This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

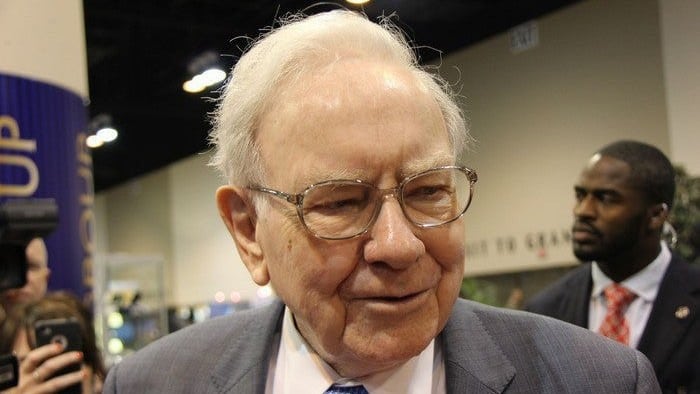

Warren Buffett has spoken to scores of groups of students over the years, answering questions, and he and his business partner Charlie Munger answer shareholder questions for hours at annual meetings of their company, Berkshire Hathaway.

A frequently asked question is how one might get better at investing, and a frequently offered bit of advice is simply to “read a lot”. In fact, Buffett has suggested reading 500 pages per day!

Here’s a closer look at that recommendation, along with some suggestions of what you might read.

The value of reading

The 500-page recommendation has been recounted by Todd Combs, one of Buffett’s two investing lieutenants (the other being Ted Weschler). Back in 2000, when he was earning his MBA at the Columbia Business School, Buffett pointed at a stack of papers and advised: “Read 500 pages like this every day … That’s how knowledge works. It builds up, like compound interest. All of you can do it, but I guarantee not many of you will do it.”

Combs did, though, and he has reportedly read as many as 1,000 pages on many days. Much of it isn’t light reading, either — the recommended kind of reading is informative fare, such as annual reports, trade magazines for various industries, transcripts of conference calls that managements hold every quarter, newspapers, and so on.

Buffett’s partner Munger is equally bullish on the value of reading, having said, “In my whole life, I have known no wise people who didn’t read all the time — none, zero … If you want wisdom, you’ll get it sitting on your a–. That’s the way it comes.”

He views reading as very profitable — literally: “I’ve gotten paid a lot over the years for reading through the newspapers.” He has quipped about it, too: “You’d be amazed at how much Warren reads — at how much I read. My children laugh at me. They think I’m a book with a couple of legs sticking out.”

What to read

Just as Buffett predicted, most of us probably won’t achieve the reading level of 500 pages per day, but that doesn’t mean we can’t change our reading habits for the better. For example:

- If you’re not much of a reader, start reading.

- If you have trouble getting around to reading, make it part of your routine, perhaps finding time early in the morning or before you go to bed.

- If you are a reader, aim to read more.

Here are some ideas of what you might read:

1. Annual reports

It’s smart to read the annual reports (including the financial statements) from any companies in which you’ve invested — and companies you’re thinking of investing in. Consider reading annual reports from competing companies, too. Buffett has explained: “If we owned stock in a company, in an industry, and there are eight other companies that are in the same industry … I want to be on the mailing list for the reports for the other eight because I can’t understand how my company is doing unless I understand what the other eight are doing.”

2. News stories and magazine articles

Both Buffett and Munger are longtime newspaper lovers, and they tend to read several each day. Those who can’t do that might still try to read as much of one good newspaper as they can each day. On top of that, read magazines about business and/or investments and magazine and/or online articles that relate to companies and industries of interest. Keeping up with financial news can give you an edge over other investors.

3. Trade magazines

Each industry will tend to have one or more trade magazines for folks in the industry, and these periodicals can impart a lot of inside information, helping you spot up-and-comers in the industry and learn about problems that the industry is facing. The hotel industry has Lodging Magazine, for example, while the fast-food industry has QSR — which stands for “Quick Serve Restaurant”. Many of these magazines exist in not only paper but also online form.

4. Conference call transcripts

It’s very common, when a publicly traded company releases its quarterly results (including its annual report), for its management to hold a conference call with analysts who ask questions. These calls can be treasure-troves of insights, and they can give you a sense of what the managers are like, too.

5. Biographies

Reading about impressive people and how they moved through their lives and achieved whatever they achieved can be very instructive — sometimes inspiring us, too. A great biography that informs your investing process and decisions doesn’t have to be about an investor or businessperson, either. Reading about politicians, scientists, philosophers, and others can also be valuable.

6. Books about great businesses

Reading about great businesses — how they were formed and how they’ve overcome challenges — can help investors learn to spot other great businesses and develop a sense of why some succeed, and others don’t. You might read books centered on particular companies, but books such as Great by Choice: Uncertainty, Chaos, and Luck — Why Some Thrive Despite Them All by Jim Collins and Moten T. Hansen that review many companies, addressing common themes, can also be great.

7. Books about great investors

There’s much to be learned from other investors, too — and reading about very successful investors might help you refine your own investing strategy. You can learn from other investors’ mistakes, which can help you avoid making them yourself. Some great investors to investigate include John Bogle, Peter Lynch, John Templeton, T. Rowe Price, and Phil Fisher.

8. Buffett’s letters to shareholders

Learn from Warren Buffett himself while you’re at it — the Berkshire Hathaway website offers links to more than 50 years’ worth of his annual letters to shareholders, each of which will impart some investing insights while also delivering a chuckle or two. He writes in a very accessible manner, as if he’s addressing his non-financial-professional sister.

So consider taking on Buffett’s challenge and see how much you can manage to read. Your investing performance can improve greatly as you absorb many insights and lessons.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

The post Do you dare take on this bold challenge from Warren Buffett? appeared first on The Motley Fool Australia.

Wondering where you should invest $1,000 right now?

When investing expert Scott Phillips has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for over ten years has provided thousands of paying members with stock picks that have doubled, tripled or even more.*

Scott just revealed what he believes could be the five best ASX stocks for investors to buy right now. These stocks are trading at near dirt-cheap prices and Scott thinks they could be great buys right now.

*Returns as of January 12th 2022

More reading

- 10 reasons Warren Buffett is such a successful investor

- Warren Buffett’s been bargain hunting following the stock market sell-off. Here’s the sector he’s been buying (and selling)

- $16 trillion ‘wiped off’ share markets. Buffett doesn’t care

- The single greatest investing lesson I ever learned

- Thinking about selling all your stocks? Here are 2 big risks you’ll face

Selena Maranjian has positions in Berkshire Hathaway (B shares). The Motley Fool Australia’s parent company Motley Fool Holdings Inc. has positions in and has recommended Berkshire Hathaway (B shares). The Motley Fool Australia’s parent company Motley Fool Holdings Inc. has recommended the following options: long January 2023 $200 calls on Berkshire Hathaway (B shares), short January 2023 $200 puts on Berkshire Hathaway (B shares), and short January 2023 $265 calls on Berkshire Hathaway (B shares). The Motley Fool Australia has recommended Berkshire Hathaway (B shares). The Motley Fool has a disclosure policy. This article contains general investment advice only (under AFSL 400691). Authorised by Scott Phillips.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

from The Motley Fool Australia https://ift.tt/sVD2OZ8