The Mesoblast Ltd (ASX: MSB) share price is blasting off in early afternoon trade on Tuesday.

Shares in the ASX biotech company closed yesterday trading for 33 cents per share.

The company requested a trading pause this morning pending a further announcement.

That announcement was just released.

And investors have responded by sending the Mesoblast share price soaring to 45 cents per share, up 36.4%.

Here’s what the company reported.

Mesoblast share price lifts off on FDA news

Mesoblast is enjoying a big lift after reporting on encouraging communications with the US Food and Drug Administration (FDA).

After additional consideration of the clinical data from Mesoblast’s phase 3 study, the FDA said there appear to be sufficient results to support the submission of the company’s proposed Biologics License Application (BLA) for its remestemcel-L medicine to treat paediatric patients with steroid-refractory acute graft versus host disease.

Remestemcel-L is being developed for inflammatory diseases in children and adults, including steroid-refractory acute graft versus host disease, and biologic-resistant inflammatory bowel disease.

Commenting on the FDA’s guidance that’s sending the Mesoblast share price soaring this afternoon, CEO Silviu Itescu said, “We thank the agency for their collaborative approach.”

Silviu added, “The responses and guidance from FDA are clear and provide us with a high level of confidence to refile our BLA for remestemcel-L in children with SR-aGVHD.”

Mesoblast said it plans to file the resubmission during the next quarter. The ASX biotech stock aims to address the remaining product characterization issues.

How has the ASX biotech stock been tracking?

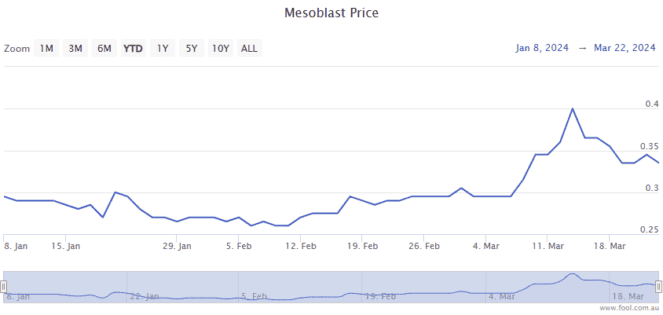

The Mesoblast share price has seen some big moves higher and lower over the past year.

With today’s intraday moves factored in, the ASX biotech share is up 45% in 2024.

The post Mesoblast share price rockets 36% on breaking FDA news appeared first on The Motley Fool Australia.

Wondering where you should invest $1,000 right now?

When investing expert Scott Phillips has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for over ten years has provided thousands of paying members with stock picks that have doubled, tripled or even more.*

Scott just revealed what he believes could be the ‘five best ASX stocks’ for investors to buy right now. We believe these stocks are trading at attractive prices and Scott thinks they could be great buys right now…

See The 5 Stocks

*Returns as of 1 February 2024

(function() {

function setButtonColorDefaults(param, property, defaultValue) {

if( !param || !param.includes(‘#’)) {

var button = document.getElementsByClassName(“pitch-snippet”)[0].getElementsByClassName(“pitch-button”)[0];

button.style[property] = defaultValue;

}

}

setButtonColorDefaults(“#0095C8”, ‘background’, ‘#5FA85D’);

setButtonColorDefaults(“#0095C8”, ‘border-color’, ‘#43A24A’);

setButtonColorDefaults(“#fff”, ‘color’, ‘#fff’);

})()

More reading

- Guess which ASX All Ords company is being sued by shareholders over stock price losses

- 4 ASX All Ords shares going gangbusters on Tuesday

- Why 4DMedical, Block, Judo, and Mesoblast shares are pushing higher today

- Why is the Mesoblast share price jumping 16% on Monday?

- Why Cettire, GQG, Mesoblast, and Nine Entertainment shares are falling today

Motley Fool contributor Bernd Struben has no position in any of the stocks mentioned. The Motley Fool Australia’s parent company Motley Fool Holdings Inc. has no position in any of the stocks mentioned. The Motley Fool Australia has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy. This article contains general investment advice only (under AFSL 400691). Authorised by Scott Phillips.

from The Motley Fool Australia https://ift.tt/ldXniHG

Leave a Reply