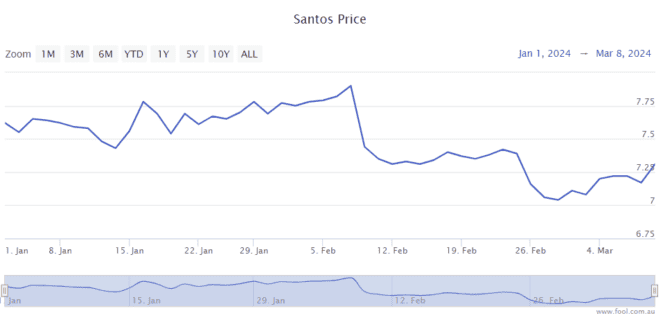

Santos Ltd (ASX: STO) shares have dropped in the last few weeks, falling 7% since the end of January. This follows the breakdown in merger talks between Santos and Woodside Energy Group Ltd (ASX: WDS).

But one fund manager is excited by the energy company‘s potential.

Why Santos shares are attractive

The fund manager L1 pointed out that Santos was continuing to review options to unlock shareholder value.

According to L1, Santos’ asset base was “materially undervalued by the market”. The fund manager believed the company had “attractive structural options” to unlock this value, regardless of a transaction needing to occur with a third party.

One of the positives for Santos is that it continues to make “material progress” on its key growth initiatives, with the Barossa project nearly 70% complete and on track for first production in 2025, while the Pikka project is nearly 40% complete.

L1 said:

We anticipate that Santos will have one of the most attractive cash flow profiles globally in the sector in 2026 when both major projects have been completed.

Valuation

Currently, the forecast for Santos shares on Commsec is that it could make earnings per share (EPS) of 58.7 cents in FY24 and 74.8 cents in FY26. That would put the Santos share price at 12x FY24’s estimated earnings and under 10x FY26’s estimated earnings.

If it does generate that sort of profit, the company is forecast to pay a dividend yield of 5.5% in FY26. In FY24, it could pay a dividend yield of 4.3%.

The dividends are currently unfranked, meaning no franking credits are attached.

Broader market comments

Talking about the overall market, L1 said:

We expect global markets to oscillate based on future economic data updates as Central Banks attempt to navigate ‘soft landing’ outcomes. Ongoing geopolitical tensions, war in the Middle East and potential impacts from events such as the US elections provide an additional layer of uncertainty.

Against this backdrop, recent equity market performance has been driven primarily by a narrow group of technology/AI stocks.

The fund manager said it saw equity markets as being “relatively fully priced overall”.

… but within that we see numerous compelling opportunities in low P/E, highly cash generative companies, along with select opportunities on the short side, particularly in some expensive growth stocks with overly optimistic market expectations.

The post Why Santos shares may be ‘one of the most attractive globally’ appeared first on The Motley Fool Australia.

Wondering where you should invest $1,000 right now?

When investing expert Scott Phillips has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for over ten years has provided thousands of paying members with stock picks that have doubled, tripled or even more.*

Scott just revealed what he believes could be the ‘five best ASX stocks’ for investors to buy right now. We believe these stocks are trading at attractive prices and Scott thinks they could be great buys right now…

See The 5 Stocks

*Returns as of 1 February 2024

(function() {

function setButtonColorDefaults(param, property, defaultValue) {

if( !param || !param.includes(‘#’)) {

var button = document.getElementsByClassName(“pitch-snippet”)[0].getElementsByClassName(“pitch-button”)[0];

button.style[property] = defaultValue;

}

}

setButtonColorDefaults(“#0095C8”, ‘background’, ‘#5FA85D’);

setButtonColorDefaults(“#0095C8”, ‘border-color’, ‘#43A24A’);

setButtonColorDefaults(“#fff”, ‘color’, ‘#fff’);

})()

More reading

- 5 things to watch on the ASX 200 on Monday

- How these tailwinds could re-energise ASX 200 energy shares in 2024

- 5 things to watch on the ASX 200 on Tuesday

- 5 things to watch on the ASX 200 on Monday

- Why Nanosonics, NIB, Santos, and TPG shares are falling today

Motley Fool contributor Tristan Harrison has no position in any of the stocks mentioned. The Motley Fool Australia’s parent company Motley Fool Holdings Inc. has no position in any of the stocks mentioned. The Motley Fool Australia has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy. This article contains general investment advice only (under AFSL 400691). Authorised by Scott Phillips.

from The Motley Fool Australia https://ift.tt/vC9Vr8s

Leave a Reply