Invested in Wesfarmers Ltd (ASX: WES) shares? Two of the S&P/ASX 200 Index (ASX: XJO) conglomerateâs cornerstone retailers have reportedly switched off part of their security systems amid an investigation by Australiaâs information watchdog.

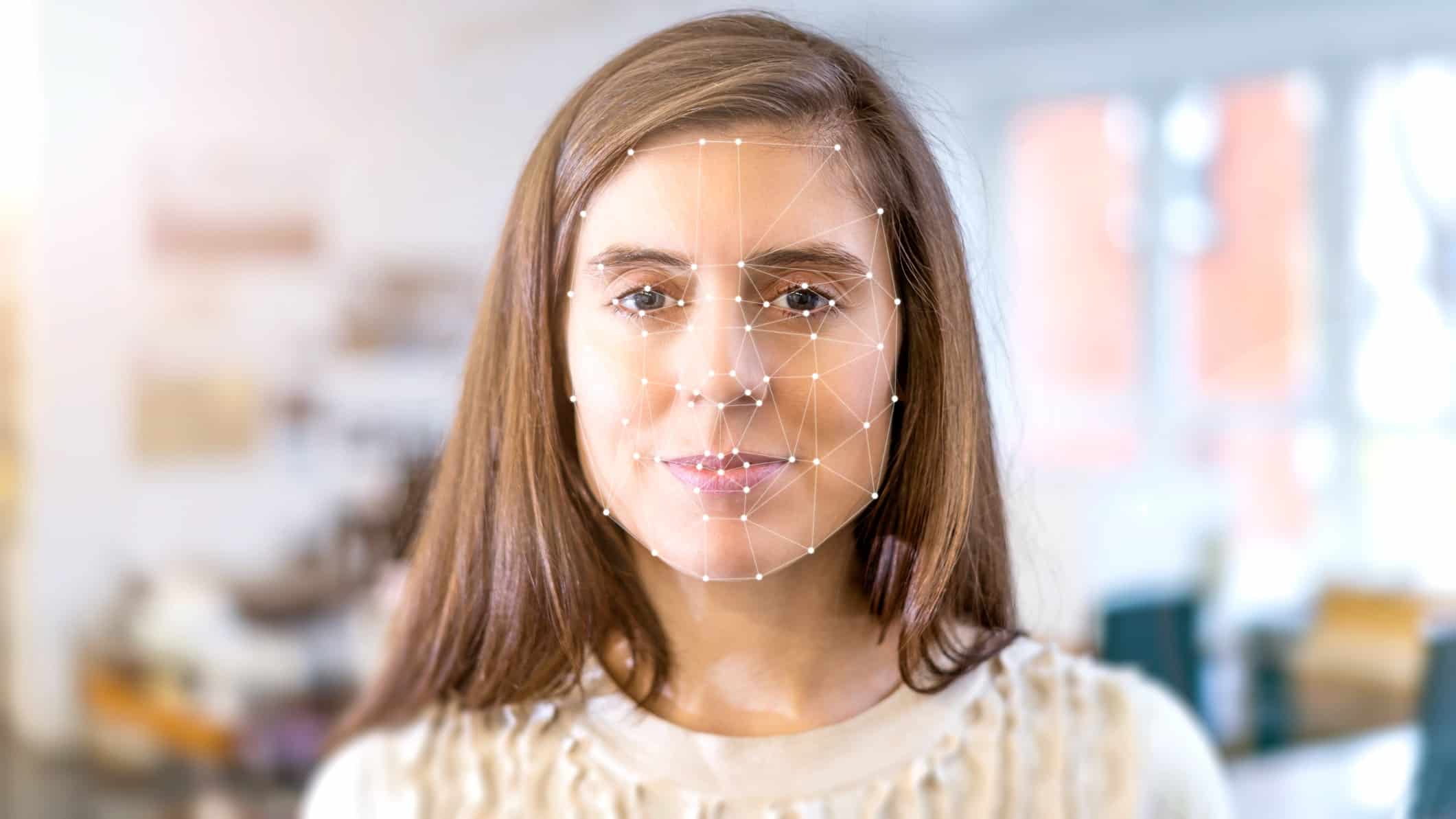

