The window of opportunity to snag the latest Wesfarmers Ltd (ASX: WES) dividend is shut.

After declaring its latest interim dividend on Thursday last week, the final day of eligibility for the retail conglomerate’s payment was yesterday. Now trading ex-dividend, any purchasing settlements of Wesfarmers shares occurring today will miss out.

Shares in the $71 billion behemoth are 1.5% lower at $63.00 apiece this morning.

Here’s what new investors are missing out on

The owner of Kmart, Bunnings, and Officeworks delivered a solid half-year result last week despite tough conditions for retailers amid exceptionally high interest rates.

Many other ASX-listed retail shares have unveiled declining profits during this reporting season. However, Wesfarmers dished out a respectable 3% increase in net profits after tax (NPAT) to $1.43 billion.

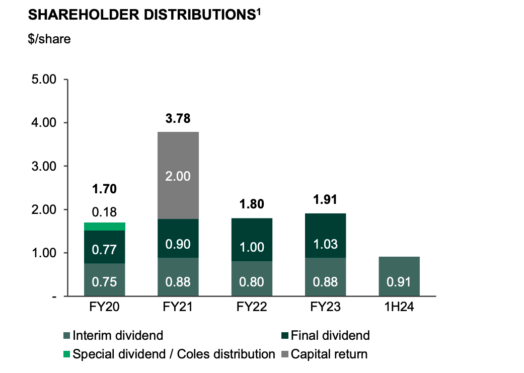

Buoyed by stronger earnings, Wesfarmers has boosted its fully franked interim dividend by 3.4% to 91 cents per share. The payment to shareholders will mark the largest interim dividend since April 2019, when the company maintained some ownership in Coles Group Ltd (ASX: COL).

If we look at the dividends over the past 12 months, shareholders have accrued $1.94 of income per share. This translates to a dividend yield of 3.08% based on the Wesfarmers share price at the time of writing.

Simply put, a $10,000 holding in Wesfarmers would have amounted to $308 worth of passive income from these two payouts. After franking, or what’s referred to as ‘gross dividends’, the figure improves to approximately $440.

Those eligible to receive Wesfarmers’ interim dividend will see it appear on 27 March 2024.

Could Wesfarmers shares still be a buy for income?

The window is shut on Wesfarmers’ interim dividend, but is it too late to buy for future passive tendies?

Analysts at investment bank Jefferies would suggest possibly not. Impressed by the result amid challenging cost inflation, the analysts bumped their Wesfarmers share price target from $57.00 to $60.00.

Furthermore, full-year earnings are expected to hit $2.53 billion in FY24 and $2.76 billion in FY25. For reference, the company raked in $2.465 billion in profits in FY23.

If this were to occur, shareholders could see dividends continue to grow over the coming years.

The post Wesfarmers shares walk back from 52-week highs without dividend appeared first on The Motley Fool Australia.

Wondering where you should invest $1,000 right now?

When investing expert Scott Phillips has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for over ten years has provided thousands of paying members with stock picks that have doubled, tripled or even more.*

Scott just revealed what he believes could be the ‘five best ASX stocks’ for investors to buy right now. These stocks are trading at near dirt-cheap prices and Scott thinks they could be great buys right now…

See The 5 Stocks

*Returns as of 10 November 2023

(function() {

function setButtonColorDefaults(param, property, defaultValue) {

if( !param || !param.includes(‘#’)) {

var button = document.getElementsByClassName(“pitch-snippet”)[0].getElementsByClassName(“pitch-button”)[0];

button.style[property] = defaultValue;

}

}

setButtonColorDefaults(“#0095C8”, ‘background’, ‘#5FA85D’);

setButtonColorDefaults(“#0095C8”, ‘border-color’, ‘#43A24A’);

setButtonColorDefaults(“#fff”, ‘color’, ‘#fff’);

})()

More reading

- Retirees: Here’s how to boost your pension in 2024

- Why I’d put Wesfarmers shares in my ultimate ASX dividend income portfolio in 2024

- If I could buy only one ASX stock this February earnings season, it would beâ¦

- Everything you need to know about the new Wesfarmers dividend

- Here are the top 10 ASX 200 shares today

Motley Fool contributor Mitchell Lawler has no position in any of the stocks mentioned. The Motley Fool Australia’s parent company Motley Fool Holdings Inc. has positions in and has recommended Wesfarmers. The Motley Fool Australia has positions in and has recommended Coles Group and Wesfarmers. The Motley Fool has a disclosure policy. This article contains general investment advice only (under AFSL 400691). Authorised by Scott Phillips.

from The Motley Fool Australia https://ift.tt/JytBiEP

Leave a Reply