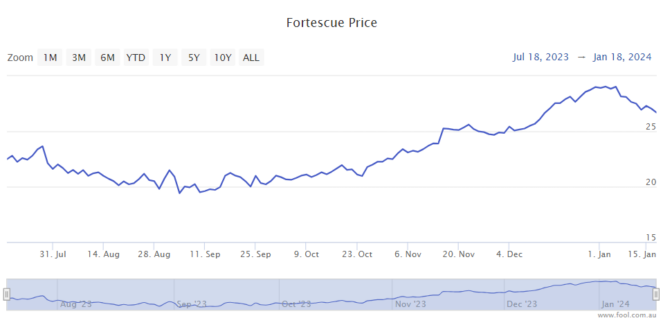

The Fortescue Ltd (ASX: FMG) share price has had a fascinating last six months, surging by 21%. 2024 could be the biggest year for the ASX resources share for multiple reasons.

Today, I’m going to look at how things might unfold.

Iron ore price volatility

The Fortescue share price has benefited from the strength of the iron ore price over the last few months, rising to US$140 per tonne. It’s currently sitting at around US$130 per tonne.

There are many positives and negatives facing the iron price in relation to China. The Chinese government has added a number of stimulus measures to try to boost its economy.

But, the economy is still not firing on all cylinders. According to Trading Economics, new home prices in China “sank at the sharpest pace since 2015, stretching the declining momentum to the sixth month and underscoring the slump in property demand in the country”.

Trading Economics added:

… uncertainty over demand for construction materials in the year ahead tempered iron ore demand from steel mills and countered added buying activity in their usual restocking season.

Market players noted that robust portside iron ore inventories limited new purchasing demand from steel mills as the sector struggles with decreasing margins, contributing to the downturn.”

The profit Fortescue generates from iron ore funds its green energy division and pays for the company’s generous dividends. So its fortunes with this resource in 2024 will influence the company and the Fortescue share price.

In addition, the new high-grade project Iron Bridge is ramping up in 2024, so it will need to start justifying the money spent on it this year.

Green energy decisions

Fortescue has already committed hundreds of millions of dollars to its green energy ambitions, and 2024 might be a pivotal year. It’s starting to make final investment decisions on projects it wants to work on in the US.

This is important â is it now making some tangible progress on diversifying its future operations? Or are hundreds of millions of dollars going up in smoke?

The decision to focus efforts on the US may also be misguided if Donald Trump wins the US election in 2024. He has committed to cut spending on clean energy projects and perhaps withdraw from the Paris agreement.

Financing will also be a key factor this year. Fortescue has flagged the option of bringing external investors into its green energy projects. How successful it is with this endeavour in 2024 (and subsequent years) may well dictate whether the company is able to achieve its lofty goals of delivering all green energy projects or not.

Fortescue share price snapshot

In the past year, the Fortescue share price has surged by around 20%.

The post 2024 could be the biggest year in history for the Fortescue share price. Here’s why! appeared first on The Motley Fool Australia.

Wondering where you should invest $1,000 right now?

When investing expert Scott Phillips has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for over ten years has provided thousands of paying members with stock picks that have doubled, tripled or even more.*

Scott just revealed what he believes could be the ‘five best ASX stocks’ for investors to buy right now. These stocks are trading at near dirt-cheap prices and Scott thinks they could be great buys right now…

See The 5 Stocks

*Returns as of 10 November 2023

(function() {

function setButtonColorDefaults(param, property, defaultValue) {

if( !param || !param.includes(‘#’)) {

var button = document.getElementsByClassName(“pitch-snippet”)[0].getElementsByClassName(“pitch-button”)[0];

button.style[property] = defaultValue;

}

}

setButtonColorDefaults(“#0095C8”, ‘background’, ‘#5FA85D’);

setButtonColorDefaults(“#0095C8”, ‘border-color’, ‘#43A24A’);

setButtonColorDefaults(“#fff”, ‘color’, ‘#fff’);

})()

More reading

- 3 ASX shares I think are ready for dividend hikes in 2024

- Top broker Citi lifts its Fortescue share price forecast

- How do Pilbara Minerals, Fortescue and BHP shares compare on FY24 dividend forecasts?

- Which had the better year in 2023: Pilbara Minerals, BHP or Fortescue shares?

- ‘Strong commodity cycle’: 2 ASX 200 iron ore shares to buy now

Motley Fool contributor Tristan Harrison has positions in Fortescue. The Motley Fool Australia’s parent company Motley Fool Holdings Inc. has no position in any of the stocks mentioned. The Motley Fool Australia has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy. This article contains general investment advice only (under AFSL 400691). Authorised by Scott Phillips.

from The Motley Fool Australia https://ift.tt/rKoJ74D

Leave a Reply