Chant West has revealed the top 10 Australian superannuation funds with growth strategies in 2023.

Workers can choose between a variety of funds with varying investment strategies offered by their preferred superannuation provider.

For example, the classic ‘balanced’ super fund offers more exposure to defensive assets such as cash and bonds. A ‘growth’ fund is typically comprised of a higher portion of ASX shares and international shares.

Balanced funds are popular with workers close to retirement who want to preserve their super savings.

Growth funds are more suited to younger workers who are willing to take more risk to build up their super monies faster, with time available to them to offset the bad years.

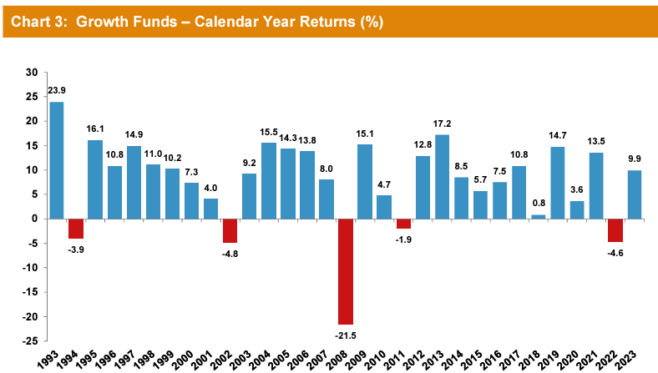

Chant West says the standard ‘growth’ superannuation funds, which are comprised of 61% to 80% growth assets like ASX shares, delivered a median 9.9% return in 2023.

This follows a 4.6% loss in 2022 and is the 11th positive return in the past 12 years. This return also comes in well above the typical target return of 6% adopted by most growth super funds.

Chant West also reported a median 11.4% return among ‘high growth’ superannuation funds, which have 81% to 95% exposure to growth assets like ASX shares.

Balanced funds, with 41% to 60% growth assets, delivered a median 8.1% return in 2023.

Shares drive strong 2023 returns

Chant West senior investment research manager Mano Mohankumar says strong share markets created superior results for superannuation funds with growth strategies last year.

Mohankumar explains:

With share markets performing so well in 2023, the better performing funds over the year were generally those that had higher allocations to shares, particularly international shares.

International shares was the standout asset class with a tremendous 23% return over the year, led by the tech sector which benefitted from advancements in [artificial intelligence] AI.

While Australian shares didn’t reach the same level, it still delivered a healthy 12.1% over the same period.

Mohankumar noted that bonds also performed well in 2023. Australian bonds returned 5.1% and international bonds delivered 5.3%. Cash returned 3.9%.

Top 10 performing growth superannuation funds for 2023

Here are the top 10 superannuation growth funds of 2023, according to Chant West.

These returns are net of investment fees and tax but before administration fees and advisor commissions.

| Fund name | Returns |

| Mine Super Growth | 11.8% |

| Vision Super Balanced Growth | 11.7% |

| IOOF Balanced Investor Trust | 11.2% |

| Aware Super Balanced | 11% |

| TWUSUPER Balanced (MySuper) | 10.6% |

| HESTA Balanced Growth | 10.5% |

| Brighter Super MySuper | 10.4% |

| UniSuper Balanced | 10.3% |

| Prime Super MySuper | 10.3% |

| Australian Retirement Trust – Super Savings Balanced | 10.2% |

Patience is a virtue for superannuation investors

Mohankumar reminded investors that superannuation investing was a long-term game, saying:

The 2023 result is also a reward for those fund members who have remained patient and maintained a long-term focus.

And that patience has certainly been tested at various points over the past four years, a period over which super funds’ investment portfolios have proven their resilience and robustness.

They’ve shown their ability to limit the damage during periods of share market weakness …

At the same time, they’re able to still capture a meaningful proportion of the upswing when markets perform strongly, as we saw this past year.

The following chart shows the long-term performance of ‘growth’ superannuation funds with 61% to 80% exposure to growth assets like ASX shares.

We recently reported the average Aussie superannuation balance at ages 60, 65, and 70.

The post Top 10 superannuation funds for growth in 2023 revealed: Chant West appeared first on The Motley Fool Australia.

Wondering where you should invest $1,000 right now?

When investing expert Scott Phillips has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for over ten years has provided thousands of paying members with stock picks that have doubled, tripled or even more.*

Scott just revealed what he believes could be the ‘five best ASX stocks’ for investors to buy right now. These stocks are trading at near dirt-cheap prices and Scott thinks they could be great buys right now…

See The 5 Stocks

*Returns as of 10 November 2023

(function() {

function setButtonColorDefaults(param, property, defaultValue) {

if( !param || !param.includes(‘#’)) {

var button = document.getElementsByClassName(“pitch-snippet”)[0].getElementsByClassName(“pitch-button”)[0];

button.style[property] = defaultValue;

}

}

setButtonColorDefaults(“#0095C8”, ‘background’, ‘#5FA85D’);

setButtonColorDefaults(“#0095C8”, ‘border-color’, ‘#43A24A’);

setButtonColorDefaults(“#fff”, ‘color’, ‘#fff’);

})()

More reading

- Here’s how the ASX 200 market sectors stacked up this week

- Here are the top 10 ASX 200 shares today

- 5 things to watch on the ASX 200 on Friday

- Here are the top 10 ASX 200 shares today

- These ASX 200 shares just hit new 52-week highs

from The Motley Fool Australia https://ift.tt/Xjt26Py

Leave a Reply