How would I invest to create passive income?

I personally am a fan of ASX growth shares, so would try to construct a well diversified portfolio of those stocks.

I reckon putting in just $300 a month could eventually land you a perpetual passive income that averages out to $22,000 each year.

Imagine what you could do with $22,000 extra every 12 months in addition to your day job.

It can go a long way into paying off the mortgage, fund the children’s education, or buying a luxurious international holiday with your loved ones.

Let’s check out hypothetically how this can be done:

3 growth shares that look great to me

Comparison site Finder last year found the average Australian has around $40,000 saved up.

So let’s start with that.

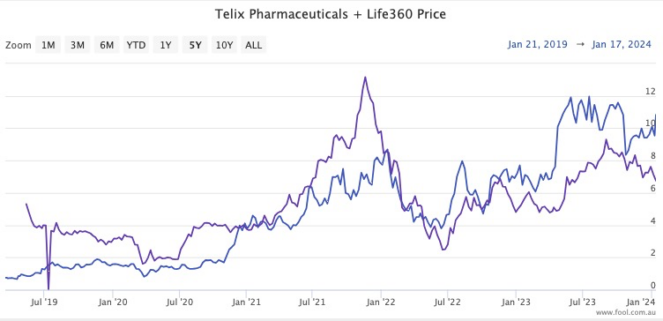

I want to diversify the growth stocks I buy, so I would perhaps choose a range like Life360 Inc (ASX: 360), Telix Pharmaceuticals Ltd (ASX: TLX) and Block Inc CDI (ASX: SQ2).

That’s one software maker, one pharmaceutical, and one fintech.

All three are well favoured by professionals at the moment.

Seven out of eight analysts covering Life360 rate the tech stock as a buy, according to CMC Invest. All seven that study Telix recommend it as a buy, while all three professionals that have evaluated Block reckon it’s an add.

Now, the past should never be taken as a sign of what’s to come in the future. But to demonstrate just how viable it is to generate decent passive income, let’s take a look at their returns.

Life360 has been on the bourse for just four months shy of five years, and the stock has climbed 34% in that time. Telix has been sensational over that half-decade, soaring an amazing 1,392%.

Block Inc, since its listing on the ASX in January 2022, has been a disaster, trading 43% lower.

Assuming a full five-year period, Life360’s compound annual growth rate (CAGR) calculates to be 6%. Telix was a sensational 71.7%.

A decade of patience, then turn on the passive income

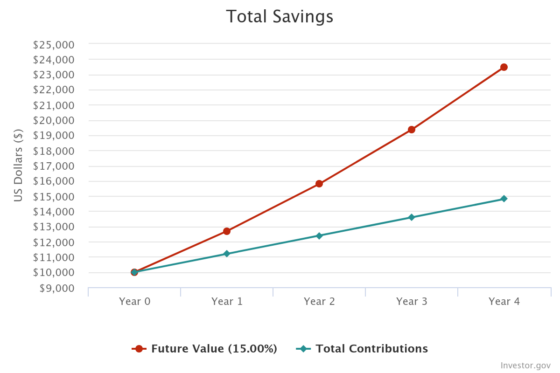

With a diversified mixture of sectors, geographies and stock performance, perhaps you could manage a CAGR of 12% with that $40,000 portfolio.

If you are disciplined with your saving and can thus add $300 each month, the growth will very much accelerate to the promised land.

After 10 years, the portfolio will have fattened up to $187,409.

From then on, the 12% return each year can be sold off to provide passive income.

That’s an average of $22,489 cash coming your way annually, as long as you maintain that stock portfolio.

Ten years. That’s all you need.

The post How I’d invest $300 a month in ASX shares to target $22,000 annual passive income! appeared first on The Motley Fool Australia.

Wondering where you should invest $1,000 right now?

When investing expert Scott Phillips has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for over ten years has provided thousands of paying members with stock picks that have doubled, tripled or even more.*

Scott just revealed what he believes could be the ‘five best ASX stocks’ for investors to buy right now. These stocks are trading at near dirt-cheap prices and Scott thinks they could be great buys right now…

See The 5 Stocks

*Returns as of 10 November 2023

(function() {

function setButtonColorDefaults(param, property, defaultValue) {

if( !param || !param.includes(‘#’)) {

var button = document.getElementsByClassName(“pitch-snippet”)[0].getElementsByClassName(“pitch-button”)[0];

button.style[property] = defaultValue;

}

}

setButtonColorDefaults(“#0095C8”, ‘background’, ‘#5FA85D’);

setButtonColorDefaults(“#0095C8”, ‘border-color’, ‘#43A24A’);

setButtonColorDefaults(“#fff”, ‘color’, ‘#fff’);

})()

More reading

- Got a spare $1,000? I’d buy 10 shares of this ASX 200 stock to aim for a million

- ‘Consistent alpha generation’: 3 ASX 200 shares sitting pretty for the long run

- Here are the top 10 ASX 200 shares today

- Here are the top 10 ASX 200 shares today

- Here are the top 10 ASX 200 shares today

Motley Fool contributor Tony Yoo has positions in Block, Life360, and Telix Pharmaceuticals. The Motley Fool Australia’s parent company Motley Fool Holdings Inc. has positions in and has recommended Block, Life360, and Telix Pharmaceuticals. The Motley Fool Australia has positions in and has recommended Block. The Motley Fool Australia has recommended Telix Pharmaceuticals. The Motley Fool has a disclosure policy. This article contains general investment advice only (under AFSL 400691). Authorised by Scott Phillips.

from The Motley Fool Australia https://ift.tt/mbITMSk

Leave a Reply