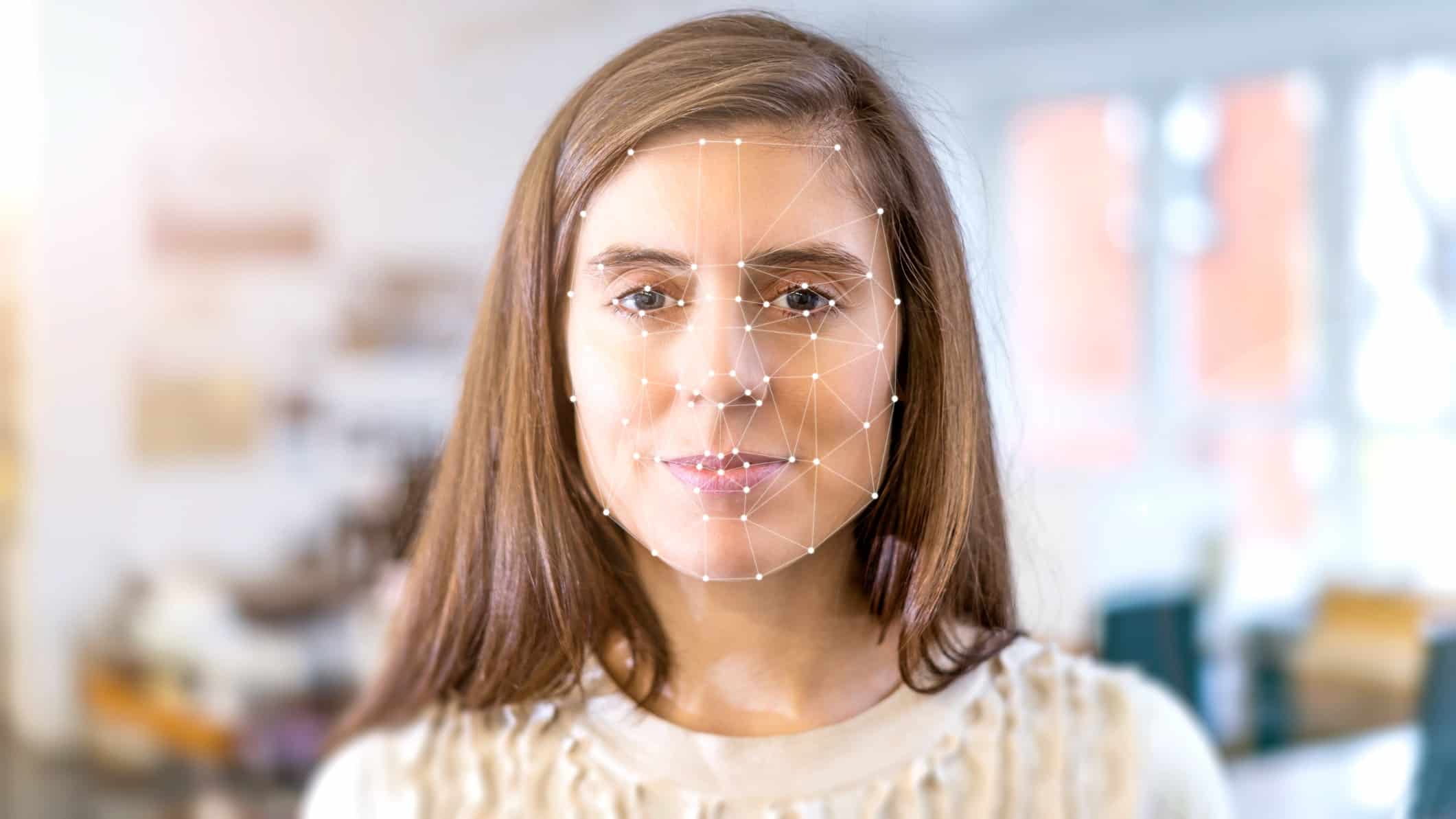

The Office of the Australian Information Commissioner (OAIC) has launched investigations into the retailersâ information-handling practices following their implementation of facial recognition technology.

