Monday has proven dire for the Hawsons Iron Ltd (ASX: HIO) share price after the company announced it’s hitting the brakes on its flagship project.

The company will slow activity on the Hawson Iron Project’s bankable feasibility study (BFS) in an attempt to preserve cash.

The Hawson Iron share price has dumped more than half its value in response. It has tumbled 62.16% to trade at 14 cents at the time of writing.

Let’s take a closer look at the news dragging the Aussie iron ore developer’s stock lower on Monday.

What’s going wrong for the iron ore developer?

The Hawson Iron share price is plummeting to its lowest point of 2022 so far on disappointing news of the company’s namesake project.

The company will slow down its work on the project’s BFS as it examines rising capital expenditure costs. As a result, the study will not be completed by December as was previously expected.

Managing director Bryan Granzien said the move will allow for the analysis of the project’s capital and operating cost estimates and the review of all options for further progression, including scaling opportunities. Granzien said:

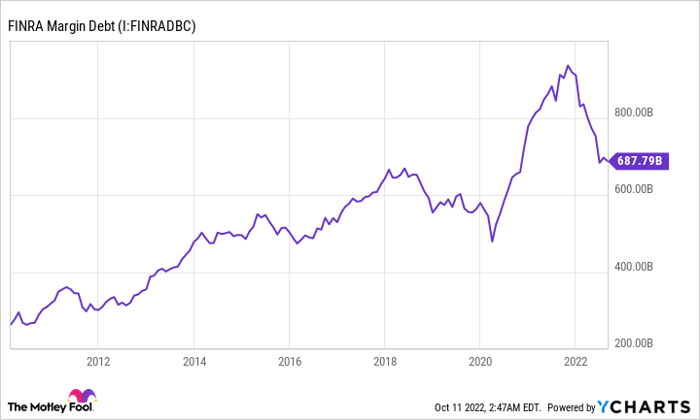

We have been left with no other choice given the current state of global capital markets and world economy.

Global inflation, rate hikes, and the war in Ukraine have brought “strong market headwinds”, said chair Dave Woodall. He continued:

We, like many companies, are being challenged by the current economic climate, falling Australian dollar, supply chain cost escalations, and restricted access to equity markets which are beyond our control.

A project slow-down is the most sensible and prudent response to preserve capital, given global cost pressures, and will allow a focus on optimising pathways in the best interests of shareholders which are reflective of deteriorating world conditions.

Woodall also said the company’s ability to raise capital over the coming year is contingent on certain resolutions to be put to shareholders at its annual general meeting (AGM). That’s set to go ahead on 15 November.

The company started working on a BFS for a 10 million tonne per annum project in 2021. The study was later expanded to look into upscaling the production profile to 20 million tonnes per annum.

Hawsons Iron share price snapshot

The Hawsons Iron share price had been on a run prior to today’s tumble.

It gained 118% between the start of 2022 and Friday’s close. It’s currently trading 20.5% lower year to date.

However, the stock is still 69% higher than it was this time last year.

The post Why did the Hawsons Iron share price just nosedive 62%? appeared first on The Motley Fool Australia.

More reading

- Sell Fortescue shares before they drop 20% and its dividends collapse: Goldman Sachs

- 3 tips from Warren Buffett to get you through any bear market

- 3 ASX 200 shares that turned a $5,000 investment into $1 million

- What caused this ASX 200 share to crash 20% on Monday?

- I’ve already made 158% on Bitcoin. Here’s why I keep holding

Motley Fool contributor Brooke Cooper has no position in any of the stocks mentioned. The Motley Fool Australia’s parent company Motley Fool Holdings Inc. has no position in any of the stocks mentioned. The Motley Fool Australia has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy. This article contains general investment advice only (under AFSL 400691). Authorised by Scott Phillips.

from The Motley Fool Australia https://ift.tt/0m1Ey4C