Owning Brickworks Limited (ASX: BKW) shares has been a very rewarding experience, particularly for investors focused on dividends.

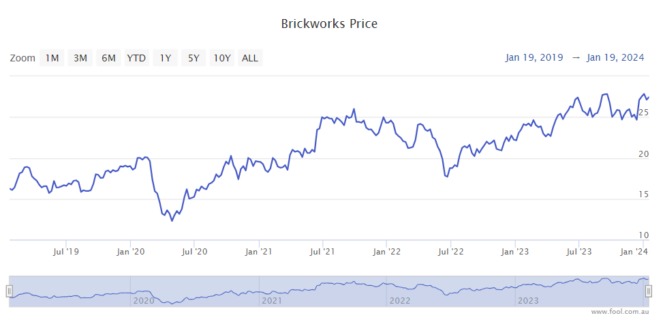

In the past five years, the Brickworks share price has risen by close to 70%, as we can see on the chart below.

I like dividend-paying businesses because it allows us to receive the benefit of profit generation without having to sell our shares. Profit growth can lead to dividend growth, meaning bigger payouts and protection against inflation.

Dividends since COVID-19

I think the last few years have been a good demonstration of any company’s dividend and reliability because of how testing the circumstances were.

In the FY20 first-half result, which was released on 26 March 2020, the interim dividend grew by 5% to 20 cents per share. This was announced in the depths of the initial COVID-19 market crash and the rapidly growing number of global deaths.

Then, in the FY20 result, it grew the full-year dividend by 4% to 59 cents per share.

The FY21 first-half result saw Brickworks’ interim dividend increase by 5% to 21 cents per share.

In the FY21 result, Brickworks decided to declare an annual dividend per share of 61 cents, an increase of 3%.

The world started returning to normal in FY22, so I’ll just mention the full-year numbers from here.

In FY22, Brickworks grew its annual dividend per share to 63 cents, a rise of 3%.

Then, in FY23, the company’s annual dividend per share rose by 3% to 65 cents.

That means, between FY20 to FY23, the business paid a total of $2.48 in dividends. That’s a cash dividend return of 13% if we use the Brickworks share price from the start of 2020.

It has grown its dividend every year since 2014, which is a great record.

Brickworks share price snapshot

In the past year, the Brickworks share price has risen around 15%.

The post Own Brickworks shares? Here’s how much you’ve been paid in dividends since COVID-19! appeared first on The Motley Fool Australia.

Wondering where you should invest $1,000 right now?

When investing expert Scott Phillips has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for over ten years has provided thousands of paying members with stock picks that have doubled, tripled or even more.*

Scott just revealed what he believes could be the ‘five best ASX stocks’ for investors to buy right now. These stocks are trading at near dirt-cheap prices and Scott thinks they could be great buys right now…

See The 5 Stocks

*Returns as of 10 November 2023

(function() {

function setButtonColorDefaults(param, property, defaultValue) {

if( !param || !param.includes(‘#’)) {

var button = document.getElementsByClassName(“pitch-snippet”)[0].getElementsByClassName(“pitch-button”)[0];

button.style[property] = defaultValue;

}

}

setButtonColorDefaults(“#0095C8”, ‘background’, ‘#5FA85D’);

setButtonColorDefaults(“#0095C8”, ‘border-color’, ‘#43A24A’);

setButtonColorDefaults(“#fff”, ‘color’, ‘#fff’);

})()

More reading

- Where I’d invest $3,000 into ASX dividend shares in January

- Top ASX passive income shares to buy in January 2024

- Dividend investing: A proven path for Australian income seekers

- I’d buy these ASX shares before interest rates start falling

- If I inherited $100,000, these are the ASX shares I’d buy for passive income

Motley Fool contributor Tristan Harrison has positions in Brickworks. The Motley Fool Australia’s parent company Motley Fool Holdings Inc. has positions in and has recommended Brickworks. The Motley Fool Australia has positions in and has recommended Brickworks. The Motley Fool has a disclosure policy. This article contains general investment advice only (under AFSL 400691). Authorised by Scott Phillips.

from The Motley Fool Australia https://ift.tt/xUNLXvi

Leave a Reply