The S&P/ASX 200 Index (ASX: XJO) is flat in afternoon trade, but that’s not holding this Australian dividend stock back.

The stock in question is ASX 200 gold miner Northern Star Resources Ltd (ASX: NST).

Northern Star shares closed yesterday trading for $13.65. At the time of writing, shares are swapping hands for $13.82 apiece, up 1.3%, having earlier posted gains of more than 1.5%.

The Australian dividend stock looks to be getting a boost from an overnight uptick in the gold price. The yellow metal is trading for US$2,162 per ounce (AU$3,297).

That sees most ASX gold stocks outperforming today, as witnessed by the 1.4% gain posted by the S&P/ASX All Ordinaries Gold Index (ASX: XGD).

What’s been happening with this Australian dividend stock?

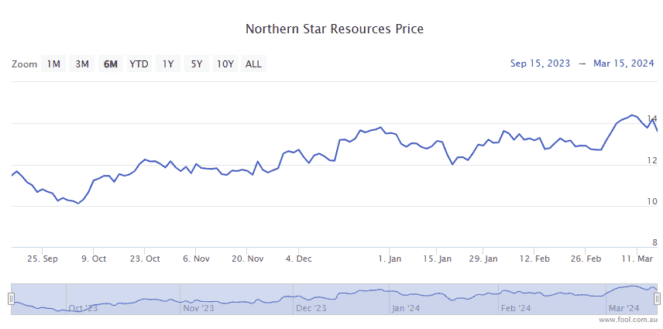

The Northern Star share price has been on a strong upward trend since early October.

In fact, the Australian dividend stock has gained a whopping 38% since 3 October when shares closed the day trading for $10.04.

The ASX 200 gold miner has enjoyed a big lift in bullion prices over that time. On 5 October, gold was fetching US$1,820 per ounce, 18.8% below today’s levels. And most of those gains will find their way into Northern Star’s bottom line.

Northern Star also reported some very solid results for the six months ending 31 December.

That was driven by a big increase in the miner’s average realised gold price from AU$2,513 per ounce in the prior corresponding period to AU$2,873 per ounce over the second half of 2023.

Highlights of the half year included a 15% increase in revenue to $2.25 billion. And cash earnings leapt 50% to an all-time high of $702 million.

That saw the Australian dividend stock please passive income investors with a record interim unfranked dividend of 15 cents per share, up 36% from the prior interim dividend.

This brought the full-year dividend payout to 30.5 cents per share. At the current Northern Star share price, the gold miner trades at an unfranked trailing yield of 2.2%.

And with gold prices having breached new all-time highs in March, and continuing to trade near those highs, the outlook for more dividend growth and potential new record payouts looks good.

The post 1 Australian dividend stock quietly crushing the ASX today appeared first on The Motley Fool Australia.

Wondering where you should invest $1,000 right now?

When investing expert Scott Phillips has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for over ten years has provided thousands of paying members with stock picks that have doubled, tripled or even more.*

Scott just revealed what he believes could be the ‘five best ASX stocks’ for investors to buy right now. We believe these stocks are trading at attractive prices and Scott thinks they could be great buys right now…

See The 5 Stocks

*Returns as of 1 February 2024

(function() {

function setButtonColorDefaults(param, property, defaultValue) {

if( !param || !param.includes(‘#’)) {

var button = document.getElementsByClassName(“pitch-snippet”)[0].getElementsByClassName(“pitch-button”)[0];

button.style[property] = defaultValue;

}

}

setButtonColorDefaults(“#0095C8”, ‘background’, ‘#5FA85D’);

setButtonColorDefaults(“#0095C8”, ‘border-color’, ‘#43A24A’);

setButtonColorDefaults(“#fff”, ‘color’, ‘#fff’);

})()

More reading

- 5 things to watch on the ASX 200 on Monday

- 5 things to watch on the ASX 200 on Friday

- 5 things to watch on the ASX 200 on Thursday

- 5 things to watch on the ASX 200 on Wednesday

- 5 things to watch on the ASX 200 on Monday

Motley Fool contributor Bernd Struben has no position in any of the stocks mentioned. The Motley Fool Australia’s parent company Motley Fool Holdings Inc. has no position in any of the stocks mentioned. The Motley Fool Australia has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy. This article contains general investment advice only (under AFSL 400691). Authorised by Scott Phillips.

from The Motley Fool Australia https://ift.tt/XCZc2I5

Leave a Reply