With the S&P/ASX 200 Index (ASX: XJO) rocketing 13.7% since the start of November, investors need to be careful they don’t buy stocks that are overvalued.

In fact, some experts reckon there are whole sectors right now that have been pumped up way too much.

Selective picking has become paramount for stock buyers now more than ever.

SG Hiscock & Company head of equities Hamish Tadgell recently mentioned a sector that his team is looking at that’s gone unloved for years.

“Healthcare looks interesting to us,” he said Tuesday at a media briefing in Sydney.

“That [sector]’s idiosyncratic and it’s around stock stories.”

Still 16% discount to last year

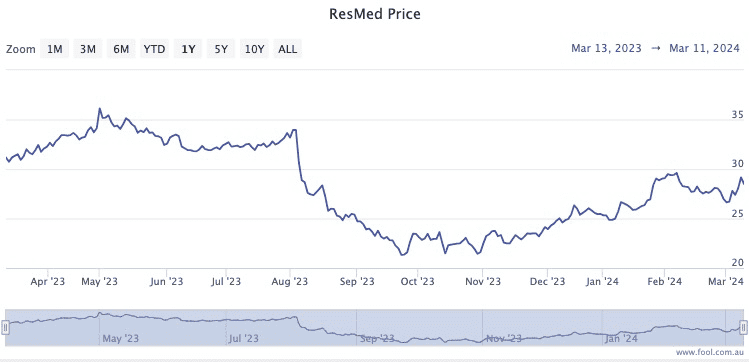

Tadgell mentioned how Resmed CDI (ASX: RMD) had a tough time of it last year.

The stock for the sleep apnoea device maker fell off a cliff during the August reporting season from fears that new GLP-1 weight loss drugs could eliminate obesity around the world.

Experts, both financial and medical, said at the time those concerns were unfounded.

Although it has slowly recovered some of those losses, the ResMed share price still remains 16% below its early August peak.

That’s perhaps why Tadgell and other professionals are bullish on the healthcare stock.

Broking platform CMC Invest suggests a whopping 19 out of 26 analysts rate ResMed shares as a buy at the moment.

The ASX 200 stock that plunged despite ‘very strong result’

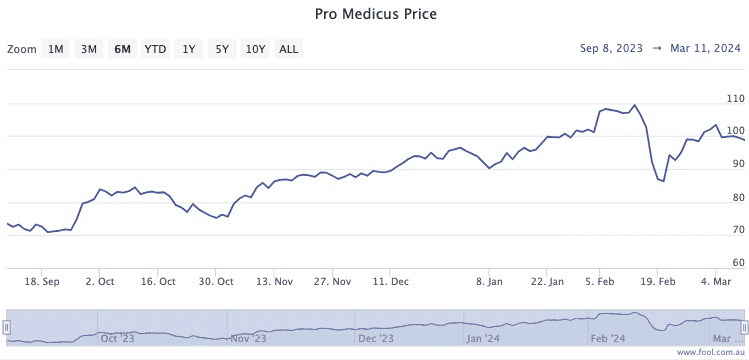

Pro Medicus Limited (ASX: PME) is another standout for Tadgell.

Shares for the medical imaging technology provider have been outstanding in recent times, rising more than 70% over 2023.

But the stock had a little hiccup during last month’s reporting season, dropping 13% on the day of its results.

It was all a little bit odd, considering The Motley Fool’s James Mickleboro called the numbers “a very strong result from the high-flying company”.

Revenue was up 30%, net profit was 33% higher, and it even paid out a small dividend.

This pullback could be a time to get in on a hot stock.

“The good news is that this strong growth looks set to continue,” said Mickleboro.

“Pro Medicus won four key contracts during the six months. These have a total contract value of $200 million at committed minimum exam volumes and contract terms ranging from 7 to 10 years.”

The post 2 ASX 200 shares to buy in the most ‘interesting’ sector right now appeared first on The Motley Fool Australia.

Wondering where you should invest $1,000 right now?

When investing expert Scott Phillips has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for over ten years has provided thousands of paying members with stock picks that have doubled, tripled or even more.*

Scott just revealed what he believes could be the ‘five best ASX stocks’ for investors to buy right now. We believe these stocks are trading at attractive prices and Scott thinks they could be great buys right now…

See The 5 Stocks

*Returns as of 1 February 2024

(function() {

function setButtonColorDefaults(param, property, defaultValue) {

if( !param || !param.includes(‘#’)) {

var button = document.getElementsByClassName(“pitch-snippet”)[0].getElementsByClassName(“pitch-button”)[0];

button.style[property] = defaultValue;

}

}

setButtonColorDefaults(“#0095C8”, ‘background’, ‘#5FA85D’);

setButtonColorDefaults(“#0095C8”, ‘border-color’, ‘#43A24A’);

setButtonColorDefaults(“#fff”, ‘color’, ‘#fff’);

})()

More reading

- Bell Potter names the best ASX shares to buy in March

- Here are the top 10 ASX 200 shares today

- Up 37% from their low: Can ResMed shares keep rising?

- 3 reliable ASX shares you can buy at a discount

- Here are the top 10 ASX 200 shares today

Motley Fool contributor Tony Yoo has positions in ResMed. The Motley Fool Australia’s parent company Motley Fool Holdings Inc. has positions in and has recommended Pro Medicus and ResMed. The Motley Fool Australia has positions in and has recommended ResMed. The Motley Fool Australia has recommended Pro Medicus. The Motley Fool has a disclosure policy. This article contains general investment advice only (under AFSL 400691). Authorised by Scott Phillips.

from The Motley Fool Australia https://ift.tt/VUqzXfn

Leave a Reply