Next year could be a curly one for ASX shares as the global economy navigates the possibility of a recession. That’s why I think it is critical to have a game plan for your portfolio heading into 2023.

Having set criteria for your investments can help prevent impulse purchases. At the same time, it clarifies your acceptable standard for portfolio entry. As the saying goes, “You can’t hit a target you cannot see, and you cannot see a target you do not have.”

The importance of an investment checklist — or non-negotiables as I like to call them — is even greater during challenging economic times. Without it, you might run the risk of adding a fragile company to your holdings.

My ‘must-have’ list for ASX shares in 2023

Firstly, these are the conditions I’m personally setting out for my investments in 2023. I strongly urge you to consider what is important to you and your portfolio to create your own ‘non-negotiables’.

Steady up on the debt hotshot

Debt can be a beautiful thing when used effectively by a company. However, with elevated interest rates, a challenging market to raise capital in, and a possibly rocky road ahead — a boatload of debt is not something you want an ASX share to be strapped with.

Normally a debt-to-equity ratio below 40% is considered healthy. For me, I’m setting a hard limit of 25% debt on the balance sheet for 2023. Ideally, the company would also be in a net cash position.

I believe financial hardiness will be an important trait to have next year.

Hitting pause on the unprofitable ASX shares

There are plenty of exciting businesses that are pre-earnings, screaming that they’ll be the next 100X investment. Yet, next year will require my investments to be profit generators.

I’m not against investing in loss-makers in general… in fact, eight out of my 27 holdings are unprofitable companies. But, it comes with added risk if the cash runs out and the company is unable to raise additional capital.

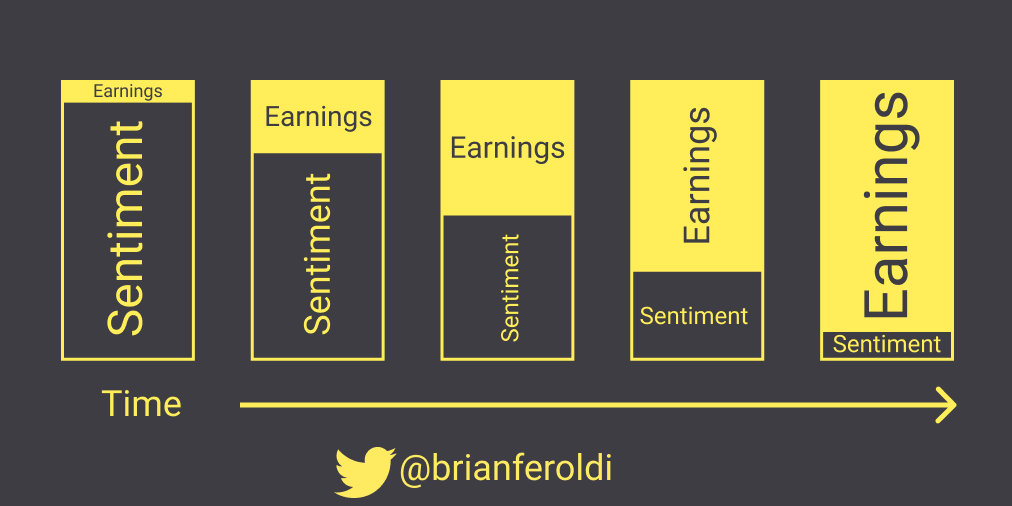

In my opinion, profitable ASX shares are offering the most attractive risk-to-reward potential now. After all, it is company earnings that drive the share price in the long run, as shown above.

Ok, but can you allocate capital like a boss?

Capital allocation will make or break a company — that I am sure of. In 2023, the most important non-negotiable is a proven track record of effective use of capital by management.

Next year’s potential economic landscape is what makes this a critical consideration. There will likely be opportunities for ASX-listed companies to acquire and grow. Executed well, this can add huge value to the company. Executed poorly, and we could look at another Slater and Gordon (value destruction from Quindell acquisition shown below).

Before investing in an ASX share, consider reviewing the company’s past return on capital (ROC). For me, the bar is set at a minimum of 15%. Although, above 20% will be preferred.

The post 2023 ready: Here are my non-negotiables for investing in ASX shares next year appeared first on The Motley Fool Australia.

FREE Beginners Investing Guide

Despite what some people may say – we believe investing in shares doesn’t have to be overwhelming or complicated…

For over a decade, we’ve been helping everyday Aussies get started on their journey.

And to help even more people cut through some of the confusion “experts’” seem to want to perpetuate – we’ve created a brand-new “how to” guide.

Yes, Claim my FREE copy!

*Returns as of November 7 2022

(function() {

function setButtonColorDefaults(param, property, defaultValue) {

if( !param || !param.includes(‘#’)) {

var button = document.getElementsByClassName(“pitch-snippet”)[0].getElementsByClassName(“pitch-button”)[0];

button.style[property] = defaultValue;

}

}

setButtonColorDefaults(“#0095C8”, ‘background’, ‘#5FA85D’);

setButtonColorDefaults(“#0095C8”, ‘border-color’, ‘#43A24A’);

setButtonColorDefaults(“#fff”, ‘color’, ‘#fff’);

})()

More reading

- 5 things to watch on the ASX 200 on Friday

- Here are the top 10 ASX 200 shares today

- Here are the 3 most heavily traded ASX 200 shares on Thursday

- 3 reasons to buy Wesfarmers shares before 2023

- Forget gold! Start hunting fallen ASX 200 shares to buy for an earlier retirement

Motley Fool contributor Mitchell Lawler has no position in any of the stocks mentioned. The Motley Fool Australia’s parent company Motley Fool Holdings Inc. has no position in any of the stocks mentioned. The Motley Fool Australia has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy. This article contains general investment advice only (under AFSL 400691). Authorised by Scott Phillips.

from The Motley Fool Australia https://ift.tt/WF483CX

Leave a Reply