The Federal Court has approved a travel order against the suspended chief of an ASX-listed technology company to prevent him from leaving the country.

The Australian Securities and Investments Commission this week submitted an application to stop Dubber Corporation Limited (ASX: DUB) chief executive and managing director Stephen McGovern exiting Australia while it conducts an investigation.

The order also prevents Christopher William Legal solicitor and principal Mark Madafferi from leaving the country.

ASIC investigating ASX CEO over missing funds

Dubber shares were placed in a trading halt on 27 February, and have been frozen ever since.

The company then reported to ASIC that McGovern was suspended as managing director and chief executive and the reasons why it took that action.

On March 1, the corporate watchdog started investigating the suspicions that funds in a term deposit belonging to Dubber and one of its subsidiaries had been misused.

The deposits were allegedly held in trust by Madafferi.

According to ASIC, $26.6 million remains unaccounted for and it has “concerns” that McGovern and Madafferi may have breached the Corporations Act.

The travel order hearing was held with both men absent.

McGovern is a UK national while Madafferi is an Australian citizen.

The matter will be heard again in court on Wednesday.

What has Dubber been doing?

Dubber operates a cloud telecommunications platform for corporate clients.

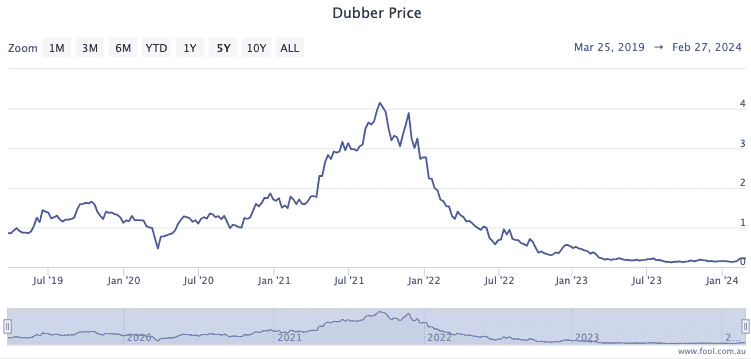

In 2021, the share price flew above the $4 mark, but at the time of the trading halt last month it was languishing at 22 cents.

Despite the term deposit scandal, Dubber announced last week that it had secured a $5 million loan from Thorney Investment Group.

“Unquestionably we were shocked by Dubber’s recent announcement,” Thorney Investment Group executive chair Alex Waislitz said.

“Notwithstanding, Thorney continues to believe Dubber has sound prospects having built a substantial global client base that includes many Tier 1 communications service providers.”

The post ASX tech CEO blocked from leaving Australia as $26.6 million goes missing appeared first on The Motley Fool Australia.

Wondering where you should invest $1,000 right now?

When investing expert Scott Phillips has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for over ten years has provided thousands of paying members with stock picks that have doubled, tripled or even more.*

Scott just revealed what he believes could be the ‘five best ASX stocks’ for investors to buy right now. We believe these stocks are trading at attractive prices and Scott thinks they could be great buys right now…

See The 5 Stocks

*Returns as of 1 February 2024

(function() {

function setButtonColorDefaults(param, property, defaultValue) {

if( !param || !param.includes(‘#’)) {

var button = document.getElementsByClassName(“pitch-snippet”)[0].getElementsByClassName(“pitch-button”)[0];

button.style[property] = defaultValue;

}

}

setButtonColorDefaults(“#0095C8”, ‘background’, ‘#5FA85D’);

setButtonColorDefaults(“#0095C8”, ‘border-color’, ‘#43A24A’);

setButtonColorDefaults(“#fff”, ‘color’, ‘#fff’);

})()

More reading

- Own Liontown shares? Here’s when the lithium stock could be profitable

- Could this development out of China reignite ASX 200 coal shares?

- Guess which ASX 200 healthcare share is jumping 7% on a guidance update

- Core Lithium shares jump 9% on ‘exceptional’ exploration results

- Why this exciting ASX biotech stock could be a future star

Motley Fool contributor Tony Yoo has no position in any of the stocks mentioned. The Motley Fool Australia’s parent company Motley Fool Holdings Inc. has positions in and has recommended Dubber. The Motley Fool Australia has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy. This article contains general investment advice only (under AFSL 400691). Authorised by Scott Phillips.

from The Motley Fool Australia https://ift.tt/cQDAa9C

Leave a Reply