Alumina Ltd (ASX: AWC) shares are off to the races today.

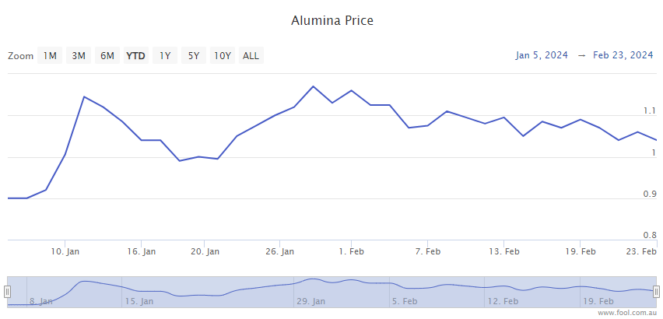

The S&P/ASX 200 Index (ASX: XJO) resources company closed on Friday trading for $1.02. At the time of writing on late Monday morning, shares are changing hands for $1.10 apiece, up 7.6%.

For some context, the ASX 200 is up 0.5% at this same time.

This comes amid news of a $3.3 billion takeover bid from its joint venture partner Alcoa Corp (NYSE: AA). Alumina owns some 40% of Alcoa World Alumina & Chemicals (AWWC) through the joint venture.

Here’s what we know.

Alumina shares rocket on takeover offer

Alumina shares are soaring after the company confirmed it has received a non-binding, indicative and conditional proposal from Alcoa to acquire 100% of its stock via a scheme of arrangement.

Alcoa is offering 0.02854 shares of its common stock for each Alumina share.

This represents a 13.1% premium to the share price of Alumina on Friday, 23 February. And it implies a 19.5% premium based on the average exchange ratio over the last 12 months.

Alcoa’s bid comes after earlier indicative offers and a period of negotiation. The US resources giant now has a 20-business day period of exclusivity.

Subject to standard conditions and the lack of a superior proposal, the Alumina board and CEO Mike Ferraro said they intend to recommend shareholders vote in favour of the takeover offer.

Alcoa noted that it’s entered into an agreement with Allan Gray Australia giving the company the right to acquire up to 19.9% of Alumina for 0.02854 Alcoa shares for each Alumina share.

Commenting on the acquisition proposal, Alcoa CEO William Oplinger said (quoted by Bloomberg):

We recognise the value creation opportunities possible under a simplified ownership structure, including the ability to implement AWAC’s operational and strategic decisions on an accelerated basis. We believe now is the right time to consolidate ownership in AWAC.

How has Alumina stock been tracking?

2024 has been a rewarding year for Alumina shareholders to date, with the stock now up 18% since the opening bell on 2 January.

The post Alumina shares leap 8% on Alcoa takeover bid appeared first on The Motley Fool Australia.

Wondering where you should invest $1,000 right now?

When investing expert Scott Phillips has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for over ten years has provided thousands of paying members with stock picks that have doubled, tripled or even more.*

Scott just revealed what he believes could be the ‘five best ASX stocks’ for investors to buy right now. These stocks are trading at near dirt-cheap prices and Scott thinks they could be great buys right now…

See The 5 Stocks

*Returns as of 10 November 2023

(function() {

function setButtonColorDefaults(param, property, defaultValue) {

if( !param || !param.includes(‘#’)) {

var button = document.getElementsByClassName(“pitch-snippet”)[0].getElementsByClassName(“pitch-button”)[0];

button.style[property] = defaultValue;

}

}

setButtonColorDefaults(“#0095C8”, ‘background’, ‘#5FA85D’);

setButtonColorDefaults(“#0095C8”, ‘border-color’, ‘#43A24A’);

setButtonColorDefaults(“#fff”, ‘color’, ‘#fff’);

})()

More reading

- Here are the top 10 ASX 200 shares today

- How ASX shares vs. property performed in January

- These were the best performers on the ASX 200 in January

- Here are the top 10 ASX 200 shares today

Motley Fool contributor Bernd Struben has no position in any of the stocks mentioned. The Motley Fool Australia’s parent company Motley Fool Holdings Inc. has no position in any of the stocks mentioned. The Motley Fool Australia has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy. This article contains general investment advice only (under AFSL 400691). Authorised by Scott Phillips.

from The Motley Fool Australia https://ift.tt/tuS2naX

Leave a Reply