The Tesla Inc (NASDAQ: TSLA) share price closed down 7.2% overnight.

Those losses added to selling pressure on the Nasdaq Composite Index (NASDAQ: .IXIC), with the tech-heavy index closing the day down 0.4%.

Shares in Elon Musk’s EV and tech company closed on Friday trading for US$202.65. At market close, those shares were swapping hands for US$188.14 apiece.

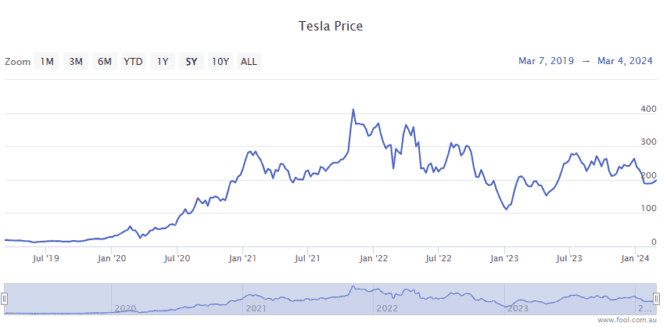

As you can see in the chart above, the Tesla share price soared an eye-popping 102% in 2023.

But 2024 has been a different story so far, with the stock down 24% since the opening bell on 2 January.

Here’s why Nasdaq investors were hitting the sell button again overnight.

Why is the Tesla share price under selling pressure?

Much of the overnight sell-off looks to have been spurred by some gloomy sales data out of China, the world’s top EV market.

According to data from China’s Passenger Car Association, Musk’s company shipped 60,365 vehicles from its Shanghai-based factory in February. That’s down almost 16% from January shipments. And it’s the lowest number of shipments in more than two years, heaping pressure on the Tesla share price.

Atop the falling vehicle sales in China, troubles continue to build for Elon Musk at X (formerly Twitter).

More lawsuits at X

While most of the headwinds buffeting the Tesla share price look to be related to the slumping China sales data, ongoing legal ructions at X could also be stoking investor angst.

As you likely recall, Elon Musk acquired Twitter for US$44 billion back in October 2022.

And not everyone was happy with how that acquisition was carried out.

There are already several class action lawsuits in the works, with sacked workers seeking more than half a billion US dollars in severance pay.

And, as Reuters reports, yesterday saw yet another lawsuit filed on behalf of four former high-ranking Twitter executives. They’re asking for a total of more than US$128 million in unpaid severance.

“This is the Musk playbook: to keep the money he owes other people, and force them to sue him,” Twitter’s sacked executives stated in the lawsuit documents.

As for the 2024 Tesla share price plunge, long-term investors should still be sitting pretty.

Shares in the US EV giant remain up 893% over five years.

The post Why did the Tesla share price just tumble 7%? appeared first on The Motley Fool Australia.

Wondering where you should invest $1,000 right now?

When investing expert Scott Phillips has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for over ten years has provided thousands of paying members with stock picks that have doubled, tripled or even more.*

Scott just revealed what he believes could be the ‘five best ASX stocks’ for investors to buy right now. We believe these stocks are trading at attractive prices and Scott thinks they could be great buys right now…

See The 5 Stocks

*Returns as of 1 February 2024

(function() {

function setButtonColorDefaults(param, property, defaultValue) {

if( !param || !param.includes(‘#’)) {

var button = document.getElementsByClassName(“pitch-snippet”)[0].getElementsByClassName(“pitch-button”)[0];

button.style[property] = defaultValue;

}

}

setButtonColorDefaults(“#0095C8”, ‘background’, ‘#5FA85D’);

setButtonColorDefaults(“#0095C8”, ‘border-color’, ‘#43A24A’);

setButtonColorDefaults(“#fff”, ‘color’, ‘#fff’);

})()

More reading

- Goldman Sachs says this US stock is replacing Tesla in the Magnificent Seven

- Buy and hold these ASX ETFs for 10 years or more

- Why Tesla stock tanked in January

Motley Fool contributor Bernd Struben has no position in any of the stocks mentioned. The Motley Fool Australia’s parent company Motley Fool Holdings Inc. has positions in and has recommended Tesla. The Motley Fool Australia has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy. This article contains general investment advice only (under AFSL 400691). Authorised by Scott Phillips.

from The Motley Fool Australia https://ift.tt/DWbJZkf

Leave a Reply