in any of the stocks mentioned. The Motley Fool Australia has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy. This article contains general investment advice only (under AFSL 400691). Authorised by Scott Phillips.

from The Motley Fool Australia https://ift.tt/XhnHUig