ANZ Group Holdings Ltd (ASX: ANZ) shares have set a new 52-week high on Friday at $26.12.

The ANZ share price is currently $26.00, up 0.81%, while the S&P/ASX 200 Index (ASX: XJO) is up 0.9%.

There is no official news from ANZ today.

The ASX bank share is currently awaiting the outcome of its appeal against the Australian Competition and Consumer Commission’s (ACCC) decision to block its merger with the banking division of Suncorp Group Ltd (ASX: SUN).

ANZ applied for a review of the ACCC’s decision by the Australian Competition Tribunal in August 2023.

As reported by Reuters, top broker Citi has put out a note on Suncorp saying the sale of its banking unit is “more likely to occur than not”.

Citi says it expects solid revenue growth for Suncorp due to interest rate increases over the past six months.

However, it also expects 1H FY24 net interest margins to be lower than forecasted due to an “intensely competitive environment”.

Citi has raised its 12-month share price target on Suncorp shares to $15.55.

The Suncorp share price is currently $14.01, up 0.21% for the day.

ANZ share price snapshot

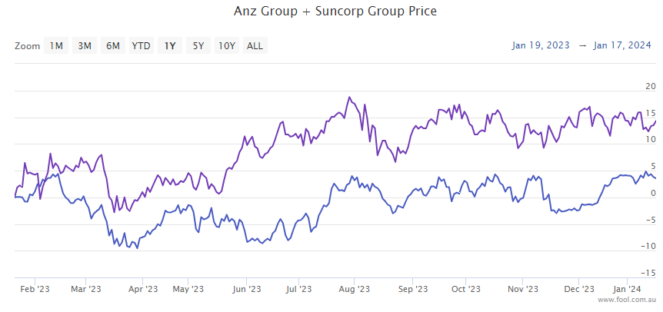

ANZ shares have lifted 4.5% over the past 12 months, while Suncorp shares have risen 13.35%.

The post ANZ shares breach 52-week record amid merger expectations appeared first on The Motley Fool Australia.

Wondering where you should invest $1,000 right now?

When investing expert Scott Phillips has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for over ten years has provided thousands of paying members with stock picks that have doubled, tripled or even more.*

Scott just revealed what he believes could be the ‘five best ASX stocks’ for investors to buy right now. These stocks are trading at near dirt-cheap prices and Scott thinks they could be great buys right now…

See The 5 Stocks

*Returns as of 10 November 2023

(function() {

function setButtonColorDefaults(param, property, defaultValue) {

if( !param || !param.includes(‘#’)) {

var button = document.getElementsByClassName(“pitch-snippet”)[0].getElementsByClassName(“pitch-button”)[0];

button.style[property] = defaultValue;

}

}

setButtonColorDefaults(“#0095C8”, ‘background’, ‘#5FA85D’);

setButtonColorDefaults(“#0095C8”, ‘border-color’, ‘#43A24A’);

setButtonColorDefaults(“#fff”, ‘color’, ‘#fff’);

})()

More reading

- Brokers name 3 ASX shares to buy now

- 5 things to watch on the ASX 200 on Friday

- Brokers say these high-yield ASX dividend shares are buys

- What will my ASX 200 bank stocks be worth in 5 years?

- How much would I need to invest in ANZ shares for $7,000 a year in passive income?

Citigroup is an advertising partner of The Ascent, a Motley Fool company. Motley Fool contributor Bronwyn Allen has positions in Anz Group. The Motley Fool Australia’s parent company Motley Fool Holdings Inc. has no position in any of the stocks mentioned. The Motley Fool Australia has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy. This article contains general investment advice only (under AFSL 400691). Authorised by Scott Phillips.

from The Motley Fool Australia https://ift.tt/e8p7xSm

Leave a Reply