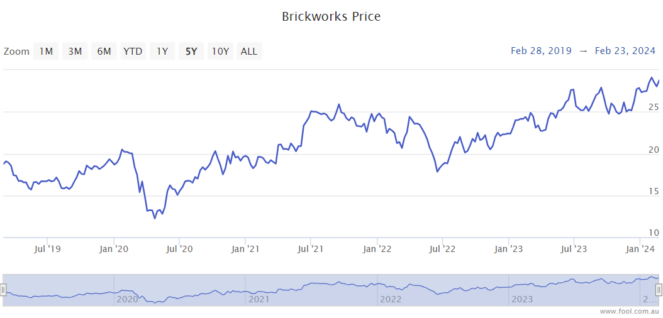

The Brickworks Limited (ASX: BKW) share price is currently up 1% and hit a peak of $29.80 earlier today. In the past three months, it has gone on an impressive run, rising by 18%.

The building products business hasn’t reported yet, its reporting period ends on 31 January 2024, a month later than most other businesses. It’s due to hand in its 2024 half-year result on 21 March 2024.

It hasn’t made any announcements since the company’s property update in December. Let’s look at what’s going on.

Why has the Brickworks share price soared?

There has been a lot of excitement in the building products space after a number of takeover bids, which has enabled investors to put a price on Brickworks’ manufacturing earnings and potential.

CSR Ltd (ASX: CSR) entered into a binding scheme implementation deed this week with Saint-Gobain for a cash price of $9 per share. The CSR share price is up 33% this year.

Boral Ltd (ASX: BLD) received a takeover offer from Seven Group Holdings Ltd (ASX: SVW). The Boral share price is up 10% in the last month and 66% in the past year.

Adbri Ltd (ASX: ABC) has entered into a scheme implementation deed with CRH. The Adbri share price is up 58% in the last three months.

Brickworks hasn’t received a takeover offer, but the Brickworks share price has gone up 20% from 11 December 2023.

The company seems to be feeding off the excitement about the sector.

If all three of CSR, Boral and Adbri are taken off the ASX, then Brickworks will be one of the few larger building product businesses.

What next?

Brickworks and Washington H. Soul Pattinson and Co. Ltd (ASX: SOL) are going to report their results in a few weeks, so we’ll get a good look at both businesses under the ‘hood’.

The business has recovered a long way from its COVID-19 low in April 2020 â it’s up by 140%.

The post How did the Brickworks share price just hit an all-time high? appeared first on The Motley Fool Australia.

Wondering where you should invest $1,000 right now?

When investing expert Scott Phillips has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for over ten years has provided thousands of paying members with stock picks that have doubled, tripled or even more.*

Scott just revealed what he believes could be the ‘five best ASX stocks’ for investors to buy right now. These stocks are trading at near dirt-cheap prices and Scott thinks they could be great buys right now…

See The 5 Stocks

*Returns as of 10 November 2023

(function() {

function setButtonColorDefaults(param, property, defaultValue) {

if( !param || !param.includes(‘#’)) {

var button = document.getElementsByClassName(“pitch-snippet”)[0].getElementsByClassName(“pitch-button”)[0];

button.style[property] = defaultValue;

}

}

setButtonColorDefaults(“#0095C8”, ‘background’, ‘#5FA85D’);

setButtonColorDefaults(“#0095C8”, ‘border-color’, ‘#43A24A’);

setButtonColorDefaults(“#fff”, ‘color’, ‘#fff’);

})()

More reading

- Buying Soul Patts shares? Here’s what you’re really buying

- How I built $5,000 of passive income starting with $0

- Owners of Brickworks shares haven’t seen a dividend cut for 47 years!

- Retirees: Here’s how to boost your pension in 2024

- Transform $50 into monthly income: The best ASX dividend stocks under $50

Motley Fool contributor Tristan Harrison has positions in Brickworks and Washington H. Soul Pattinson and Company Limited. The Motley Fool Australia’s parent company Motley Fool Holdings Inc. has positions in and has recommended Brickworks and Washington H. Soul Pattinson and Company Limited. The Motley Fool Australia has positions in and has recommended Brickworks and Washington H. Soul Pattinson and Company Limited. The Motley Fool has a disclosure policy. This article contains general investment advice only (under AFSL 400691). Authorised by Scott Phillips.

from The Motley Fool Australia https://ift.tt/RrZXGES

Leave a Reply