Starting from just a modest amount, anyone can build an ASX stock portfolio to fatten up for a significant flow of passive income later.

Just $20,000, which is about half the savings that the average Australian has in their bank account, can get you started.

I reckon, eventually, you could sit back and watch an average of $25,000 every year land in your bank account.

It’s all possible using the power of compounding.

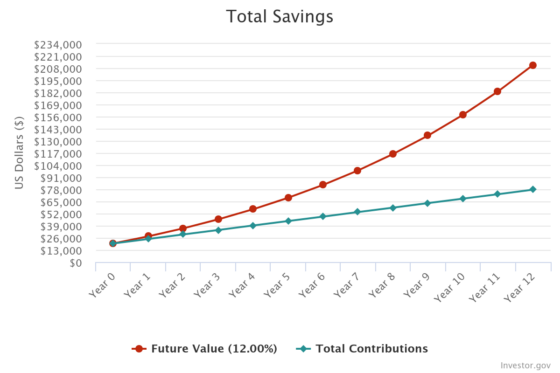

Check this out:

Invest and keep adding to it

Let’s hypothetically assume you can build a portfolio with that $20,000 that can, over the long term, average a compound annual growth rate (CAGR) of 12%.

I contend that this is reasonable, with diligent research and stock selection.

Quality businesses like Johns Lyng Group Ltd (ASX: JLG) and Lovisa Holdings Ltd (ASX: LOV) have managed to return 40.6% and 23.3% per annum over the past five years.

So with a mixture of those sorts of winners, some neutrals and the inevitable losers, there’s no reason why your $20,000 can’t grow at 12% a year.

Just practice sensible diversification, and act on sensible advice.

But it’s not just about investing and then forgetting about it.

Big rewards only come with hard work, and you need to keep saving and adding to this investment.

Assuming that you can afford to add $400 a month, after 12 years of monthly compounding, the nest egg will have grown to $211,436.

Passive income after 12 years of 12%

Now let’s have some fun.

From the 13th year, sell off the 12% gains each year.

That will provide you with an annual passive income of $25,372.

Mission accomplished.

Of course, the share market can be volatile so you won’t receive this much every single year.Â

In some years, the passive income will be far less. In others, it will be much more.

But if you maintain a portfolio with a 12% CAGR, over the long run the cash flow will average out to $25,372.

The moral of the story is that regardless of how much you can afford to put in, start investing.

You can’t buy time, but it’s such an important ingredient.

The post I’d aim to turn a $20,000 savings account into $25,400 of passive income appeared first on The Motley Fool Australia.

Wondering where you should invest $1,000 right now?

When investing expert Scott Phillips has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for over ten years has provided thousands of paying members with stock picks that have doubled, tripled or even more.*

Scott just revealed what he believes could be the ‘five best ASX stocks’ for investors to buy right now. These stocks are trading at near dirt-cheap prices and Scott thinks they could be great buys right now…

See The 5 Stocks

*Returns as of 10 November 2023

(function() {

function setButtonColorDefaults(param, property, defaultValue) {

if( !param || !param.includes(‘#’)) {

var button = document.getElementsByClassName(“pitch-snippet”)[0].getElementsByClassName(“pitch-button”)[0];

button.style[property] = defaultValue;

}

}

setButtonColorDefaults(“#0095C8”, ‘background’, ‘#5FA85D’);

setButtonColorDefaults(“#0095C8”, ‘border-color’, ‘#43A24A’);

setButtonColorDefaults(“#fff”, ‘color’, ‘#fff’);

})()

More reading

- Here are the top 10 ASX 200 shares today

- Here’s how these 3 ASX 200 shares just earned substantial broker upgrades

- A once-in-a-decade chance to get rich from ASX 200 shares?

- Here are the top 10 ASX 200 shares today

- Why Bega Cheese, Domino’s, Lovisa, and Universal Store shares are rocketing today

Motley Fool contributor Tony Yoo has positions in Johns Lyng Group and Lovisa. The Motley Fool Australia’s parent company Motley Fool Holdings Inc. has positions in and has recommended Johns Lyng Group and Lovisa. The Motley Fool Australia has recommended Johns Lyng Group and Lovisa. The Motley Fool has a disclosure policy. This article contains general investment advice only (under AFSL 400691). Authorised by Scott Phillips.

from The Motley Fool Australia https://ift.tt/mNsLjiA

Leave a Reply