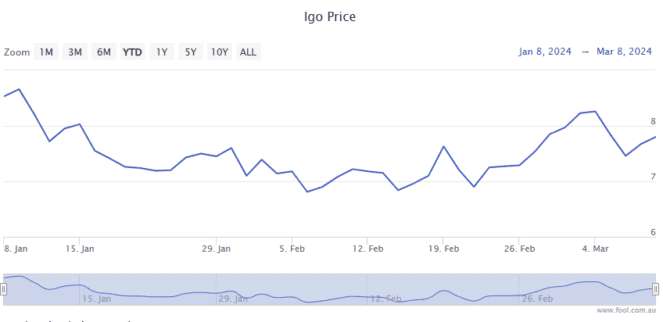

The IGO Ltd (ASX: IGO) share price is marching higher today.

Shares in the S&P/ASX 200 Index (ASX: XJO) lithium stock closed yesterday trading for $7.56. In morning trade on Tuesday, shares are swapping hands for $7.73 apiece, up 2.3%.

For some context, the ASX 200 is up 0.2% at this same time.

Here’s what’s happening.

IGO share price rises on ex-dividend day

Investors never like seeing one of their stock holdings retrace.

And the good news for shareholders in this ASX 200 resource producer is that despite IGO trading ex-dividend today, the IGO share price is in the green.

When a stock trades without the rights to the dividend, it’s common to see the share price fall to reflect this. But after IGO closed down 3.3% yesterday, investors are shaking off the fact they won’t be entitled to the greatly reduced interim dividend, buying the stock at what could be a bargain entry point today.

IGO reported its half-year results (H1 FY 2024) on 22 February.

And those results confirmed that the miner had clearly been under pressure from falling lithium and commodity prices.

Those falling prices saw IGO’s half-year revenue decrease by 19% year on year to $438 million.

And with net profit after tax (NPAT) down 53% to $288 million, management slashed the fully franked interim dividend by 21% to 11 cents per share.

Commenting on the company’s dividend payment and outlook on the day the results were announced, IGO CEO Ivan Vella said, “While we have faced some challenges in recent months, our business remains in a great position.”

Vella added:

The declaration of an 11 cent per share interim dividend today, in line with our capital management framework, reflects our strong underlying free cash flow and robust balance sheet position.

Adding the interim dividend back into today’s IGO share price, it would see the ASX 200 stock up 3.7%.

If you held shares at market close yesterday, you can expect to see the IGO dividend payout land in your bank account in two weeks, on 27 March.

The post IGO share price marching higher despite trading ex-dividend today appeared first on The Motley Fool Australia.

Wondering where you should invest $1,000 right now?

When investing expert Scott Phillips has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for over ten years has provided thousands of paying members with stock picks that have doubled, tripled or even more.*

Scott just revealed what he believes could be the ‘five best ASX stocks’ for investors to buy right now. We believe these stocks are trading at attractive prices and Scott thinks they could be great buys right now…

See The 5 Stocks

*Returns as of 1 February 2024

(function() {

function setButtonColorDefaults(param, property, defaultValue) {

if( !param || !param.includes(‘#’)) {

var button = document.getElementsByClassName(“pitch-snippet”)[0].getElementsByClassName(“pitch-button”)[0];

button.style[property] = defaultValue;

}

}

setButtonColorDefaults(“#0095C8”, ‘background’, ‘#5FA85D’);

setButtonColorDefaults(“#0095C8”, ‘border-color’, ‘#43A24A’);

setButtonColorDefaults(“#fff”, ‘color’, ‘#fff’);

})()

More reading

- 5 things to watch on the ASX 200 on Tuesday

- 13 ASX 200 shares with ex-dividend dates next week

- Why the 2024 outlook for these rebounding ASX 200 lithium shares looks ‘better than market expectations’

- Here’s the latest lithium price forecast through to 2027

- Here are the top 10 ASX 200 shares today

Motley Fool contributor Bernd Struben has no position in any of the stocks mentioned. The Motley Fool Australia’s parent company Motley Fool Holdings Inc. has no position in any of the stocks mentioned. The Motley Fool Australia has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy. This article contains general investment advice only (under AFSL 400691). Authorised by Scott Phillips.

from The Motley Fool Australia https://ift.tt/pBx1mGs

Leave a Reply