The Rural Funds Group (ASX: RFF) share price is down more than 1% after the S&P/ASX 300 Index (ASX: XKO) share went ex-distribution.

This comes at a time when the ASX 300 is currently up 0.1%.

Ex-distribution date

Rural Funds pays a distribution every three months and the latest payment will soon be allocated to investors.

The ex-distribution date tells us when new investors miss out on the payment â there has to be a cut-off point for the upcoming payment.

For Rural Funds, today (27 March 2024) is the ex-distribution date. Anyone buying Rural Funds shares won’t receive the upcoming distribution of 2.93 cents per unit. So, investors aren’t getting as much short-term value today as yesterday.

At yesterday’s Rural Funds share price, the upcoming quarterly payment translates into a distribution yield of 1.4%.

When is the Rural Funds distribution being paid?

Rural Funds is planning to pay this quarterly distribution on 30 April 2024.

If investors want to receive more Rural Funds units rather than cash, they can take part in the distribution reinvestment plan (DRP). The DRP election date is Tuesday 2 April 2024, with 5 pm being the cut-off time.

What is the FY24 distribution yield?

In the recent FY24 first-half result, Rural Funds confirmed it’s planning to pay an annual distribution of 11.73 cents per unit, which is a current distribution yield of 5.7%.

This is mostly being paid for by an expected adjusted funds from operations (AFFO) â which is essentially net rental profit â of 11.2 cents per unit.

The business is investing in some farms, and converting a few to macadamia farms, which will hopefully lead to improved rental income.

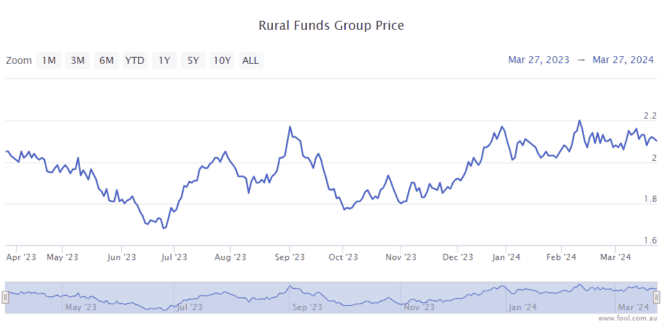

Rural Funds share price snapshot

Despite everything that has happened over the past 12 months, the Rural Funds share price is virtually where it was a year ago.

The post Why is the Rural Funds share dropping today? appeared first on The Motley Fool Australia.

Wondering where you should invest $1,000 right now?

When investing expert Scott Phillips has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for over ten years has provided thousands of paying members with stock picks that have doubled, tripled or even more.*

Scott just revealed what he believes could be the ‘five best ASX stocks’ for investors to buy right now. We believe these stocks are trading at attractive prices and Scott thinks they could be great buys right now…

See The 5 Stocks

*Returns as of 1 February 2024

(function() {

function setButtonColorDefaults(param, property, defaultValue) {

if( !param || !param.includes(‘#’)) {

var button = document.getElementsByClassName(“pitch-snippet”)[0].getElementsByClassName(“pitch-button”)[0];

button.style[property] = defaultValue;

}

}

setButtonColorDefaults(“#0095C8”, ‘background’, ‘#5FA85D’);

setButtonColorDefaults(“#0095C8”, ‘border-color’, ‘#43A24A’);

setButtonColorDefaults(“#fff”, ‘color’, ‘#fff’);

})()

More reading

- Almost ready to retire? I’d buy cheap ASX dividend shares for income

- 3 high-quality ASX retirement shares to buy this week

- 3 fantastic high-yield ASX dividend shares to buy next week

- Top ASX shares to buy instead of a term deposit in March 2024

- Popular ASX All Ords shares with ex-dividend dates next week

Motley Fool contributor Tristan Harrison has positions in Rural Funds Group. The Motley Fool Australia’s parent company Motley Fool Holdings Inc. has no position in any of the stocks mentioned. The Motley Fool Australia has positions in and has recommended Rural Funds Group. The Motley Fool has a disclosure policy. This article contains general investment advice only (under AFSL 400691). Authorised by Scott Phillips.

from The Motley Fool Australia https://ift.tt/PrjgkIz

Leave a Reply