A little-known ASX pharmaceutical stock is setting the bar high today.

Very high.

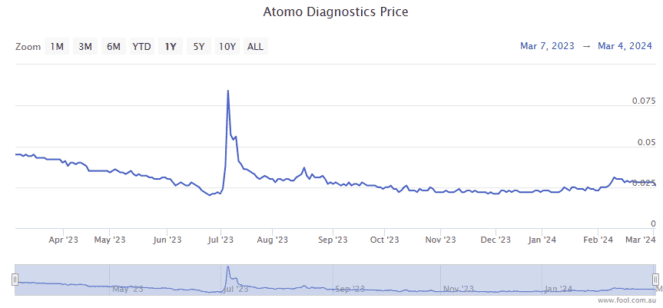

Shares in the medical device company closed yesterday trading for 2.7 cents. In morning trade on Wednesday, the ASX pharmaceutical stock leapt to 6.0 cents per share, up a whopping 122%.

After some likely profit-taking, at the time of writing shares are trading for 4.4 cents apiece, up a very healthy 63.0%.

For some context, the All Ordinaries Index (ASX: XAO) is down 0.3% at this same time.

Any guesses?

If you said Atomo Diagnostics Ltd (ASX: AT1), give yourself a virtual gold star.

Here’s what’s piquing investor interest in the microcap stock today.

What’s sending the ASX pharmaceutical stock soaring?

The Atomo Diagnostics share price is rocketing higher after the company announced it had secured purchase orders from Viatris Healthcare for around $970,000 worth of HIV Self-Tests.

The test kits, manufactured by the ASX pharmaceutical stock under the Mylan brand, will be used to supply a number of low and middle income countries (LMICs).

The orders are for manufacture during the second half of FY 2024.

“We have seen growing demand during FY24 for the Atomo HIV Self-Test here in Australia as well as across branded versions supplied to international markets,” Atomo CEO John Kelly said.

“Following significant increases in sales to Europe and in Australia, it is good to now see emergent demand across LMIC markets from our global health partner for HIV testing, Viatris,” Kelly added.

The ASX pharmaceutical stock has commercialised a number of products across international markets. It has existing supply agreements for testing applications targeting infectious diseases including COVID-19, HIV, viral versus bacterial differentiation and female health.

The post Guess which ASX pharmaceutical stock just rocketed 122%! appeared first on The Motley Fool Australia.

Wondering where you should invest $1,000 right now?

When investing expert Scott Phillips has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for over ten years has provided thousands of paying members with stock picks that have doubled, tripled or even more.*

Scott just revealed what he believes could be the ‘five best ASX stocks’ for investors to buy right now. We believe these stocks are trading at attractive prices and Scott thinks they could be great buys right now…

See The 5 Stocks

*Returns as of 1 February 2024

(function() {

function setButtonColorDefaults(param, property, defaultValue) {

if( !param || !param.includes(‘#’)) {

var button = document.getElementsByClassName(“pitch-snippet”)[0].getElementsByClassName(“pitch-button”)[0];

button.style[property] = defaultValue;

}

}

setButtonColorDefaults(“#0095C8”, ‘background’, ‘#5FA85D’);

setButtonColorDefaults(“#0095C8”, ‘border-color’, ‘#43A24A’);

setButtonColorDefaults(“#fff”, ‘color’, ‘#fff’);

})()

More reading

- Why is the Core Lithium share price down 14% in two days?

- Is it too late to join the booming ASX gold rush?

- Why is the Cettire share price crashing 27% on Wednesday?

- Why is this ASX 200 tech stock crashing 11% today?

- Why is the Graincorp share price having such a bumper week?

Motley Fool contributor Bernd Struben has no position in any of the stocks mentioned. The Motley Fool Australia’s parent company Motley Fool Holdings Inc. has no position in any of the stocks mentioned. The Motley Fool Australia has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy. This article contains general investment advice only (under AFSL 400691). Authorised by Scott Phillips.

from The Motley Fool Australia https://ift.tt/JIEl8YS

Leave a Reply