The Megaport Ltd (ASX: MP1) share price is losing ground today.

Shares in the S&P/ASX 200 Index (ASX: XJO) tech stock closed yesterday trading for $13.80. In morning trade on Tuesday, shares are changing hands for $13.31 apiece. That’s down 3.6% following the release of the company’s half-year results (1H FY 2024).

For some context, the ASX 200 is down 0.1% at this same time.

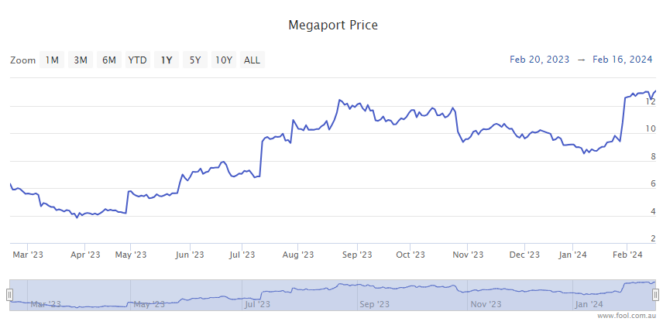

Longer-term shareholders won’t be overly concerned with the retrace though. Shares in the network as a Service (NaaS) solutions provider are still up an impressive 119% over 12 months.

Here’s what ASX 200 investors are considering today.

Megaport share price slides despite profit surge

- Half-year revenue of $95 million, up 35% from 1H FY 2023

- Record annual recurring revenue (ARR) of $192 million up 29% from the prior year

- Gross profit of $67 million up 43% from 1H FY 2023

- Record earnings before interest, taxes, depreciation and amortisation (EBITDA) of $30 million, up 785% from 1H FY 2023

What else happened during the half for Megaport?

With some lofty market expectations, the Megaport share price is in the red today despite strong financial metrics across the board.

The company credited the huge boost in half-year EBITDA to its 35% top-line revenue growth and management’s tight focus on cost control.

The boost in operating and financial performance drove EBITDA margins up to 32% over the six-month period, up from 5% in 1H FY 2023.

Net profit came in at just over $4 million, up from a sizeable loss in the prior corresponding half-year.

As at 31 December, Megaport had net cash of $46 million, up from $40 million a year earlier.

What did management say?

Commenting on the half-year operations which have seen the Megaport share price among the top performers on the ASX 200, CEO Michael Reid said the company’s earnings surge was “an amazing result and indicative of the outstanding financial turnaround.”.

Reid added:

$12.5 million in net cash flow represents a massive $40.8 million improvement from the $28.3 million net cash outflow we reported for the half year at this time last year. A phenomenal result that has enabled us to make investments in the go-to-market engine while maintaining our robust financial position.

What’s next for the ASX 200 tech share?

Looking at what could impact the Megaport share price in the months ahead, Reid said, “A strong financial foundation has been laid, and I look forward to doubling down on our efforts in the second half as we continue to deliver profitable, efficient growth.”

ASX 200 investors may be taking some profits today, however, with Megaport’s guidance unchanged despite the company’s very strong first-half results.

According to Reid:

With our finances in great shape and a go-to-market engine poised to fire, we’re happy to report that FY24 revenue and EBITDA guidance is being restated at $190 to $195 million and $51 to $57 million, respectively.

And our net cash flow remains strong after already lowering our capex guidance to $20 to $22 million in January 2024.

Megaport share price snapshot

Even with today’s intraday retrace factored in, 2024 has started out with a bang for the ASX 200 tech share.

Since the opening bell on 2 January, the Megaport share price is up more than 44%.

The post Up 119% in a year, Megaport share price slipping today despite record earnings appeared first on The Motley Fool Australia.

Wondering where you should invest $1,000 right now?

When investing expert Scott Phillips has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for over ten years has provided thousands of paying members with stock picks that have doubled, tripled or even more.*

Scott just revealed what he believes could be the ‘five best ASX stocks’ for investors to buy right now. These stocks are trading at near dirt-cheap prices and Scott thinks they could be great buys right now…

See The 5 Stocks

*Returns as of 10 November 2023

(function() {

function setButtonColorDefaults(param, property, defaultValue) {

if( !param || !param.includes(‘#’)) {

var button = document.getElementsByClassName(“pitch-snippet”)[0].getElementsByClassName(“pitch-button”)[0];

button.style[property] = defaultValue;

}

}

setButtonColorDefaults(“#0095C8”, ‘background’, ‘#5FA85D’);

setButtonColorDefaults(“#0095C8”, ‘border-color’, ‘#43A24A’);

setButtonColorDefaults(“#fff”, ‘color’, ‘#fff’);

})()

More reading

- 5 things to watch on the ASX 200 on Tuesday

- Here are the top 10 ASX 200 shares today

- This ASX 200 share is predicted to benefit from AI demand for years

- 2 ASX 200 growth shares to buy with ‘immense opportunity’ ahead

- Brokers say these explosive ASX growth shares are buys with massive upside

Motley Fool contributor Bernd Struben has no position in any of the stocks mentioned. The Motley Fool Australia’s parent company Motley Fool Holdings Inc. has positions in and has recommended Megaport. The Motley Fool Australia has recommended Megaport. The Motley Fool has a disclosure policy. This article contains general investment advice only (under AFSL 400691). Authorised by Scott Phillips.

from The Motley Fool Australia https://ift.tt/VCNcJID

Leave a Reply