Since you’re reading The Motley Fool, the chances are you have some money to invest.

Even if that amount is as little as $10,000, you can have a decent go at setting up a nice stream of passive income for yourself.

The places you could end up using the power of ASX shares and compounding could surprise you.

Let me throw up a hypothetical using one particular stock:

A market darling tipped to go even further

MMA Offshore Ltd (ASX: MRM) is a stock that many experts are particularly fond of at the moment.

The business provides marine services to clients with sea-borne infrastructure such as oil and gas rigs.

With the world experiencing energy anxiety over the past couple of years since Russia invaded Ukraine, MMA Offshore has been going gangbusters.

Just since November alone, the stock has gained more than 54%.

Over the longer term, the MMA Offshore share price has rocketed 107% over the past five years.

According to CMC Invest, all five analysts that cover it reckon MMA Offshore is a strong buy.

Just four years to produce passive income

Past performance, of course, is never an indicator of the future. But we can use this track record to demonstrate how you could grow your $10,000 into a passive income generator.

The last half-decade of returns from MMA shares equate to 15.7% compound annual growth rate (CAGR).

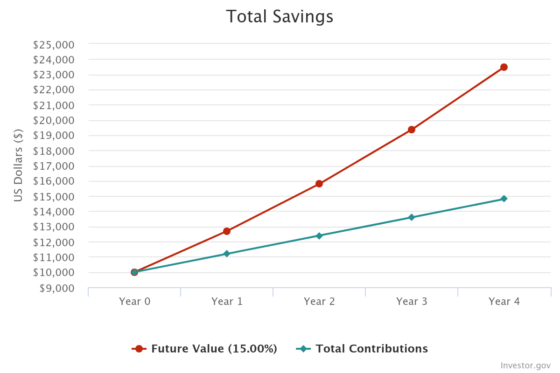

Even if we round that down to 15%, a $10,000 investment could take you to $2,500 of yearly passive income very swiftly.

The “trick” is to keep saving money and add $100 to the nest egg each month.

At that rate, after four years, the MMA shares will amount to $23,482.

From then on, selling off the 12% gain each year would reap you $3,522.

That’s $3,500 of cash for no work.

Right now $10,000 will buy you 5,181 MMA Offshore shares.

So what are you waiting for?

The post $10,000 in excess savings? I’d buy 5,181 shares of this ASX stock to aim for $3,500 in passive income appeared first on The Motley Fool Australia.

Wondering where you should invest $1,000 right now?

When investing expert Scott Phillips has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for over ten years has provided thousands of paying members with stock picks that have doubled, tripled or even more.*

Scott just revealed what he believes could be the ‘five best ASX stocks’ for investors to buy right now. These stocks are trading at near dirt-cheap prices and Scott thinks they could be great buys right now…

See The 5 Stocks

*Returns as of 10 November 2023

(function() {

function setButtonColorDefaults(param, property, defaultValue) {

if( !param || !param.includes(‘#’)) {

var button = document.getElementsByClassName(“pitch-snippet”)[0].getElementsByClassName(“pitch-button”)[0];

button.style[property] = defaultValue;

}

}

setButtonColorDefaults(“#0095C8”, ‘background’, ‘#5FA85D’);

setButtonColorDefaults(“#0095C8”, ‘border-color’, ‘#43A24A’);

setButtonColorDefaults(“#fff”, ‘color’, ‘#fff’);

})()

More reading

- I’d invest in these 2 ASX shares for a real shot at $1 million

- Up 140% in 13 months, experts are still backing this ASX stock for the long run

- Top ASX shares to buy in January 2024

Motley Fool contributor Tony Yoo has no position in any of the stocks mentioned. The Motley Fool Australia’s parent company Motley Fool Holdings Inc. has no position in any of the stocks mentioned. The Motley Fool Australia has recommended Mma Offshore. The Motley Fool has a disclosure policy. This article contains general investment advice only (under AFSL 400691). Authorised by Scott Phillips.

from The Motley Fool Australia https://ift.tt/CAjcD6B

Leave a Reply