The Corporate Travel Management Ltd (ASX: CTD) share price is falling off a cliff on Wednesday amid its FY24 first-half results.

Shares in the travel management solutions company are down 18.5% to $16.18 this morning. At one point the share price reached $15.82 soon after opening, equating to a 20% fall.

Corporate Travel share price craters on mirky results

- Revenue up 25% from the prior corresponding period to $363.7 million

- Underlying EBITDA up 96% to $100.7 million

- Underlying net profit after tax (NPAT) up 162% to $57.9 million

- Statutory NPAT up 222% to $50.4 million

- Interim unfranked dividend of 17 cents per share, up from 6 cents

What happened in the first half?

For the six months ended 31 December 2023, Corporate Travel Management enjoyed a self-described record half.

Despite a minimal recovery in the global travel market, the company notched up its revenue by 25%, mainly from market share gains. For example, $630 million worth of new clients were won, outpacing the industry.

The outsized growth in earnings relative to revenue was achieved through ‘improving efficiency and controlling costs’.

Looking at the performances of the different regions that Corporate Travel Management operates in, it quickly becomes apparent there were some mixed results.

Revenue growth was subdued in North America and Australia and New Zealand (ANZ). Meanwhile, Europe and Asia experienced exceptional increases, with both regions posting record EBITDA. According to the report, Europe operations benefit from the company’s proprietary technology in over 90% of online transactions.

Outlook for the company

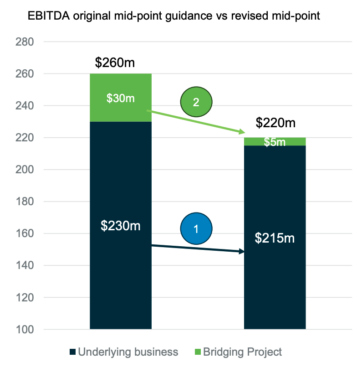

Corporate Travel Management laid out a couple of items that are expected to impact its previous forecasts. With a combination of ‘macro issues’ and material underperformance of its United Kingdom Bridging contract, the company is eyeing a $40 million EBITDA headwind in FY24, as shown below.

As a result, FY24 guidance has been updated to the following:

- Revenue between $730 million to $760 million, suggesting a 15% increase at the midpoint

- Underlying EBITDA between $210 million to $230 million, suggesting a 31.7% increase at the midpoint

- Underlying NPAT between $125 million to $140 million

Importantly, it was noted the above detracting factors are out of the company’s control.

What else?

Lastly, a five-year growth plan was unveiled in today’s results. The newly devised strategy aims to double FY24 profits organically by FY29. To do this, Corporate Travel Management plans to apply the following five priorities:

- Revenue growth of more than 10% per annum over five years

- Client retention of 97% per annum

- Further improvements to productivity and innovation

- EBITDA growth above revenue growth, converting 50% of new revenue into EBITDA

- Acquisitions to provide growth in addition to organic goals

The Corporate Travel Management share price is down 9% compared to a year ago.

The post Corporate Travel share price plunges 18% despite tripling net profits appeared first on The Motley Fool Australia.

Wondering where you should invest $1,000 right now?

When investing expert Scott Phillips has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for over ten years has provided thousands of paying members with stock picks that have doubled, tripled or even more.*

Scott just revealed what he believes could be the ‘five best ASX stocks’ for investors to buy right now. These stocks are trading at near dirt-cheap prices and Scott thinks they could be great buys right now…

See The 5 Stocks

*Returns as of 10 November 2023

(function() {

function setButtonColorDefaults(param, property, defaultValue) {

if( !param || !param.includes(‘#’)) {

var button = document.getElementsByClassName(“pitch-snippet”)[0].getElementsByClassName(“pitch-button”)[0];

button.style[property] = defaultValue;

}

}

setButtonColorDefaults(“#0095C8”, ‘background’, ‘#5FA85D’);

setButtonColorDefaults(“#0095C8”, ‘border-color’, ‘#43A24A’);

setButtonColorDefaults(“#fff”, ‘color’, ‘#fff’);

})()

More reading

Motley Fool contributor Mitchell Lawler has no position in any of the stocks mentioned. The Motley Fool Australia’s parent company Motley Fool Holdings Inc. has positions in and has recommended Corporate Travel Management. The Motley Fool Australia has recommended Corporate Travel Management. The Motley Fool has a disclosure policy. This article contains general investment advice only (under AFSL 400691). Authorised by Scott Phillips.

from The Motley Fool Australia https://ift.tt/Q235klE

Leave a Reply