Yes, the headline does say “beginner” stocks.

And I will certainly fulfil that mission by revealing two ASX shares that would make an excellent starting core for a portfolio.

But, you know, I think it’s a bit of a misnomer to call them beginner stocks.

Because if they’re outstanding all-round investments, they should be great for every portfolio, not just for novices.

Whether you are a veteran or a rookie, you have the same goal — to maximise reliable returns over the long run.

And I believe these shares could meet that aim:

What do Mickey Mouse, Google, and Michael Jordan have in common?

A fantastic place to start for any portfolio are exchange-traded fund (ETF) stocks, because of the instant diversification effect that will reduce volatility.

And for me, one that ticks a lot of boxes is Vaneck Morningstar Wide Moat Etf (ASX: MOAT).

This fund simulates the Morningstar Wide Moat Focus NR AUD Index, which keeps track of US stocks that the research firm deems to have the widest “economic moats“.

That is, it invests in businesses with the best competitive advantage over its rivals or potential challengers.

Currently the Wide Moat ETF holds names like Walt Disney Co (NYSE: DIS), Alphabet Inc (NASDAQ: GOOGL) and Nike Inc (NYSE: NKE).

As well as paying out an irregular dividend, the ETF has gained 90% over the past five years.

The Internet also needs somewhere to live

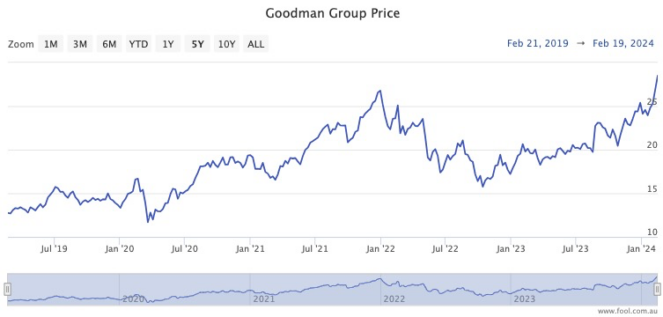

The second stock that I like for the core of the portfolio is Goodman Group (ASX: GMG).

The industrial real estate group both develops and manages properties, which means it has future growth potential while also raking in revenue from existing assets.

Despite its involvement in a traditional sector, the types of real estate it manages — warehouses, logistics centres, and business parks — are all critical for e-commerce.

For example, one of its major clients is Amazon.com Inc (NASDAQ: AMZN), which requires ever more warehousing space as the demand for online shopping grows.

Goodman Group is also delving into developing properties to house data centres, which is also a huge growth area with the insatiable demand for cloud computing and artificial intelligence (AI).

Goodman shares have returned 123% over the past five years, excluding a small dividend each year.

Professional investors are still bullish despite a 42% rocket since late October.

According to CMC Invest, eight out of 12 analysts currently rate Goodman shares as a buy.

The post 2 no-brainer ASX ‘beginner’ stocks I’d buy appeared first on The Motley Fool Australia.

Wondering where you should invest $1,000 right now?

When investing expert Scott Phillips has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for over ten years has provided thousands of paying members with stock picks that have doubled, tripled or even more.*

Scott just revealed what he believes could be the ‘five best ASX stocks’ for investors to buy right now. These stocks are trading at near dirt-cheap prices and Scott thinks they could be great buys right now…

See The 5 Stocks

*Returns as of 10 November 2023

(function() {

function setButtonColorDefaults(param, property, defaultValue) {

if( !param || !param.includes(‘#’)) {

var button = document.getElementsByClassName(“pitch-snippet”)[0].getElementsByClassName(“pitch-button”)[0];

button.style[property] = defaultValue;

}

}

setButtonColorDefaults(“#0095C8”, ‘background’, ‘#5FA85D’);

setButtonColorDefaults(“#0095C8”, ‘border-color’, ‘#43A24A’);

setButtonColorDefaults(“#fff”, ‘color’, ‘#fff’);

})()

More reading

- For $1,500 in monthly passive income, buy 1,400 shares of this ASX 200 stock

- Buy and hold these ASX ETFs for 10 years or more

- How this rocketing ASX ETF is tapping into the billionaire-making AI revolution

- Here are the top 10 ASX 200 shares today

- 2 ASX 200 real estate shares leaping higher on earnings news

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Foolâs board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Foolâs board of directors. Motley Fool contributor Tony Yoo has positions in VanEck Morningstar Wide Moat ETF. The Motley Fool Australia’s parent company Motley Fool Holdings Inc. has positions in and has recommended Alphabet, Amazon, Goodman Group, Nike, and Walt Disney. The Motley Fool Australia’s parent company Motley Fool Holdings Inc. has recommended the following options: long January 2025 $47.50 calls on Nike. The Motley Fool Australia has recommended Alphabet, Amazon, Goodman Group, Nike, VanEck Morningstar Wide Moat ETF, and Walt Disney. The Motley Fool has a disclosure policy. This article contains general investment advice only (under AFSL 400691). Authorised by Scott Phillips.

from The Motley Fool Australia https://ift.tt/fQklRbv

Leave a Reply