This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

If you want to outperform the market over the long term, buy stocks in growing companies that generate high and/or rising returns on invested capital (ROIC) at fair or better valuations.

Image source: The Motley Fool.

Image source: The Motley Fool.

| Comparing ROIC | Company A | Company B |

|---|---|---|

| Current EPS | $1 | $1 |

| Desired EPS growth rate | 5% | 5% |

| Return on invested capital (ROIC) | 20% | 10% |

| Reinvestment rate (solve using G = ROIC x Reinvestment) | 25% | 50% |

| Growth | 5% | 5% |

| Left to distribute (100% less reinvestment rate) | 75% | 50% |

| Free (or distributable) cash flow per $1 of EPS | $0.75 | $0.50 |

Adapted from McKinsey & Co. book Valuation: Measuring and Managing the Value of Companies.

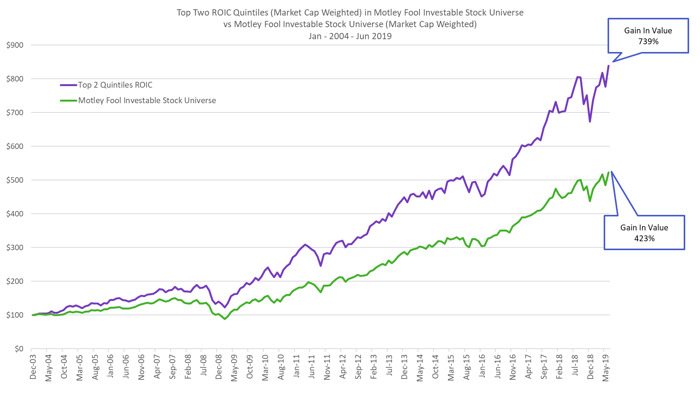

As the first two charts above clearly show:

- Companies with high ROIC outperform the market by a country mile and

- Companies with rising ROIC outperform the market by a light-year.

This is because ROIC is the most important financial metric. It is the ultimate measure of profit and performance and a main driver of free cash flow (FCF), which is ultimately what we are after as investors.

Here’s a simple formula to show you just how powerful ROIC really is. That formula is

ROIC x Reinvestment Rate = Operating Profit Growth

Assume we have two companies (Company A and Company B) that aim to grow earnings at a rate of 5% per year, but Company A has an ROIC of 20% and Company B has an ROIC of only 10%. Under these parameters, Company A only has to reinvest 25% of its profits to grow earnings 5% (20% x 25% = 5%), but Company B has to reinvest 50% of its profits to grow earnings at the same 5% rate (10% x 50% = 5%). See the table above for the math.

The company with the higher ROIC has a lower reinvestment rate and will need to reinvest less capital to achieve the same level of earnings growth. And because the higher-ROIC business requires less capital (or reinvestment) to grow, it generates higher free cash flow (FCF), and free cash flow is what determines intrinsic value. Mathematically, companies with higher ROIC generate more FCF per dollar of earnings.

Let’s all say that together: Businesses with higher ROIC generate more FCF per dollar of earnings, and growth of free cash flow is what drives growth of intrinsic value!

Because these high-ROIC businesses generate so much FCF, they can finance their growth internally rather than relying on outside capital (other people’s money) to grow. This means less debt or less equity dilution for shareholders. They can invest more in fortifying their moats. They can invest in new initiatives to build new moats and new profitable growth streams over time. They can invest in taking care of stakeholders, including employees, customers, suppliers, communities, and the planet. They can set their own time frames, remain adaptable, and future-proof their businesses.

Finally, some of the excess FCF can be used to pay down existing debt, and what’s left over will sit on the balance sheet to build up an even larger net cash position (for many of our companies at least), which further strengthens the balance sheet and builds optionality.

Before moving on from the formula, it’s important to point out that a company cannot grow operating profit faster than its incremental ROIC without taking on outside financing. Basically, a business that generates an ROIC of 20% can’t grow operating profit faster than 20%, and to do so, it must reinvest 100% of its profits (20% x 100% = 20%). Remember this the next time you hear that so-and-so company can sustainably grow earnings at 40% or 50%. The answer is that it probably can’t without taking on outside financing.

Here’s more:

An increase in ROIC always increases intrinsic value.

But an increase in revenue growth does not always increase intrinsic value. Growth only increases business value if a company’s ROIC is greater than its weighted average cost of capital (WACC).

If ROIC > WACC then growth increases intrinsic value.

If ROIC = WACC then growth neither creates nor destroys value.

If ROIC < WACC then growth destroys intrinsic value.

This is why return on invested capital is more important than revenue growth…an increase in ROIC is always value added, but an increase in growth can actually destroy value, which is a big reason you’re seeing some profitless growth stocks blow up and fall 50% to 70% or even more.

Now, if ROIC is high, a percentage-point increase in revenue growth creates more value than does a percentage-point increase in an already-high ROIC. So when ROIC is high, companies should focus on growth and can even sacrifice some ROIC to drive growth (yes, some modest decline in ROIC can be a good thing). But when ROIC is low, a company must focus on increasing its ROIC (to get it above the WACC) before it shifts into growth mode.

Don’t overthink it. Understand the basics of intrinsic value growth! Focus on finding companies with strong balance sheets, high or increasing ROIC, and growing FCF, and then just don’t pay too much.

At the end of the day, FCF growth, what we pay for it, and having the proper mindset are pretty much all that matter for long term market-beating returns.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

The post Why return on invested capital is the most important investing metric appeared first on The Motley Fool Australia.

Wondering where you should invest $1,000 right now?

When investing expert Scott Phillips has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for over ten years has provided thousands of paying members with stock picks that have doubled, tripled or even more.*

Scott just revealed what he believes could be the five best ASX stocks for investors to buy right now. These stocks are trading at near dirt-cheap prices and Scott thinks they could be great buys right now.

*Returns as of January 12th 2022

More reading

- Will the $2 billion Telus International up its bid for ASX-listed Appen?

- Why Catapult, Costa, Endeavour, and Whitehaven Coal shares are dropping

- Here’s what’s impacting the Qantas share price on Thursday

- What’s going on with the Australian Vanadium share price today?

- What’s the outlook for ASX 200 dividend shares in the second half of 2022?

The Motley Fool Australia’s parent company Motley Fool Holdings Inc. has no position in any of the stocks mentioned. The Motley Fool Australia has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy. This article contains general investment advice only (under AFSL 400691). Authorised by Scott Phillips.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

from The Motley Fool Australia https://ift.tt/ZQsSeVm