Just $9,000 could start your journey into the delicious world of passive income.

In fact, I reckon you’re in with a shot of generating a perpetual monthly payment of $500 if you play your cards right.

Don’t believe me?

Check out this hypothetical:

Go the growth shares, I reckon

With $9,000, I would construct a diversified portfolio of ASX growth shares.

Although the Australian stock market suffers from the stereotype that it’s dominated by dividend stocks, there are plenty of excellent growth investments out there.

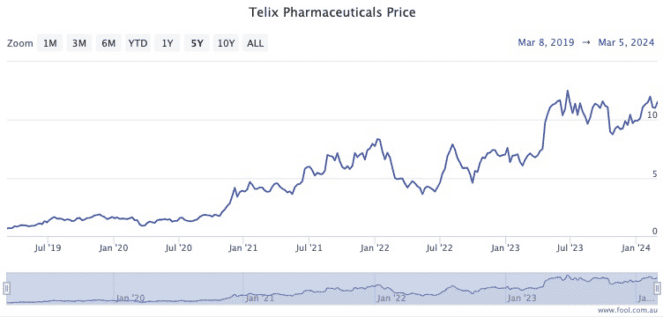

Take Telix Pharmaceuticals Ltd (ASX: TLX) and Audinate Group Ltd (ASX: AD8), for example.

Both are well established businesses mature enough to be in the S&P/ASX 200 Index (ASX: XJO).

Yet the Audinate share price has soared more than 305% over the past five years, equating to a compound annual growth rate (CAGR) of 32%.

As for Telix? Its investors are tickled pink as the stock returned a mind-blowing 1,647% in the last half-decade.

That’s a CAGR of 77%.

So I reckon it’s within the realms of possibility that you could build a portfolio that could average 13% of growth a year.

Passive income later requires discipline now

That’s not all though.

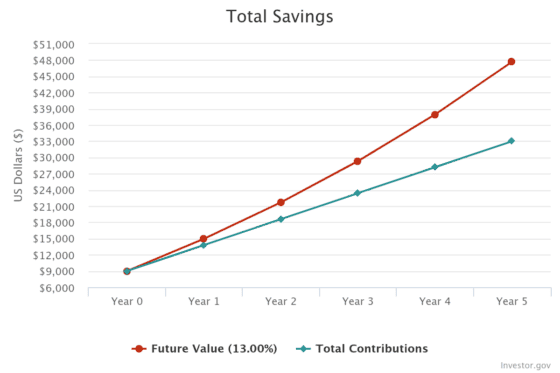

You want to keep saving and adding to this investment.

If you can spare $100 a week or $400 a month, the nest egg will grow in no time.

After just five years of that savings discipline with a CAGR of 13% will see the portfolio reach $47,687.

Beyond that, try selling off the 13% return each year instead of leaving it in the portfolio.

That will reap an average of $6,199 per annum, which is $516 of monthly passive income.

Whoomp, there it is.

What if that passive income isn’t enough though?

You just need to add patience to the pot.

Let the portfolio grow for 10 years instead of five, and it will have hit $118,965.

From that point on if you cash in your winnings each year that’s a cool $15,465. In monthly terms, that’s $1,288 of passive income.

Nice work.

The post $9,000 in savings? Here’s how I’d try to turn that into $516 a month of passive income appeared first on The Motley Fool Australia.

Wondering where you should invest $1,000 right now?

When investing expert Scott Phillips has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for over ten years has provided thousands of paying members with stock picks that have doubled, tripled or even more.*

Scott just revealed what he believes could be the ‘five best ASX stocks’ for investors to buy right now. We believe these stocks are trading at attractive prices and Scott thinks they could be great buys right now…

See The 5 Stocks

*Returns as of 1 February 2024

(function() {

function setButtonColorDefaults(param, property, defaultValue) {

if( !param || !param.includes(‘#’)) {

var button = document.getElementsByClassName(“pitch-snippet”)[0].getElementsByClassName(“pitch-button”)[0];

button.style[property] = defaultValue;

}

}

setButtonColorDefaults(“#0095C8”, ‘background’, ‘#5FA85D’);

setButtonColorDefaults(“#0095C8”, ‘border-color’, ‘#43A24A’);

setButtonColorDefaults(“#fff”, ‘color’, ‘#fff’);

})()

More reading

- 2 ASX 200 shares smashing 52-week highs that are STILL BUYS

- Guess which 4 shares are being dumped from the ASX 200 index

- 6 ASX shares to buy and hold until the next leap year

- Here are the top 10 ASX 200 shares today

- 1 ASX stock I think is just as hot as Nvidia (without all the hype)

Motley Fool contributor Tony Yoo has positions in Audinate Group and Telix Pharmaceuticals. The Motley Fool Australia’s parent company Motley Fool Holdings Inc. has positions in and has recommended Audinate Group and Telix Pharmaceuticals. The Motley Fool Australia has positions in and has recommended Audinate Group. The Motley Fool Australia has recommended Telix Pharmaceuticals. The Motley Fool has a disclosure policy. This article contains general investment advice only (under AFSL 400691). Authorised by Scott Phillips.

from The Motley Fool Australia https://ift.tt/o9gWAnl

Leave a Reply