While regular readers all know that diversification is the key to successful investing, it’s still fun to see those stocks that rocket rapidly and imagine what could have been.

There is a practical purpose to looking at such examples too, other than allowing us to fantasise.

Such cases show us that not every stock we pick for our portfolio has to be a winner.

In fact, that sort of expectation is unrealistic and downright dangerous.

In most portfolios a handful of winners will do the heavy lifting to cancel out the losses and boost the overall returns.

Let’s check out one mining stock that’s gone gangbusters in the past year to demonstrate this power:

Overnight sensation

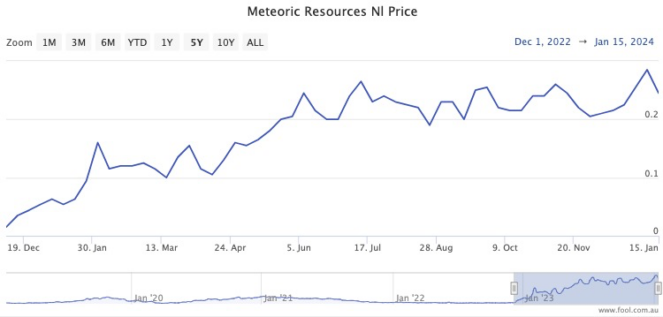

Back on 7 December 2022, Meteoric Resources NL (ASX: MEI) was a junior explorer that was literally a penny stock with its share price languishing at 1.6 cents.

But then it went into a trading halt for 11 days and all hell broke loose.

On 16 December 2022, it emerged with news that it had acquired a site in Brazil with potential to be a rare earths producer. By the end of the day Meteoric shares had almost doubled to 3.1 cents.

The project, named Caldeira, then kept putting out positive drilling results through the next 12 months.

And every tidbit has aroused the market’s interest in the now-$460 million company.

On Tuesday, Meteoric shares were trading for 24 cents.

That means that the shares have multiplied 15 times in just 13 months.

If you had invested $20,000 back in December 2022, that would now be worth an amazing $300,000.

If you take on the risk, you deserve the reward

Aside from the obvious thrill, a great benefit of repairing such a windfall is that it can make up for all the losses from your dud stock picks.

That is, if you had invested $20,000 each into 10 shares including Meteoric, the other nine could be worth $0 now and your portfolio would still be up 50%.

How crazy is that!

Of course, not everyone will be able to pick such a spectacular winner.

But the point here is that even if 4 out of your 10 picks are in the green, they have infinite potential whereas the most you can lose from your dogs is 100%.

Also, those fortunate enough to have held Meteoric shares the last 13 months deserve the wealth they created because they took on a significant risk premium.

As each positive test results came out, the less risky the business became.

This ASX mining stock is still a buy after all that

For the record, many experts still think Meteoric Resources shares are a buy.

CMC Invest currently shows all six analysts that cover it still recommend adding it to portfolios.

Novus Capital stock broker John Edwards, who personally owns the stock, said last month that its “tenements are among the biggest and richest in the world”.

“Speculation exists that this rare earths junior is a potential takeover target,” he told The Bull.

“I have a 12-month price target of up to 50 cents a share.”

The post If you’d put $20,000 in this ASX mining stock 13 months ago, you’d have $300,000 now appeared first on The Motley Fool Australia.

Wondering where you should invest $1,000 right now?

When investing expert Scott Phillips has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for over ten years has provided thousands of paying members with stock picks that have doubled, tripled or even more.*

Scott just revealed what he believes could be the ‘five best ASX stocks’ for investors to buy right now. These stocks are trading at near dirt-cheap prices and Scott thinks they could be great buys right now…

See The 5 Stocks

*Returns as of 10 November 2023

(function() {

function setButtonColorDefaults(param, property, defaultValue) {

if( !param || !param.includes(‘#’)) {

var button = document.getElementsByClassName(“pitch-snippet”)[0].getElementsByClassName(“pitch-button”)[0];

button.style[property] = defaultValue;

}

}

setButtonColorDefaults(“#0095C8”, ‘background’, ‘#5FA85D’);

setButtonColorDefaults(“#0095C8”, ‘border-color’, ‘#43A24A’);

setButtonColorDefaults(“#fff”, ‘color’, ‘#fff’);

})()

More reading

- 3 ASX mining shares hitting 52-week highs today

- 5 best performing ASX All Ords shares of 2023

- 13-bagger in a year: 2 ASX mining shares that could be takeover targets

- Why Atlantic Lithium, Meteoric Resources, Stockland, and Strickland shares are sinking today

Motley Fool contributor Tony Yoo has no position in any of the stocks mentioned. The Motley Fool Australia’s parent company Motley Fool Holdings Inc. has no position in any of the stocks mentioned. The Motley Fool Australia has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy. This article contains general investment advice only (under AFSL 400691). Authorised by Scott Phillips.

from The Motley Fool Australia https://ift.tt/nIaCRW7

Leave a Reply