We’ve all been there once.

It’s a scary step to invest in stocks for the first time. You’ve yet to experience the ups and downs first-hand, so it’s hard to know whether you’re doing the right thing.

If you’re in this spot, I want to try to make that first step a tad easier.

Here are two ASX shares that I’d start a blank portfolio with:

A balance between risk and reward

Xero Ltd (ASX: XRO) is an oldie but a goodie for beginners.

It’s a well-established $20 billion company now, but still has much room to grow. So I feel like the S&P/ASX 200 Index (ASX: XJO) stock is a nice balance between risk and reward for those taking the plunge for the first time.

Despite some major shocks over the past five years, such as COVID-19 and steeply rising interest rates, Xero shares have managed to gain a tidy 172%.

The New Zealand business has shown it can adapt to changing conditions. Last year, a new chief executive was brought on to pivot Xero from a cash-burning technology startup to one that’s more focused on positive cash flow.

And the market has warmed to that new philosophy, sending the Xero share price 69% upwards over the past 12 months.

Even after that, nine out of 12 experts currently surveyed on broking platform CMC Invest are still recommending the stock as a buy.

The ASX shares that aren’t really an investment in shares

Maybe you are investing in shares to get away from unaffordable Australian real estate, but there’s a way to have your cake and eat it too.

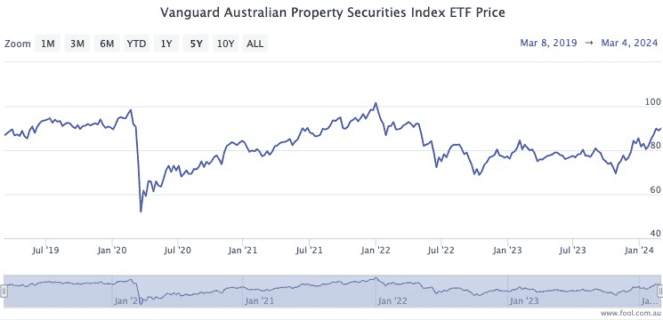

Vanguard Australian Property Securities Index ETF (ASX: VAP) is an exchange-traded fund (ETF) that replicates the constituency of the S&P/ASX 300 A-REIT Index.

That index, in turn, represents the real estate investment trusts (REITs) from the 300 biggest companies on the ASX.

With the prospect of stability and even a cut in interest rates, the property market is already buoyant, sending the VAP share price 32% higher since late October.

But the fact remains the ETF is still more than 30% down from its 2021 peak. And we all know how much Aussies love real estate.

VAP also hands out quarterly distributions, which currently stand at around 3.4% yield.

The post Beginners: Buy these 2 ASX shares to start your portfolio appeared first on The Motley Fool Australia.

Wondering where you should invest $1,000 right now?

When investing expert Scott Phillips has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for over ten years has provided thousands of paying members with stock picks that have doubled, tripled or even more.*

Scott just revealed what he believes could be the ‘five best ASX stocks’ for investors to buy right now. We believe these stocks are trading at attractive prices and Scott thinks they could be great buys right now…

See The 5 Stocks

*Returns as of 1 February 2024

(function() {

function setButtonColorDefaults(param, property, defaultValue) {

if( !param || !param.includes(‘#’)) {

var button = document.getElementsByClassName(“pitch-snippet”)[0].getElementsByClassName(“pitch-button”)[0];

button.style[property] = defaultValue;

}

}

setButtonColorDefaults(“#0095C8”, ‘background’, ‘#5FA85D’);

setButtonColorDefaults(“#0095C8”, ‘border-color’, ‘#43A24A’);

setButtonColorDefaults(“#fff”, ‘color’, ‘#fff’);

})()

More reading

- Top brokers name 3 ASX shares to buy today

- Best ASX growth stocks to consider buying in March

- Goldman Sachs has added this ASX 200 tech stock to its APAC conviction list

- Top brokers name 3 ASX shares to buy next week

- Here’s how the ASX 200 market sectors stacked up this week

Motley Fool contributor Tony Yoo has positions in Vanguard Australian Property Securities Index ETF and Xero. The Motley Fool Australia’s parent company Motley Fool Holdings Inc. has positions in and has recommended Xero. The Motley Fool Australia has positions in and has recommended Xero. The Motley Fool has a disclosure policy. This article contains general investment advice only (under AFSL 400691). Authorised by Scott Phillips.

from The Motley Fool Australia https://ift.tt/0BOZPew

Leave a Reply