Westpac Banking Corp (ASX: WBC) shares may be facing incoming costs based on what may be needed to reset the ASX bank share.

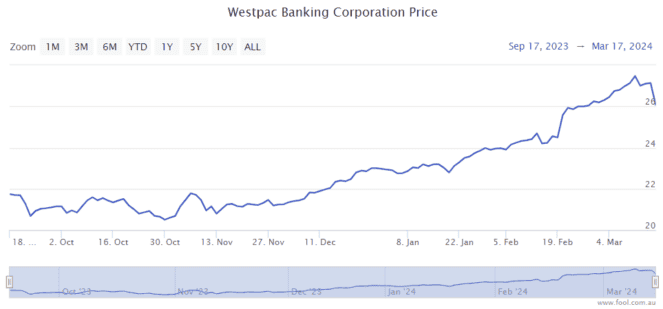

Over the last six months, Westpac shares have gone up 20%, but have we seen the peak?

The Australian reported on comments by banking analyst Brian Johnson from MST Marquee which said Westpac’s “long-running operational underperformance” meant it needed a new external leader which is crucial to turn the bank around.

Significant costs incoming?

The analyst Johnson said:

We think Westpac requires a significant reset and that requires an external CEO successor.

He also said Westpac’s mammoth IT simplification project could “consume much of (its) perceived existing core equity tier one capital.”

The bank reportedly is close to finishing its multi-year risk and regulatory program of work, in which it has invested billions of dollars.

Westpac is looking to consolidate 180 back office systems into 60 over the next four or five years at a cost of around $2 billion, according to reporting by The Australian. Johnson said:

History suggests bank IT projects cost more, take longer and can compromise system stability during decommissioning.

Westpac is expected to tell investors about its technology turnaround initiatives on 27 March 2024.

There are reports that the ASX bank share is planning for a succession of the CEO. The Australian reported on comments that DNR Capital chief investment officer Jamie Nicol said it was important to have a CEO who would “own” the IT project. Nicol said:

Given that’s just about to start, you probably want the appointment sooner rather than later, unless Peter King was there to oversee the whole thing, but that would be four or five years.

That’s probably too long given that he was just about out the door before and he extended his stay.

Johnson suggests that a turnaround for Westpac may need to recognise “significant wrote-offs and restructuring costs.”

Costs could mean a reduction of profit, and profit is usually what investors like to value a business on.

Westpac share price valuation

After the run-up of the Westpac share price, its price/earnings (P/E) ratio has increased. The experts may be right to be concerned about the valuation, though it doesn’t have the highest earnings multiple in the sector (that title belongs to Commonwealth Bank of Australia (ASX: CBA)).

According to the estimate on Commsec, the ASX bank share is valued at 14 times FY24’s estimated earnings.

The post Why Westpac shares could suffer from a ‘significant reset’ appeared first on The Motley Fool Australia.

Wondering where you should invest $1,000 right now?

When investing expert Scott Phillips has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for over ten years has provided thousands of paying members with stock picks that have doubled, tripled or even more.*

Scott just revealed what he believes could be the ‘five best ASX stocks’ for investors to buy right now. We believe these stocks are trading at attractive prices and Scott thinks they could be great buys right now…

See The 5 Stocks

*Returns as of 1 February 2024

(function() {

function setButtonColorDefaults(param, property, defaultValue) {

if( !param || !param.includes(‘#’)) {

var button = document.getElementsByClassName(“pitch-snippet”)[0].getElementsByClassName(“pitch-button”)[0];

button.style[property] = defaultValue;

}

}

setButtonColorDefaults(“#0095C8”, ‘background’, ‘#5FA85D’);

setButtonColorDefaults(“#0095C8”, ‘border-color’, ‘#43A24A’);

setButtonColorDefaults(“#fff”, ‘color’, ‘#fff’);

})()

More reading

- Here’s what Westpac says the RBA will do with interest rates next week

- Why Pilbara Minerals, Syrah Resources, Tabcorp, and Westpac shares are sinking today

- Why are ASX investors so obsessed with dividends?

- What’s going so wrong for ASX 200 shares on Friday?

- Buyer beware! Why Macquarie just downgraded the big four ASX 200 banks

Motley Fool contributor Tristan Harrison has no position in any of the stocks mentioned. The Motley Fool Australia’s parent company Motley Fool Holdings Inc. has no position in any of the stocks mentioned. The Motley Fool Australia has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy. This article contains general investment advice only (under AFSL 400691). Authorised by Scott Phillips.

from The Motley Fool Australia https://ift.tt/SYNT8zI

Leave a Reply