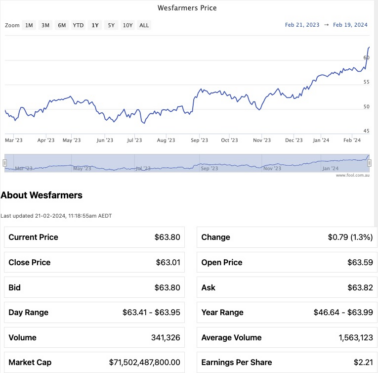

Shares for conglomerate Wesfarmers Ltd (ASX: WES) largely went sideways for all of this year, until about a week ago.

Over the past eight days, the stock has risen 9%.

So is this a buy signal? Are other investors aware of something you’re not?

Let’s see what’s going on:

Why has the Wesfarmers share price risen?

There seem to be a couple of reasons for the recent arousal in the Wesfarmers share price.

First is that the market received the company’s half-year results positively last week.

The Motley Fool’s James Mickleboro reported that Wesfarmers’ net profit after tax was up 3% to $1.4 billion despite tough conditions for the retail sector.

“This was driven largely by the Kmart Group business, which posted a 26.5% increase in earnings for the six months.

“Management advised that its record result reflects the positive customer response to Kmart’s lowest price positioning.”

The second factor was the announcement that it would pay out a 91 cent dividend, which is the largest seen since April 2019.

Is it too late to buy?

So that’s all fantastic, but is it still worth buying Wesfarmers this late?

Opinion among the professional community is mixed.

According to broking platform CMC Invest, only two out of 17 analysts currently rate Wesfarmers shares as a buy.

A majority of 10 professionals recommend a hold, while five are urging investors to sell out.

So the answer to those considering buying Wesfarmers shares is⦠probably not.

Perhaps the recent price rise has made it even less attractive.

After all, if you go back to June 2022, the Wesfarmers share price has amazingly rocketed 55%. That’s during a period when the Reserve Bank put interest rates up 13 times.

However, The Motley Fool’s Sebastian Bowen is one that doesn’t mind committing to the conglomerate now with a long-term horizon.

“Wesfarmers is a holding that I’ve been hoping to add to for a while now and just might after the company’s latest earnings.

“Given the rising cost of living and stubborn interest rates, I think this is a great result for a company that would traditionally be described as cyclical and discretionary.”

The post The Wesfarmers share price is rising again. Should I buy the stock now? appeared first on The Motley Fool Australia.

Wondering where you should invest $1,000 right now?

When investing expert Scott Phillips has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for over ten years has provided thousands of paying members with stock picks that have doubled, tripled or even more.*

Scott just revealed what he believes could be the ‘five best ASX stocks’ for investors to buy right now. These stocks are trading at near dirt-cheap prices and Scott thinks they could be great buys right now…

See The 5 Stocks

*Returns as of 10 November 2023

(function() {

function setButtonColorDefaults(param, property, defaultValue) {

if( !param || !param.includes(‘#’)) {

var button = document.getElementsByClassName(“pitch-snippet”)[0].getElementsByClassName(“pitch-button”)[0];

button.style[property] = defaultValue;

}

}

setButtonColorDefaults(“#0095C8”, ‘background’, ‘#5FA85D’);

setButtonColorDefaults(“#0095C8”, ‘border-color’, ‘#43A24A’);

setButtonColorDefaults(“#fff”, ‘color’, ‘#fff’);

})()

More reading

- Wesfarmers shares walk back from 52-week highs without dividend

- Retirees: Here’s how to boost your pension in 2024

- Why I’d put Wesfarmers shares in my ultimate ASX dividend income portfolio in 2024

- If I could buy only one ASX stock this February earnings season, it would beâ¦

- Everything you need to know about the new Wesfarmers dividend

Motley Fool contributor Tony Yoo has no position in any of the stocks mentioned. The Motley Fool Australia’s parent company Motley Fool Holdings Inc. has positions in and has recommended Wesfarmers. The Motley Fool Australia has positions in and has recommended Wesfarmers. The Motley Fool has a disclosure policy. This article contains general investment advice only (under AFSL 400691). Authorised by Scott Phillips.

from The Motley Fool Australia https://ift.tt/hQK9irV

Leave a Reply