The Aussie Broadband Ltd (ASX: ABB) share price is rocketing after it announced bumper half-year results, upgraded guidance, and leadership changes.

After closing Thursday at $3.82, the stock price was a whopping 10.7% higher in early trade on Friday morning to hit $4.23.

What did the company report?

- Revenue up 17.7% to $446 million

- Net profit after tax (NPAT) up 14.6% to $9.8 million

- EBITDA before transaction-related costs up 12.7% to $46.3 million

- Operating cash flow up 57.8% to $40.7 million

- Total broadband connections up 20.6% to 756,800

Aussie Broadband also announced that its co-founder Phillip Britt would move from the chief executive role to group managing director, with chief financial officer Brian Maher becoming the chief of the Aussie Broadband arm. Meanwhile executive director Michael Omeros will be appointed chief executive of Symbio once the acquisition completes.

What else happened in the first half?

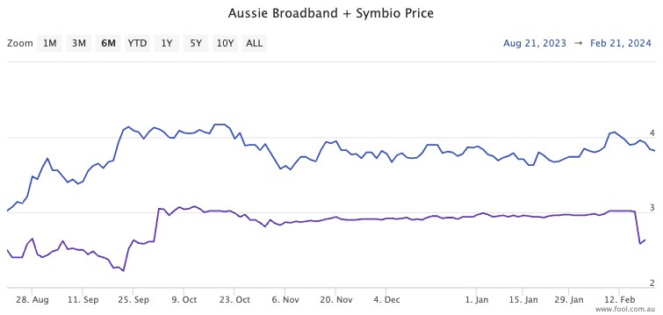

The major development during the half was Aussie Broadband’s takeover of cloud telecommunications provider Symbio Holdings Ltd (ASX: SYM) for $262 million. The transaction is due to complete at the end of this month.

Aussie raised $140 million through stock issues to fund the Symbio deal and prepare for other potential mergers.

The Aussie Broadband share price fell when the acquisition was first announced in early November, but has since stabilised.

What did management say?

Aussie Broadband co-founder and group managing director Phillip Britt welcomed the results, saying:

The company’s transition from being a largely residential-focused retail service provider into a multi-faceted communications and technology service provider is well on track and delivering strong results. At the same time, our award-winning customer service has underpinned our success while continuing to grow our NBN market share.

We believe that the ACCC’s finalisation of the new NBN SAU regulations that came into effect on 1 December 2023 will be positive for Aussie. Following these changes, we were able to reduce prices in 100Mbps speed and above while improving margins in market segments that Aussie is already strong in. The full effect of these changes will flow through from the second half of FY24.

What’s next for Aussie Broadband?

Aussie Broadband upgraded its full-year guidance, with EBITDA forecast now $105 to $110 million, compared to $100 to $110 million previously. Expected capex has come down from $47 to $52 million to a range of $40 to $45 million.

The company reported already 19,000 new broadband connections have signed up in the second half.

Aussie Broadband share price snapshot

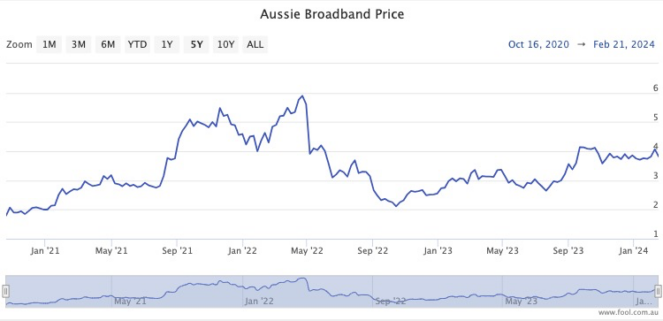

The broadband provider issued shares at $1 during its initial public offering (IPO) in late 2020. Before market open on Friday, it was almost a four-bagger to trade at $3.82.

The post Aussie Broadband share price rockets 11% after bumper results and upgraded guidance appeared first on The Motley Fool Australia.

Wondering where you should invest $1,000 right now?

When investing expert Scott Phillips has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for over ten years has provided thousands of paying members with stock picks that have doubled, tripled or even more.*

Scott just revealed what he believes could be the ‘five best ASX stocks’ for investors to buy right now. These stocks are trading at near dirt-cheap prices and Scott thinks they could be great buys right now…

See The 5 Stocks

*Returns as of 10 November 2023

(function() {

function setButtonColorDefaults(param, property, defaultValue) {

if( !param || !param.includes(‘#’)) {

var button = document.getElementsByClassName(“pitch-snippet”)[0].getElementsByClassName(“pitch-button”)[0];

button.style[property] = defaultValue;

}

}

setButtonColorDefaults(“#0095C8”, ‘background’, ‘#5FA85D’);

setButtonColorDefaults(“#0095C8”, ‘border-color’, ‘#43A24A’);

setButtonColorDefaults(“#fff”, ‘color’, ‘#fff’);

})()

More reading

Motley Fool contributor Tony Yoo has no position in any of the stocks mentioned. The Motley Fool Australia’s parent company Motley Fool Holdings Inc. has positions in and has recommended Aussie Broadband and Symbio. The Motley Fool Australia has recommended Aussie Broadband. The Motley Fool has a disclosure policy. This article contains general investment advice only (under AFSL 400691). Authorised by Scott Phillips.

from The Motley Fool Australia https://ift.tt/lXP419i

Leave a Reply