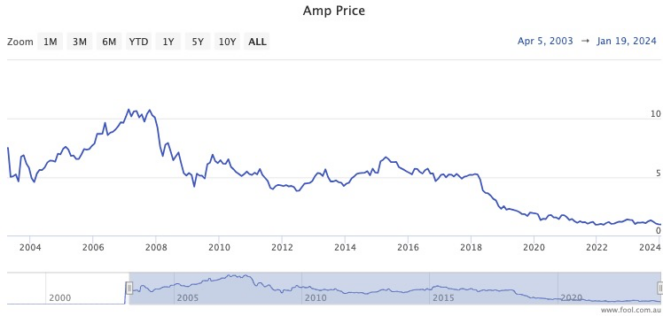

Is there a more maligned S&P/ASX 200 Index (ASX: XJO) stock this century than AMP Ltd (ASX: AMP)?

The financial services provider, especially in the past half-dozen years, has lurched from one scandal to another.

There were unfavourable findings from the financial industry Royal Commission, legal action from multiple parties, and the retention of an executive accused of sexual harassment, just to name a few of the bad memories.

The market has responded accordingly, sending the AMP share price plunging more than 80% since February 2018. The stock now trades in the mid-90 cent zone.

Due to all these troubles, the leadership at AMP is occupied by different faces to what it was just five years ago.

So can investors look forward to a turnaround in 2014, or will AMP shares set a new all-time low?

Not much love for AMP shares, even at this price

Probably the biggest observation to make for AMP shares is that hardly any fund manager or analyst talks about it these days.

It seems very few professional portfolios have the stock on their books.

AMP has always had a disproportionately high number of retail investors. That’s because when it demutualised and listed on the ASX in 1998, all previous customer-owners received shares.

Nevertheless, it’s not a great sign when no professional investor is willing to give an ASX 200 stock a run, even as a contrarian play.

This aversion is reflected on CMC Invest, which surveys the sentiment of analysts that keep an eye on AMP.

Currently, there is only one out of 10 experts rating the stock as a buy, and even that’s a low-conviction “moderate” buy.

The rest are either urging sell or hold.

How low can it go?

So how bearish is the market on AMP?

Will it crash to just 80 cents this year, which would mark a new all-time low?

It could get close.

In November, UBS Group AG (SWX: UBSG) analysts downgraded its target price for AMP shares to just 82 cents.

At about the same time, the team at Citigroup Inc (NYSE: C) reduced its 12-month expectations to 90 cents, which is not far off the mark already.

The post Could AMP shares crash to 80 cents in 2024? appeared first on The Motley Fool Australia.

Wondering where you should invest $1,000 right now?

When investing expert Scott Phillips has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for over ten years has provided thousands of paying members with stock picks that have doubled, tripled or even more.*

Scott just revealed what he believes could be the ‘five best ASX stocks’ for investors to buy right now. These stocks are trading at near dirt-cheap prices and Scott thinks they could be great buys right now…

See The 5 Stocks

*Returns as of 10 November 2023

(function() {

function setButtonColorDefaults(param, property, defaultValue) {

if( !param || !param.includes(‘#’)) {

var button = document.getElementsByClassName(“pitch-snippet”)[0].getElementsByClassName(“pitch-button”)[0];

button.style[property] = defaultValue;

}

}

setButtonColorDefaults(“#0095C8”, ‘background’, ‘#5FA85D’);

setButtonColorDefaults(“#0095C8”, ‘border-color’, ‘#43A24A’);

setButtonColorDefaults(“#fff”, ‘color’, ‘#fff’);

})()

More reading

- Here are the top 10 ASX 200 shares today

- Why did the AMP share price sink almost 30% in 2023?

- What are brokers saying about AMP shares?

Citigroup is an advertising partner of The Ascent, a Motley Fool company. Motley Fool contributor Tony Yoo has no position in any of the stocks mentioned. The Motley Fool Australia’s parent company Motley Fool Holdings Inc. has no position in any of the stocks mentioned. The Motley Fool Australia has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy. This article contains general investment advice only (under AFSL 400691). Authorised by Scott Phillips.

from The Motley Fool Australia https://ift.tt/Zu5dh18

Leave a Reply