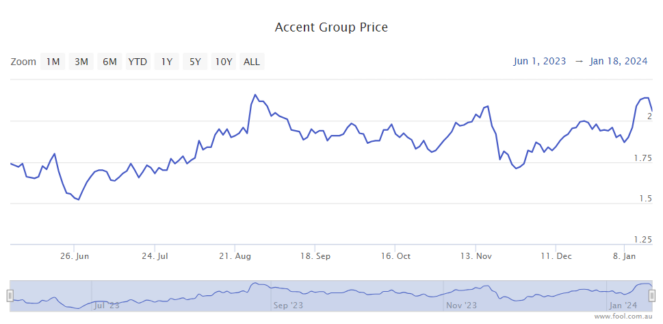

The Accent Group Ltd (ASX: AX1) share price has done very well over the last several months, as we can see on the chart below.

Accent is one of the largest shoe retailers in Australia, it acts as the distributor for a number of different global brands including Vans, Ugg, Kappa, Hoka, Skechers, Dr Martens and CAT. The business owns a number of brands in Australia including The Athlete’s Foot, Glue Store, Nude Lucy, Stylerunner and Trybe.

Strong returns by the Accent share price

The ASX retail share has seen a rise of around 33% since the low in June 2023, which is a very strong return considering the S&P/ASX 200 Index (ASX: XJO) only went up by 3.8% over the same time period. That means the business has outperformed by around 30% in about seven months.

I wouldn’t expect the next several months to show that level of outperformance again because that’s not usually how things go â past performance is not a reliable indicator of future returns, particularly in the shorter term.

With a $1,000 investment, it would have turned into $1,330. A $3,000 investment would have turned into approximately $4,000. A $5,000 investment making a 33% return would become $6,660.

On top of that, the business has paid a dividend which boosted the return. The company paid a dividend per share of 5.5 cents a few months ago. That added an extra 3.6% of a return, which is a return of over 36%.

Can the ASX retail share keep rising?

Anything can happen on the ASX in the shorter term.

In the middle of last year, the Accent share price was suffering from an investor weakness as investors didn’t know how long the high inflation and interest rates were going to stay.

To me, it’s understandable that some investor confidence has returned with inflation reducing and interest rates look to have seemingly peaked.

2024 may see some weak trading conditions with households suffering amid a higher cost of living and high interest rates. But, if interest rates start to come down, we could see household budgets improving and spending more on retail, including shoes.

The company can also grow its number of stores, expanding its reach. The company is also looking to grow digital sales, which can help grow its market share. The business can also grow its brand portfolio or expand its own brands overseas.

By doing these things, the profit could keep rising and this can help the Accent share price.

The post The Accent share price has sprinted ahead since June! Here’s how much you’ve made appeared first on The Motley Fool Australia.

Wondering where you should invest $1,000 right now?

When investing expert Scott Phillips has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for over ten years has provided thousands of paying members with stock picks that have doubled, tripled or even more.*

Scott just revealed what he believes could be the ‘five best ASX stocks’ for investors to buy right now. These stocks are trading at near dirt-cheap prices and Scott thinks they could be great buys right now…

See The 5 Stocks

*Returns as of 10 November 2023

(function() {

function setButtonColorDefaults(param, property, defaultValue) {

if( !param || !param.includes(‘#’)) {

var button = document.getElementsByClassName(“pitch-snippet”)[0].getElementsByClassName(“pitch-button”)[0];

button.style[property] = defaultValue;

}

}

setButtonColorDefaults(“#0095C8”, ‘background’, ‘#5FA85D’);

setButtonColorDefaults(“#0095C8”, ‘border-color’, ‘#43A24A’);

setButtonColorDefaults(“#fff”, ‘color’, ‘#fff’);

})()

More reading

- These ASX 300 dividend shares offer major upside and good yields

- Top ASX shares for beginner investors to buy in 2024

- I could generate an extra $200 a month by buying 21,622 shares of this ASX dividend stock

- 3 ASX dividend stocks with big yields to buy now

- Why I think these 2 ASX shares are steals

Motley Fool contributor Tristan Harrison has positions in Accent Group. The Motley Fool Australia’s parent company Motley Fool Holdings Inc. has no position in any of the stocks mentioned. The Motley Fool Australia has recommended Accent Group. The Motley Fool has a disclosure policy. This article contains general investment advice only (under AFSL 400691). Authorised by Scott Phillips.

from The Motley Fool Australia https://ift.tt/ENJIkV1

Leave a Reply