Looking to build a $1,000 monthly passive income stream with S&P/ASX 200 Index (ASX: XJO) shares?

Well, you’re certainly shopping in the right market.

Over the next nine weeks, ASX 200 investors will receive an eye-popping $34 billion in dividends. And as staggering as that figure is, it’s actually down from the $35.1 billion in dividends paid over the same period in 2023.

With that said, here are two top ASX 200 shares to consider buying now for $1,000 a month, or $12,000 annually, in passive income.

But first…

Trailing yields and diversification

If you’re looking to build a proper, long-term passive income portfolio, you’ll want to hold more than just two stocks.

While there’s no magic number, 10 is a decent ballpark figure. Ideally, the companies will operate in various sectors and locations. That kind of diversity will help lower the overall risk to your income portfolio if any one company or sector takes an unexpected hit.

Also, bear in mind that the yields you generally see quoted are trailing yields. Future yields may be higher or lower depending on a range of company-specific and macroeconomic factors.

With that said…

Two ASX 200 shares to tap for passive income

The first company to buy for passive income is ASX 200 bank stock Commonwealth Bank of Australia (ASX: CBA).

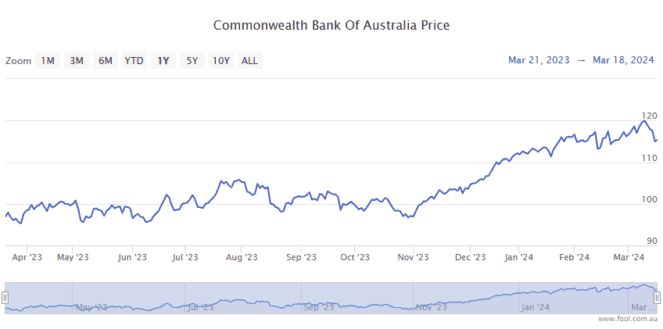

CBA has a lengthy history of paying two fully franked dividends per year. And shares in Australia’s biggest bank have been trading near all-time highs.

Some investors might be jittery following the recent share price strength. But I like buying into strength. New record highs, after all, are often followed by more new record highs.

As for that passive income, the ASX 200 bank paid a final dividend of $2.40 per share on 28 September. Investors who owned CBA shares at market close on 20 February can expect to see the interim dividend of $2.15 per share land in their bank account on 28 March.

That equates to a full-year payout of $4.55 per share.

At the current CBA share price of $116.44, that works out to a fully franked trailing yield of 3.9%.

Which brings us to the second company to buy today for passive income, ASX 200 mining stock Fortescue Metals Group Ltd (ASX: FMG).

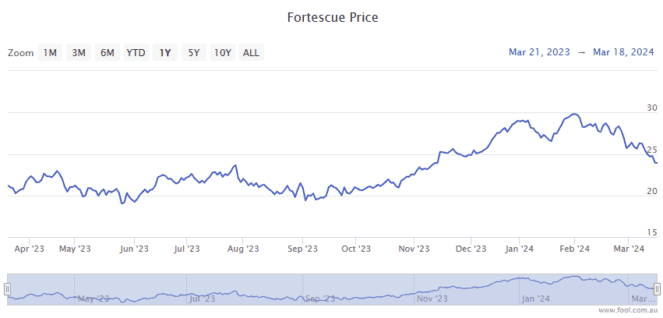

The Fortescue share price has rebounded over the past week. This comes amid an uptick in the iron ore price, fuelled by increased optimism on China’s economic growth outlook.

Shares are currently changing hands for $24.97 apiece.

Fortescue paid a final dividend of $1.00 per share on 28 September. If you owned shares at market close on 27 February, you can expect to receive the interim dividend of $1.08 per share next week, on March 27.

That comes out to a full-year passive income payout of $2.08 per share. Which sees Fortescue shares trading on a fully franked yield of 8.3%.

$1,000 a month in passive income from these ASX shares

Assuming you buy the same amount of each ASX 200 dividend share, you’ll earn an average yield of 6.1%.

To collect your $1,000 monthly passive income ($12,000 yearly) then, you’d need to invest $196,721 today.

Now, that’s sizeable amount to invest in one go.

But that’s okay.

Investing is a long game.

You can always invest smaller amounts each month. If you stick with it, you’ll reach that passive income goal in good time.

The post 2 top ASX 200 shares to buy now for $1,000 a month in passive income appeared first on The Motley Fool Australia.

Wondering where you should invest $1,000 right now?

When investing expert Scott Phillips has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for over ten years has provided thousands of paying members with stock picks that have doubled, tripled or even more.*

Scott just revealed what he believes could be the ‘five best ASX stocks’ for investors to buy right now. We believe these stocks are trading at attractive prices and Scott thinks they could be great buys right now…

See The 5 Stocks

*Returns as of 1 February 2024

(function() {

function setButtonColorDefaults(param, property, defaultValue) {

if( !param || !param.includes(‘#’)) {

var button = document.getElementsByClassName(“pitch-snippet”)[0].getElementsByClassName(“pitch-button”)[0];

button.style[property] = defaultValue;

}

}

setButtonColorDefaults(“#0095C8”, ‘background’, ‘#5FA85D’);

setButtonColorDefaults(“#0095C8”, ‘border-color’, ‘#43A24A’);

setButtonColorDefaults(“#fff”, ‘color’, ‘#fff’);

})()

More reading

- Why are ASX 200 mining shares are smashing the benchmark on Wednesday?

- Here are the top 10 ASX 200 shares today

- Shares vs. property: Which Australian states and ASX stocks are delivering the best passive income?

- 3 ASX 200 mining shares to buy now with less than $1,000

- Fortescue shares retreat to fresh 2024 low as iron ore breaks below US$100 per tonne

Motley Fool contributor Bernd Struben has no position in any of the stocks mentioned. The Motley Fool Australia’s parent company Motley Fool Holdings Inc. has no position in any of the stocks mentioned. The Motley Fool Australia has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy. This article contains general investment advice only (under AFSL 400691). Authorised by Scott Phillips.

from The Motley Fool Australia https://ift.tt/p6JKtQR

Leave a Reply