Letâs take a closer look at whatâs going on with Bunnings and Kmart.

Bunnings and Kmart under investigation

Wesfarmers shares have traded relatively flat over the last two months. Meanwhile, two of the company’s hallmark retail brands have found themselves in the headlines.

Wesfarmers fans might remember last monthâs report by Choice questioning the use of facial recognition technology by multiple retailers, including some Kmart and Bunnings stores.

The consumer advocacy group said most customers werenât aware the retailers were using technology capable of capturing and storing unique biometric information such as facial features.

Choice’s Kate Bower also noted their collecting of biometric data could constitute a breach of The Privacy Act. Well, the consumer group may not have been the only one concerned about such a breach.

Its findings sparked an investigation by Australiaâs information watchdog earlier this month.

The investigation has, in turn, pushed Wesfarmersâ hallmark retailers to halt their use of the controversial security system, The Guardian reported this week.

Bunnings CEO Simon McDowell has previously said the retailersâ use of the facial recognition technology was âconsistent with The Privacy Actâ.

However, managing director Mike Schneider confirmed Bunnings has stopped using the technology in the face of the investigation, adding:

When we have customers berate our team, pull weapons, spit, or throw punches â we ban them from our stores. But a ban isnât effective if itâs hard to enforce. Facial recognition gives us a chance to identify when a banned person enters a store so we can support our team to handle the situation before it escalates.

[A]n individualâs image is only retained by the system if they are already … banned or associated with crime in our stores. We donât use it for marketing or customer behaviour tracking, and we certainly donât use it identify regular customers who enter our stores.

Wesfarmers share price snapshot

The Wesfarmers share price has struggled to gain traction this year.

It has fallen 22% since the start of 2022 and 26% over the last 12 months.

Meanwhile, the ASX 200 has dumped 10% year to date and 8% since this time last year.

Wesfarmers had not responded to The Motley Fool Australia’s requests for comment at the time of publication.

The post Own Wesfarmers shares? Hereâs why Bunnings and Kmart are under investigation by the information watchdog appeared first on The Motley Fool Australia.

Should you invest $1,000 in Wesfarmers Ltd right now?

Before you consider Wesfarmers Ltd, you’ll want to hear this.

Motley Fool Investing expert Scott Phillips just revealed what he believes are the 5 best stocks for investors to buy right now… and Wesfarmers Ltd wasn’t one of them.

The online investing service heâs run for over a decade, Motley Fool Share Advisor, has provided thousands of paying members with stock picks that have doubled, tripled or even more.* And right now, Scott thinks there are 5 stocks that are better buys.

See The 5 Stocks

*Returns as of July 7 2022

(function() {

function setButtonColorDefaults(param, property, defaultValue) {

if( !param || !param.includes(‘#’)) {

var button = document.getElementsByClassName(“pitch-snippet”)[0].getElementsByClassName(“pitch-button”)[0];

button.style[property] = defaultValue;

}

}

setButtonColorDefaults(“#0095C8”, ‘background’, ‘#5FA85D’);

setButtonColorDefaults(“#0095C8”, ‘border-color’, ‘#43A24A’);

setButtonColorDefaults(“#fff”, ‘color’, ‘#fff’);

})()

More reading

- Broker names 2 blue chip ASX shares to buy now

- Should investors buy Wesfarmers shares for dividends?

- Can ASX dividend shares deliver during earnings season?

- Could ASX earnings season be ‘a lot better than what the market is positioned forâ?

- ASX 200 retail shares rise as consumer confidence improves

Motley Fool contributor Brooke Cooper has no position in any of the stocks mentioned. The Motley Fool Australia’s parent company Motley Fool Holdings Inc. has no position in any of the stocks mentioned. The Motley Fool Australia has positions in and has recommended Wesfarmers Limited. The Motley Fool has a disclosure policy. This article contains general investment advice only (under AFSL 400691). Authorised by Scott Phillips.

from The Motley Fool Australia https://ift.tt/OBHCMJh

Leave a Reply