The Commonwealth Bank of Australia (ASX: CBA) share price is in the green today.

Shares in the S&P/ASX 200 Index (ASX: XJO) bank stock closed yesterday trading for $118.31. In morning trade on Thursday, shares are changing hands for $118.82 apiece, up 0.43%.

For some context, the ASX 200 is up 0.22% at this same time.

This comes amid some “difficult” news from CommBank.

What’s happening with CommBank?

The CBA share price is in the green this morning after its Western Australian subsidiary, Bankwest, announced it will transition to a digital bank in 2024.

Bankwest traces its history all the way back to 1895. It was acquired by CBA 16 years ago.

The digital shakeup will see 45 Bankwest branches shuttered by October 2024. Fifteen additional regional Bankwest centres will be converted to CBA branches. Management expects that to be complete by the end of 2024.

CBA noted that 97% of all Bankwest transactions are already completed digitally. But that doesn’t mean the transition will be painless for everyone.

“I understand this will be difficult news for some of our customers,” Bankwest executive general manager Jason Chan said.

He said the bank was introducing “a range of support measures to help our customers who are regular branch users carefully through this transition”.

CBA doesn’t expect the digital transformation to result in any job losses.

According to Chan:

Our branch colleagues have invaluable knowledge and experience, and they will all be offered opportunities to access the next generation of banking jobs so they can continue to support customers nationwide from in their own communities.

CommBank is hoping the transformation will cut its overall costs. This could help support profit margins and the CBA share price amid stiff ongoing competition in the lucrative Aussie mortgage markets.

As for Bankwest, Chan said it was here to stay.

“Bankwest is now 129 years old, and we’ll continue to evolve in the years to come to ensure we remain a sustainable, growing, and successful WA-based business, and a major WA employer, in a highly competitive national banking sector,” he said.

CBA share price snapshot

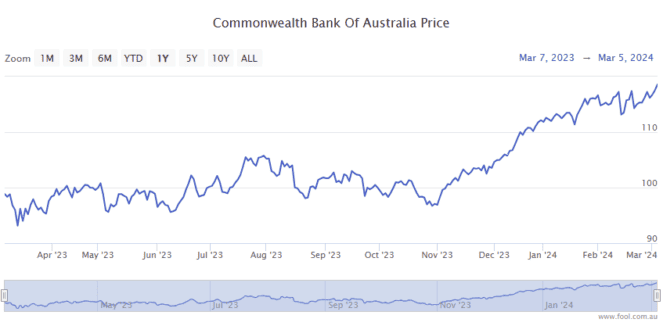

The CBA share price has been a very strong performer over the past year.

Shares in the ASX 200 bank stock are up 19% over 12 months, almost four times the gains posted by the benchmark index.

The post CBA share price marching higher amid ‘difficult news’ appeared first on The Motley Fool Australia.

Wondering where you should invest $1,000 right now?

When investing expert Scott Phillips has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for over ten years has provided thousands of paying members with stock picks that have doubled, tripled or even more.*

Scott just revealed what he believes could be the ‘five best ASX stocks’ for investors to buy right now. We believe these stocks are trading at attractive prices and Scott thinks they could be great buys right now…

See The 5 Stocks

*Returns as of 1 February 2024

(function() {

function setButtonColorDefaults(param, property, defaultValue) {

if( !param || !param.includes(‘#’)) {

var button = document.getElementsByClassName(“pitch-snippet”)[0].getElementsByClassName(“pitch-button”)[0];

button.style[property] = defaultValue;

}

}

setButtonColorDefaults(“#0095C8”, ‘background’, ‘#5FA85D’);

setButtonColorDefaults(“#0095C8”, ‘border-color’, ‘#43A24A’);

setButtonColorDefaults(“#fff”, ‘color’, ‘#fff’);

})()

More reading

- Is the blistering rally in ASX 200 bank shares overdone?

- An 8% yield on CBA shares? Here’s how these passive income investors achieved it!

- Investing in an ASX share portfolio for lifelong passive income!

- 3 ASX 200 shares I think could grow to be bigger than BHP one day

- CBA shares rally to new record high. Is $196 billion too much for this banking giant?

Motley Fool contributor Bernd Struben has no position in any of the stocks mentioned. The Motley Fool Australia’s parent company Motley Fool Holdings Inc. has no position in any of the stocks mentioned. The Motley Fool Australia has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy. This article contains general investment advice only (under AFSL 400691). Authorised by Scott Phillips.

from The Motley Fool Australia https://ift.tt/xmNpgyI

Leave a Reply