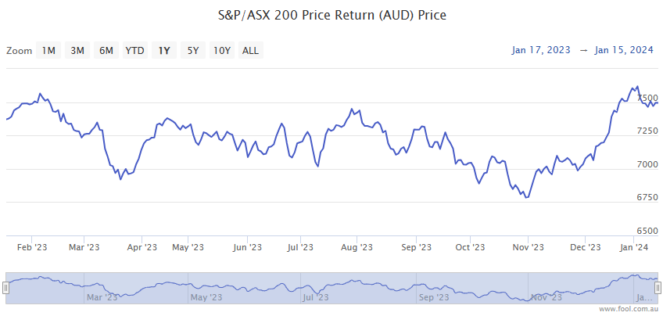

S&P/ASX 200 Index (ASX: XJO) shares aren’t just sensitive to interest rate moves from the Reserve Bank of Australia (RBA). Like it or not, they’ve also proven to be susceptible to rates set by the United States Federal Reserve.

As we covered at the start of the year, ASX 200 shares came within a whisker of setting new all-time highs on 2 January. But that new record slipped further away in the first weeks of trading in 2024, in part because investors pared their bets of a March rate cut from the US Fed.

That March Fed rate cut is still possible. But a potential deal in the works for US$70 billion (AU$106 billion) in tax breaks for US households and businesses could throw cold water on those hopes.

Here’s what’s happening.

ASX 200 shares eyeing Fed rate cuts

While not all ASX 200 shares would face headwinds from a delay in interest rate cuts from the Fed, the benchmark index will most likely fare better once the world’s most watched central bank begins easing.

And that easing could be delayed if the $106 billion in proposed tax breaks work to fuel inflation.

If passed the deal â which remains under Congressional negotiations â would increase the child tax credit and renew corporate tax breaks through 2025. And households could see the benefits of that extra cash as early as March.

Now that extra cash will certainly be welcomed by those on the receiving end, and work to spur the US economy. But if it stalls the Fed’s battle to bring inflation back to its 2% target range, investors in ASX 200 shares may have a longer wait than many expected for the Fed to begin easing.

Mickey Levy, a visiting scholar at the Hoover Institution, noted that the US economy is still awash with some of the fiscal stimulus unleashed during the global pandemic.

“There’s already substantial fiscal stimulus driving up economic activity,” Levy said (quoted by Bloomberg).

Commenting on the potential $106 billion in tax cuts, Marc Goldwein, senior policy director for the Committee for a Responsible Federal Budget said, “This is going to be a decent amount of fiscal cost with very little of it going to encourage new investment in a time when there are still inflation pressures.”

As for today, ASX 200 shares are down an average of 1.2%.

The post Buying ASX 200 shares in 2024? Here’s why this $106 billion proposed US tax break matters appeared first on The Motley Fool Australia.

Wondering where you should invest $1,000 right now?

When investing expert Scott Phillips has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for over ten years has provided thousands of paying members with stock picks that have doubled, tripled or even more.*

Scott just revealed what he believes could be the ‘five best ASX stocks’ for investors to buy right now. These stocks are trading at near dirt-cheap prices and Scott thinks they could be great buys right now…

See The 5 Stocks

*Returns as of 10 November 2023

(function() {

function setButtonColorDefaults(param, property, defaultValue) {

if( !param || !param.includes(‘#’)) {

var button = document.getElementsByClassName(“pitch-snippet”)[0].getElementsByClassName(“pitch-button”)[0];

button.style[property] = defaultValue;

}

}

setButtonColorDefaults(“#0095C8”, ‘background’, ‘#5FA85D’);

setButtonColorDefaults(“#0095C8”, ‘border-color’, ‘#43A24A’);

setButtonColorDefaults(“#fff”, ‘color’, ‘#fff’);

})()

More reading

- 5 things to watch on the ASX 200 on Tuesday

- Here are the top 10 ASX 200 shares today

- The pros and cons of buying Wesfarmers shares right now

- Bullish about data centre growth? I’d try these 3 ASX 200 shares

- 5 things to watch on the ASX 200 on Monday

Motley Fool contributor Bernd Struben has no position in any of the stocks mentioned. The Motley Fool Australia’s parent company Motley Fool Holdings Inc. has no position in any of the stocks mentioned. The Motley Fool Australia has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy. This article contains general investment advice only (under AFSL 400691). Authorised by Scott Phillips.

from The Motley Fool Australia https://ift.tt/hyJK2Oj

Leave a Reply