Westpac Banking Corp (ASX: WBC) shares not only offer the potential for capital gains, but the S&P/ASX 200 Index (ASX: XJO) bank stock is also well known for its reliable fully franked dividend payments.

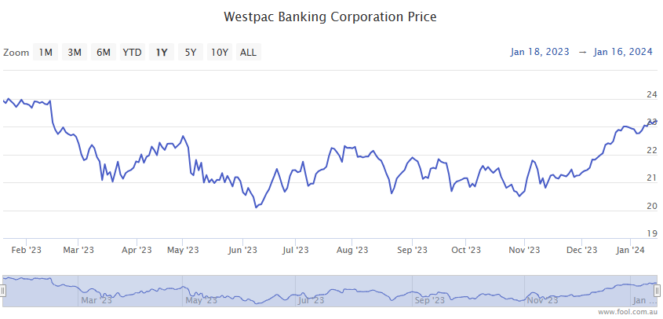

So far in 2023, Westpac shares haven’t been able to shake off the broader market pressure. This sees the big four bank’s stock down 0.3% year to date, trading for $22.93 apiece.

Though that’s a good bit better than the 3.5% loss notched by the ASX 200 so far in 2024.

But that’s the market for you. Over the shorter term, there’ll always be some down swings along with the up swings.

So, let’s take a step back to two years ago to get a better gauge of what this ASX 200 bank stock has delivered for longer-term shareholders.

How much would these Westpac shares have returned by today?

On 28 January 2022, Westpac shares closed the day trading for $20.63 apiece.

That means your $10,000 investment could have bought you 484 shares with enough change left over for a fast-food meal.

Today, as mentioned above, those same shares are worth $22.93.

If you opted to sell your 484 shares today, they’d be worth $11,098. Or a handy $1,098 gain on your $10,000 investment.

But let’s not forget those dividends!

If you’d bought $10,000 worth of Westpac stock on 28 January 2022, you’d have received the past four fully franked dividends totalling $2.67 a share. The most recent dividend of 72 cents a share would have landed in your bank account just in time for Christmas, on 19 December.

Adding those dividends back in, the accumulated value of your Westpac shares would now be $25.60 apiece, plus the potential tax benefits from those franking credits.

This brings the total value of your 484 shares to $12,394.

That’s a tidy 23.9% gain. Or a profit of $2,394 on your initial $10,000 investment two years ago.

The post If you’d bought $10,000 of Westpac shares in January 2022, here’s what you’d have now! appeared first on The Motley Fool Australia.

Wondering where you should invest $1,000 right now?

When investing expert Scott Phillips has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for over ten years has provided thousands of paying members with stock picks that have doubled, tripled or even more.*

Scott just revealed what he believes could be the ‘five best ASX stocks’ for investors to buy right now. These stocks are trading at near dirt-cheap prices and Scott thinks they could be great buys right now…

See The 5 Stocks

*Returns as of 10 November 2023

(function() {

function setButtonColorDefaults(param, property, defaultValue) {

if( !param || !param.includes(‘#’)) {

var button = document.getElementsByClassName(“pitch-snippet”)[0].getElementsByClassName(“pitch-button”)[0];

button.style[property] = defaultValue;

}

}

setButtonColorDefaults(“#0095C8”, ‘background’, ‘#5FA85D’);

setButtonColorDefaults(“#0095C8”, ‘border-color’, ‘#43A24A’);

setButtonColorDefaults(“#fff”, ‘color’, ‘#fff’);

})()

More reading

- What will my ASX 200 bank stocks be worth in 5 years?

- 3 things ASX investors should watch this week

- Here’s how much I’d need to invest in Westpac shares for $3,000 a year in passive income

- The Westpac share price heavily underperformed the ASX 200 in 2023

- Why are the big four ASX 200 bank shares under pressure today?

Motley Fool contributor Bernd Struben has no position in any of the stocks mentioned. The Motley Fool Australia’s parent company Motley Fool Holdings Inc. has no position in any of the stocks mentioned. The Motley Fool Australia has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy. This article contains general investment advice only (under AFSL 400691). Authorised by Scott Phillips.

from The Motley Fool Australia https://ift.tt/YSgioe1

Leave a Reply