It’s been a very pleasant day indeed for the S&P/ASX 200 Index (ASX: XJO) and many ASX 200 shares. At present, the index has gained a comfortable 0.51%, putting it back over 7,730 points. But let’s talk about one ASX 200 energy stock that has just hit a fresh new all-time high.

That ASX 200 energy stock is none other than Ampol Ltd (ASX: ALD). Ampol shares closed at $39.64 each yesterday. But at present, the petroleum distributor, refiner and retailer has surged by a pleasing 1.59% up to $40.27. The company hit its new record high of $40.34 just after midday today. It’s the latest in a series of new highs for Ampol.

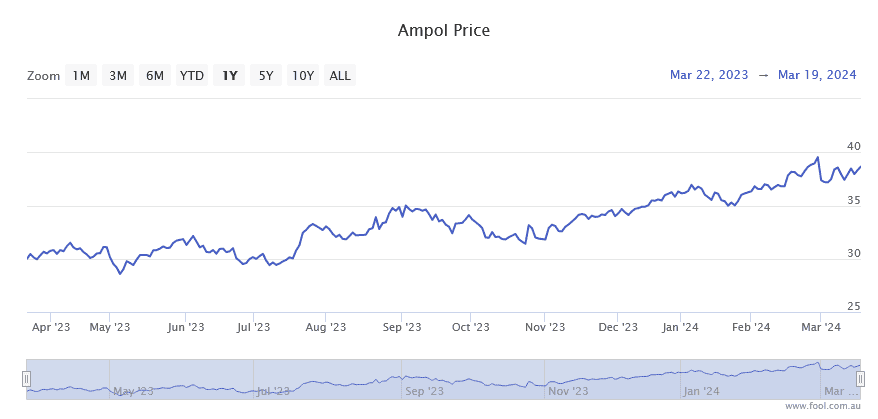

This gain puts the Ampol share price up a solid 9.91% over 2024 to date. It also means that Ampol shares have gained a massive 35.3% over the past 12 months. Check that out for yourself below:

But how did this ASX 200 energy stock get here? After all, Ampol shares didn’t do a whole lot over the entirety of 2021 to 2023.

How is this ASX 200 energy stock at another new record high?

Well, there is one primary factor that we can point to that seems to have put a rocket under this ASX 200 energy stock. It’s Ampol’s most recent full-year earnings report.

On 19 February, Ampol delivered its latest full-year earnings. The company told investors that it achieved a record sales volume of 28.4 billion litres over 2023, helped by the integration of the Z Energy business that Ampol bought in 2022. That was up a whopping 17% year on year.

This helped Ampol to report a 2% rise in earnings to $1.3 billion, which in turn helped fund a record final dividend of $1.20 per share (fully franked), up 14.3% over 2023’s final dividend of $1.05 per share.

Not only that but shareholders were also treated to a special dividend of 60 cents per share (also fully franked) on top. That takes Ampol’s total dividends over the past 12 months to another record of $2.75 per share.

Following these results, Ampol shares also got some love from ASX brokers, which may also have contributed to its recent share price success.

As my Fool colleague Bernd covered last month, analysts at Macquarie liked what they saw in this earnings report. The broker gave this ASX 200 energy stock an increased 12-month share price target of $42.50.

If this is realised, it would obviously represent yet another new record high for the Ampol share price. No doubt this came as music to investors’ ears.

Let’s see if this ASX broker is on the money over the coming 12 months.

The post How has this ASX 200 energy stock just hit another new record high? appeared first on The Motley Fool Australia.

Wondering where you should invest $1,000 right now?

When investing expert Scott Phillips has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for over ten years has provided thousands of paying members with stock picks that have doubled, tripled or even more.*

Scott just revealed what he believes could be the ‘five best ASX stocks’ for investors to buy right now. We believe these stocks are trading at attractive prices and Scott thinks they could be great buys right now…

See The 5 Stocks

*Returns as of 1 February 2024

(function() {

function setButtonColorDefaults(param, property, defaultValue) {

if( !param || !param.includes(‘#’)) {

var button = document.getElementsByClassName(“pitch-snippet”)[0].getElementsByClassName(“pitch-button”)[0];

button.style[property] = defaultValue;

}

}

setButtonColorDefaults(“#0095C8”, ‘background’, ‘#5FA85D’);

setButtonColorDefaults(“#0095C8”, ‘border-color’, ‘#43A24A’);

setButtonColorDefaults(“#fff”, ‘color’, ‘#fff’);

})()

More reading

- This soaring ASX 200 oil stock is near all-time highs. Is it too late to buy?

- Is this surging ASX 200 stock an under-the-radar buy?

- Here are the top 10 ASX 200 shares today

- Why Ampol, Calix, Collins Foods, and Propel shares are tumbling today

- Why is the Ampol share price tumbling 5% on Friday?

Motley Fool contributor Sebastian Bowen has no position in any of the stocks mentioned. The Motley Fool Australia’s parent company Motley Fool Holdings Inc. has positions in and has recommended Macquarie Group. The Motley Fool Australia has positions in and has recommended Macquarie Group. The Motley Fool has a disclosure policy. This article contains general investment advice only (under AFSL 400691). Authorised by Scott Phillips.

from The Motley Fool Australia https://ift.tt/UaDmxpZ

Leave a Reply