Qantas Airways Ltd (ASX: QAN) shares are catching some headwinds today.

Shares in the S&P/ASX 200 Index (ASX: XJO) airline stock closed yesterday trading for $5.12. In early afternoon trade on Wednesday, shares are changing hands for $5.045 apiece, down 1.5%.

For some context the ASX 200 is down 0.17% at this same time.

This follows a court ruling finding Qantas guilty of illegally standing down a ground services worker during the early months of the global pandemic.

ASX 200 airline guilty of ‘shameful’ conduct

Qantas shares could face more brand damage after New South Wales District Court Judge David Russell fined the company’s subsidiary, Qantas Ground Services (QGS), $250,000 for illegally standing down lift truck driver Theo Seremetidis in early 2020.

Seremetidis, an elected health and safety representative, was working out of Sydney International Airport at the time.

As ABC News reported, Qantas took action against Seremetidis after he expressed his worries that personnel cleaning planes arriving from China could be at risk of being infected by COVID-19.

Last year, the court ruled that the airline had engaged in discriminatory conduct in unfairly cutting Seremetidis off from staff who sought out his help. Last week, Qantas agreed to pay him $21,000 for economic and non-economic losses.

The $250,000 conviction today (of which the prosecutor will receive half) came after Russell determined the actions by QGS were deliberate rather than inadvertent.

According to Russell (quoted by ABC News):

The conduct against Mr Seremetidis was quite shameful. Even when he was stood down and under investigation, QGS attempted to manufacture additional reasons for its actions.

He added that “The effect of the conduct of QGS upon Mr Seremetidis personally was traumatic and long-lasting.”

Responding to the ruling that could be pressuring Qantas shares today, a spokesperson for the ASX 200 airline said, “We agreed to compensation for Theo Seremetidis and the court has today made orders for that compensation to be paid.”

They added that Qantas “acknowledged in court the impact that this incident had on Mr Seremetidis and apologised to him”.

How have Qantas shares been tracking longer-term?

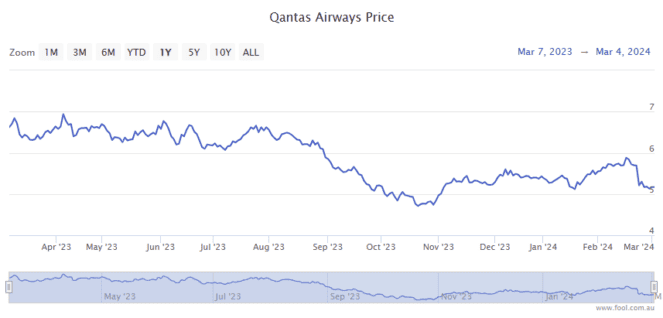

Qantas shares have struggled over the past year, down 23%.

Despite that retrace, the ASX 200 airline’s shares have more than doubled since the depths of the pandemic-driven sell-off in early 2020.

The post Qantas shares hit turbulence amid $250,000 fine for ‘shameful’ conduct appeared first on The Motley Fool Australia.

Wondering where you should invest $1,000 right now?

When investing expert Scott Phillips has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for over ten years has provided thousands of paying members with stock picks that have doubled, tripled or even more.*

Scott just revealed what he believes could be the ‘five best ASX stocks’ for investors to buy right now. We believe these stocks are trading at attractive prices and Scott thinks they could be great buys right now…

See The 5 Stocks

*Returns as of 1 February 2024

(function() {

function setButtonColorDefaults(param, property, defaultValue) {

if( !param || !param.includes(‘#’)) {

var button = document.getElementsByClassName(“pitch-snippet”)[0].getElementsByClassName(“pitch-button”)[0];

button.style[property] = defaultValue;

}

}

setButtonColorDefaults(“#0095C8”, ‘background’, ‘#5FA85D’);

setButtonColorDefaults(“#0095C8”, ‘border-color’, ‘#43A24A’);

setButtonColorDefaults(“#fff”, ‘color’, ‘#fff’);

})()

More reading

- If I invest $10,000 in Qantas shares, how much passive income will I receive in 2024?

- Analysts think these ASX 200 shares are dirt cheap buys

- These ASX shares could rise 30% to 50% in 12 months

- Qantas descends, Treasurer’s RBA dilemma and Twiggy’s payday: Scott Phillips on Nine’s Late News

- Brokers name 3 ASX shares to buy now

Motley Fool contributor Bernd Struben has no position in any of the stocks mentioned. The Motley Fool Australia’s parent company Motley Fool Holdings Inc. has no position in any of the stocks mentioned. The Motley Fool Australia has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy. This article contains general investment advice only (under AFSL 400691). Authorised by Scott Phillips.

from The Motley Fool Australia https://ift.tt/YP5u0kH

Leave a Reply